If you are struggling with federal student loan debt and work in public service, Public Service Loan Forgiveness (PSLF) may allow you to eliminate your remaining student loan balance tax-free. However, many borrowers lose eligibility for forgiveness due to application errors, employer mistakes, or missing paperwork.

Before applying, you should also understand other legal relief paths that may apply in parallel or as backup options, including bankruptcy-based student loan relief and private loan settlement strategies.

To build a complete strategy, review these essential guides first:

- If you are facing legal hardship, read this step-by-step guide on how to file an adversary proceeding to challenge student loans in bankruptcy

- Borrowers with private debt should understand private student loan settlement options

- Learn how student loans are collected and how enforcement actions begin

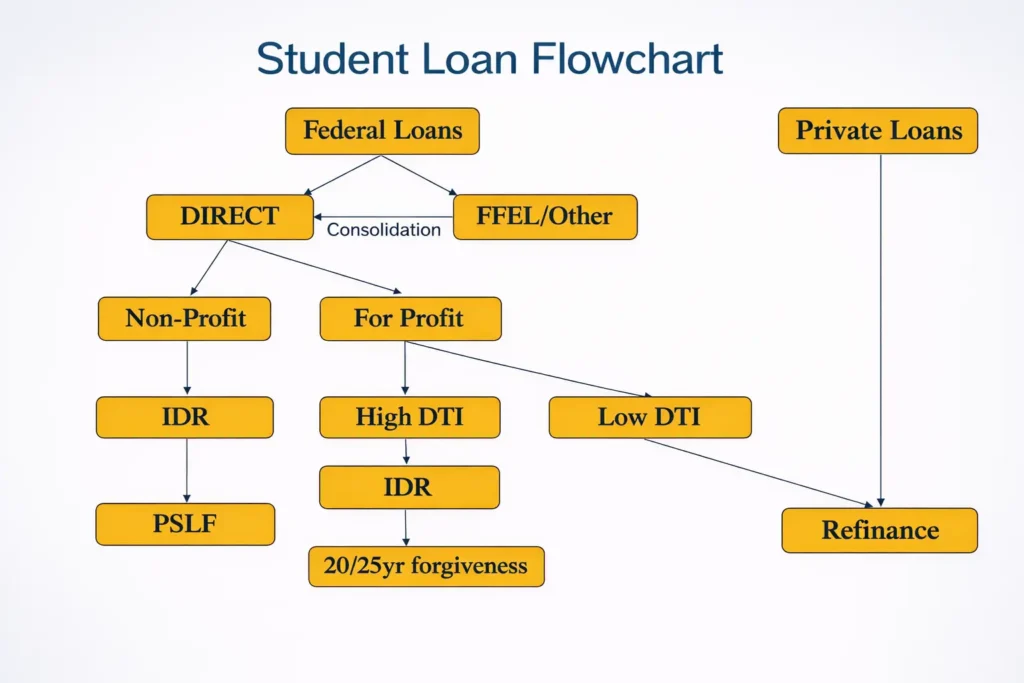

- Understand the difference between federal and private student loans

- For extreme hardship, see student loan bankruptcy relief and discharge options

- Track legislative changes affecting forgiveness, including the student loan forgiveness House vote

Once you understand your options, this guide walks you through the federal student loan forgiveness public service application process, step by step—from eligibility to final approval.

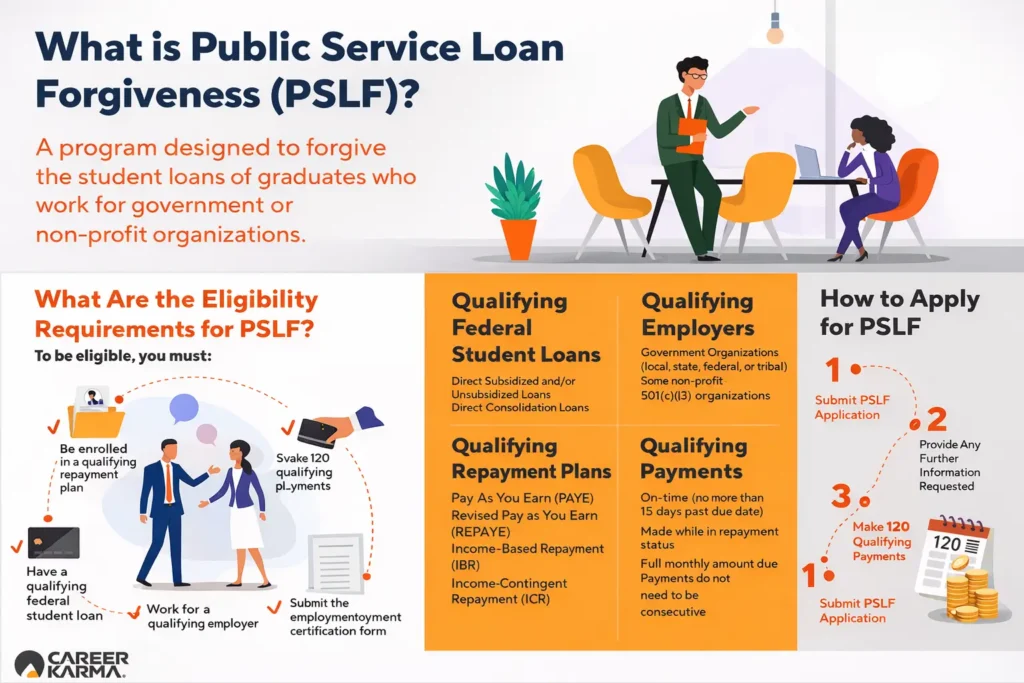

What Is Public Service Loan Forgiveness (PSLF)?

Public Service Loan Forgiveness is a federal program created to encourage long-term careers in public service. It allows eligible borrowers to receive 100% tax-free forgiveness on their remaining federal Direct Loan balance after making 120 qualifying monthly payments while working for a qualifying employer.

According to the U.S. Department of Education, PSLF is one of the strongest borrower protection programs available—but also one of the most misunderstood.

For a program overview and historical background, see Public Service Loan Forgiveness on Wikipedia.

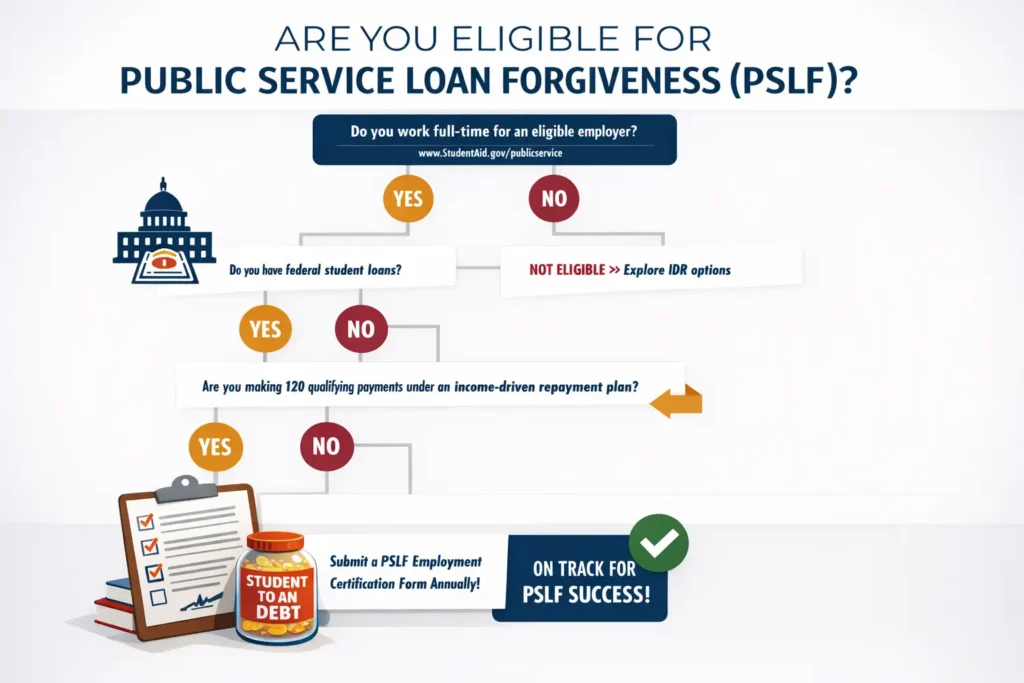

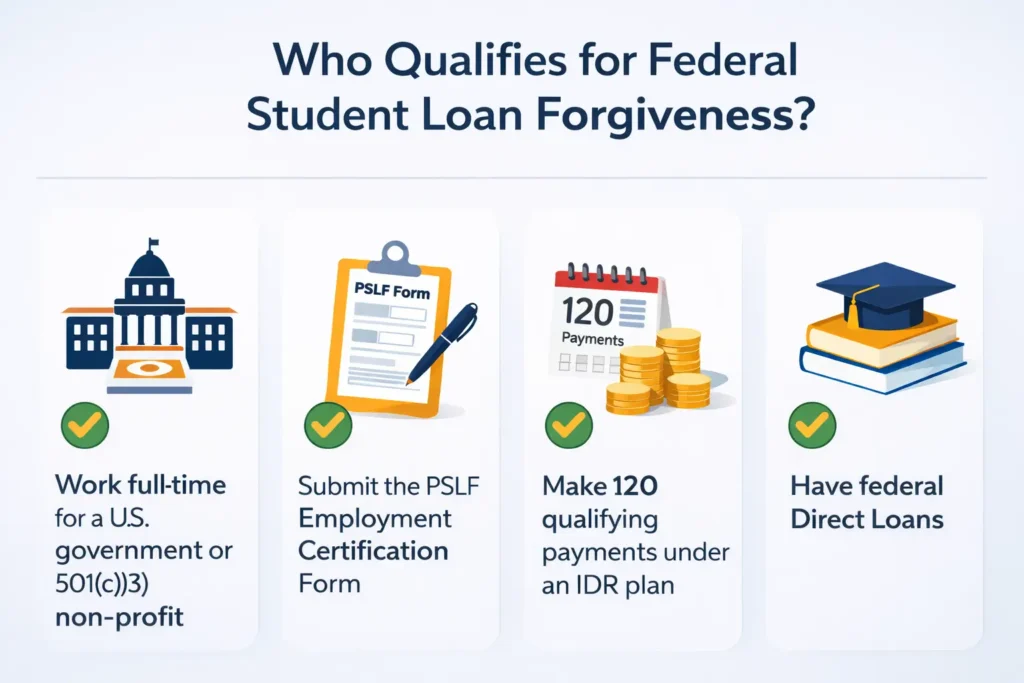

Who Qualifies for Federal Student Loan Forgiveness Public Service Application?

1. Qualifying Employment

You must work full-time (30+ hours/week) for a qualifying public service employer, including:

- Federal, state, local, or tribal Government agencies

- Public schools, colleges, and universities

- 501(c)(3) nonprofit organizations

- Certain public health, emergency, and military services

❌ Working for a private company—even if it serves the public—does not qualify unless it is a certified nonprofit.

2. Eligible Loan Types

Only Direct Loans qualify for PSLF.

If you have:

- FFEL loans

- Perkins loans

You must consolidate into a Direct Consolidation Loan before qualifying payments count.

3. Qualifying Repayment Plans

You must be enrolled in an income-driven repayment (IDR) plan, such as:

- Income-Based Repayment (IBR)

- PAYE

- REPAYE / SAVE

Standard 10-year plans technically qualify—but usually result in full repayment before forgiveness.

Federal Student Loan Forgiveness Public Service Application: Step-by-Step

Step 1: Confirm Employer Eligibility

Use the PSLF Help Tool to verify your employer qualifies. Employer eligibility errors are the

#1 cause of PSLF denial.

Step 2: Submit the PSLF Employment Certification Form

This form verifies:

- Employer qualification

- Full-time status

- Employment dates

💡 Best practice: submit this form every year, not just at the end.

Step 3: Track Qualifying Payments

Only payments that meet all of the following count:

- Made after October 1, 2007

- Made under a qualifying repayment plan

- Made while employed full-time in public service

- Made on time (within 15 days of due date)

Step 4: File the PSLF Forgiveness Application

After 120 qualifying payments:

- Submit the Public Service Loan Forgiveness Application for Forgiveness

- Continue working in qualifying employment during review

Step 5: Application Review and Final Discharge

Approval timelines vary:

- Typical review: 3–6 months

- Complicated cases: 9–12 months

Once approved, the remaining balance is discharged tax-free.

Common PSLF Application Mistakes (And How to Avoid Them)

Most PSLF denials are preventable.

Frequent Errors

- Wrong employer classification

- Missing signatures

- Incorrect repayment plan

- Consolidation timing mistakes

- Servicer payment miscounts

If forgiveness is denied in error, borrowers may need legal remedies, including administrative appeals or, rarely, court action.

What If Your PSLF Application Is Denied?

If your PSLF application is denied, you still have options:

Administrative Fixes

- Request payment recount

- Submit corrected employment forms

- Change repayment plans

Legal & Financial Backup Options

If PSLF fails due to permanent hardship:

- Bankruptcy hardship discharge (adversary proceeding)

- Settlement of private student loans

- Legislative forgiveness changes

This is why understanding all student loan relief paths together is critical.

How PSLF Fits Into the Bigger Student Loan Relief Strategy

PSLF is not a standalone solution—it should be part of a comprehensive strategy:

| Situation | Best Option |

| Public service + federal loans | PSLF |

| Private loans | Settlement |

| Severe hardship | Bankruptcy review |

| Collection risk | Early intervention |

Frequently Asked Questions

How long does the public service loan forgiveness application take?

Most applications are processed within 3–6 months, but complex cases can take up to a year.

Is PSLF taxable?

No. PSLF forgiveness is completely tax-free under federal law.

Can PSLF rules change?

Congress can change future rules, but earned qualifying payments are protected under current law.

Do I need a lawyer to apply for PSLF?

No, but legal advice is helpful if your application is denied or payments are miscounted.

Final Thoughts: Apply Early, Verify Often

The federal student loan forgiveness public service application can eliminate tens or hundreds of thousands of dollars in debt—but only if done correctly.

To protect yourself:

- Certify employment annually

- Track payments independently

- Keep copies of all forms

- Understand backup relief options

PSLF rewards long-term service—but preparation is what ensures success.