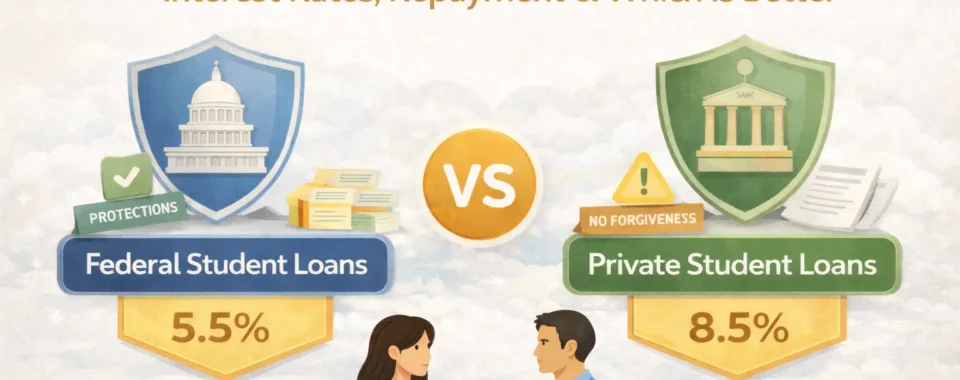

Always fixed rates determined by Congress and standardized across borrowers.Federal and private student loans are the two primary ways students finance higher education in the United States. While both allow students to borrow money for college or career school, they differ enormously in terms of eligibility, repayment flexibility, protections, and…

Private student loans in the United States are issued by banks, credit unions, and private lenders, and unlike federal loans, they lack federal protections and forgiveness programs. Borrowers often face higher interest rates, stricter repayment terms, and limited flexibility in hardship situations. This can make repayment difficult, especially when financial…

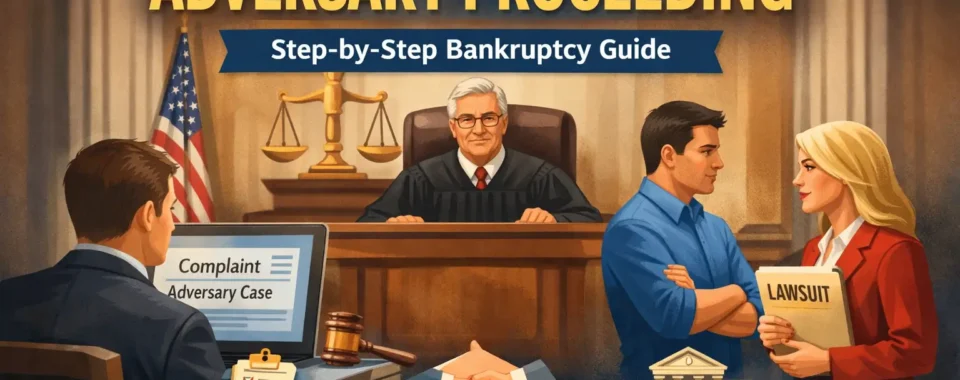

Filing bankruptcy can eliminate or reorganize many debts, but some disputes require more than a simple motion. If you are dealing with student loan discharge, creditor fraud, lien disputes, or challenges to debt dischargeability, you may need to take an additional legal step—filing an adversary proceeding. This in-depth guide explains…

Choosing the correct type of student loan can affect your finances for decades. Because of this, one of the most common and essential questions borrowers ask is: federal vs private student loans—what’s the difference, and which is better? Both options help pay for college. However, they operate under very different…

Private Student Loan Settlement Options: A Complete Guide to Reducing Your Debt Private student loan debt can quickly become overwhelming—especially when payments spiral out of control, and lenders refuse flexible relief. Unlike federal student loans, private loans are governed by lender-defined rules, leaving borrowers with fewer protections and fewer relief…

Understanding how student loans are collected is critical for borrowers who want to avoid default, protect their income, and make informed financial decisions. Student loan collection follows a structured legal process that differs significantly depending on whether the loan is federal or private. Before diving into collections, it’s essential to…