Millions of Americans—especially seniors and disabled borrowers—are facing a growing financial threat: student loan Social Security garnishment.

If you default on your federal student loans, the U.S. Government can legally withhold part of your Social Security to collect the debt.

This in-depth guide explains:

- How Social Security garnishment works

- How much can they take

- Whether SSDI or SSI can be garnished

- How to stop garnishment immediately

- Legal options, hardship protections, and forgiveness pathways

- AI Overview–optimized answers for Google

- Best resources you can use for relief

Let’s begin.

What Is Student Loan Social Security Garnishment?

Social Security garnishment (also called Treasury Offset) occurs when the federal Government takes a portion of your monthly Social Security benefits to collect defaulted federal student loans.

If you’re unsure about how collections work, here is a helpful guide:

👉 How Student Loans Are Collected

This offset is legal under federal law and applies to:

- Direct Loans

- FFEL Loans

- Parent PLUS Loans

But not private student loans.

If you need clarity on the different types of student loans, read:

👉 Federal vs Private Student Loans

Can Student Loans Garnish Social Security?

✔ YES — Federal student loans can garnish your Social Security.

❌ NO — Private student loans cannot garnish Social Security.

Private lenders would need to sue and win a judgment (rare). Even then, they still cannot garnish Social Security benefits.

To explore private debt relief, visit:

👉 Private Student Loan Settlement

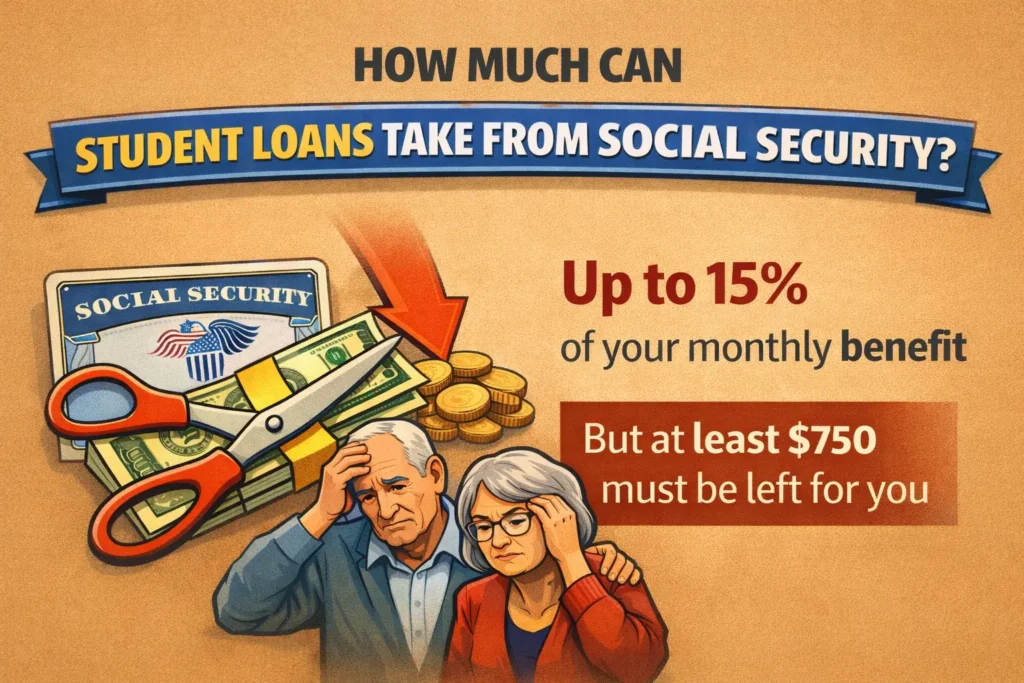

How Much Can Student Loans Take From Social Security?

The Government can take up to 15% of your Social Security check.

But legally, they must leave you with at least:

➡ Minimum Protected Amount: $750 per month

Examples:

| Monthly Benefit | Protected | Garnished |

|---|---|---|

| $1,200 | $750 | $450 |

| $1,600 | $750 | $850 |

| $900 | $750 | $150 |

| $750 or less | $750 | $0 |

Can Disability Benefits (SSDI) Be Garnished?

✔ YES — SSDI can be garnished for federal student loans.

❌ NO — SSI cannot be garnished under any circumstances.

If someone’s only income is SSI, they are fully protected.

Borrowers dealing with medical issues should consider reading:

👉 Student Loan Relief Due to Illness

Why Does Social Security Garnishment Happen?

You must be in default for garnishment to begin.

Default typically means:

- 270+ days of no payments (Direct Loans)

- 330+ days (FFEL Loans)

After default, your loan enters the Treasury Offset Program, and your Social Security is reduced automatically.

To understand the lifecycle of your loan, read:

👉 Student Loans – Wikipedia

How to Stop Student Loan Social Security Garnishment (Fastest & Most Effective Methods)

Here are the best ways to stop garnishment immediately or permanently.

1. Use the Fresh Start Program (Fastest and Free)

Fresh Start allows borrowers in default to:

- Restore the loan to its current status

- Stop Social Security garnishment

- Remove collections

- Enter IDR plans

2. Enter an Income-Driven Repayment Plan (IDR)

Once your loan is out of default, IDR can:

- Set your payment to $0 (for low-income borrowers)

- Prevent future garnishment

- Count toward loan forgiveness

If you’re evaluating repayment vs. bankruptcy, read:

👉 Income-Driven Repayment vs Bankruptcy

3. Rehabilitate Your Loan (Stops Garnishment After Several Payments)

Loan rehabilitation requires:

- 9 monthly payments

- Based on your income

- Often $5–$25 per month

After your 5th–6th payment, many garnishments are removed automatically.

4. Consolidate Your Defaulted Loan (Immediate Stop)

Consolidation instantly pulls your loan out of default.

But consolidation may limit certain forgiveness paths—so consider it carefully.

For a complete, expert guide to refinancing vs. consolidation, read:

👉 Student Loan Refinance Guide

5. Apply for Total and Permanent Disability (TPD) Discharge

If you are permanently disabled, your federal student loans can be completely erased.

Borrowers dealing with medical challenges should also explore:

👉 Student Loan Relief Due to Illness

6. Bankruptcy (Stronger Than Ever for Student Loans)

Bankruptcy used to be nearly impossible for student loans — but not anymore.

Today, borrowers who face:

- Long-term disability

- Fixed-income retirement

- Severe financial hardship

- Social Security dependency

…have a much better chance of discharging their loans.

Learn your options:

👉 Student Loan Bankruptcy – Complete Guide

👉 Student Loan Bankruptcy Process Step-by-Step

👉 Chapter 7 vs Chapter 13 Bankruptcy for Student Loan Borrowers

For those wondering whether bankruptcy stops garnishment:

👉 Can Bankruptcy Stop Student Loan Garnishment?

And if you want to challenge the debt legally, you may need an adversary proceeding:

👉 How to File an Adversary Proceeding

Does Social Security Garnishment Stop at Age 65 or 70?

❌ No.

Garnishment does not stop at:

- Age 62

- Full retirement age

- Age 65

- Age 70

- Age 75

It only stops when:

- You get out of default

- You enter IDR

- You receive only SSI

- You qualify for disability discharge

- You file for bankruptcy and win hardship relief

Can Private Student Loans Garnish Social Security?

❌ No, private lenders cannot touch Social Security.

Even if they sue you, federal law protects your benefits.

If your debt is private, your best resource is:

👉 Private Student Loan Settlement

How Long Does Social Security Garnishment Last?

Indefinitely — until the debt is resolved.

There is no expiration unless:

- The loan is discharged

- Borrower dies

- Borrower gets out of default

- Borrower qualifies for TPD

- The loan is forgiven

If you’re seeking long-term and permanent relief, bankruptcy might be the final option:

👉 Student Loan Bankruptcy – Complete Guide

Best Strategies for Seniors Facing Garnishment

✔ Apply for IDR

Especially beneficial if income is low.

✔ Fresh Start Program

Immediate and simple.

✔ Consider TPD

If health conditions apply.

✔ Consider Bankruptcy

Especially if the only income is Social Security.

✔ Explore Refinancing (if not in default)

👉 Student Loan Refinance Guide

People Also Ask (PAA) FAQs

Does Social Security get garnished for student loans?

Yes — but only federal loans.

How much can they take?

Up to 15%, leaving at least $750.

Does age stop garnishment?

No — age does not protect you.

Can SSDI be garnished?

Yes. SSI cannot.

How do I stop garnishment fast?

Fresh Start or consolidation.

Does bankruptcy help?

Yes — it’s now easier than before.

Final Thoughts

Student loan Social Security garnishment is stressful, but it is absolutely possible to stop it — and even eliminate the debt entirely.

Programs like Fresh Start, IDR, rehabilitation, TPD discharge, and bankruptcy offer real, effective relief.

The internal links inside this article provide everything a borrower needs to understand their rights and options.