Getting a student loan is one of the most important financial decisions you will ever make. Whether you are applying for federal aid, exploring private lenders, or searching for the easiest way to secure funding quickly, knowing the steps, requirements, and strategies will help you avoid common mistakes and ensure approval.

This guide explains how to get a student loan, from filling out the FAFSA to choosing the right lender. It also covers the required documents, eligibility criteria, timelines, tips for approval, and more.

1. Understand the Two Main Types of Student Loans

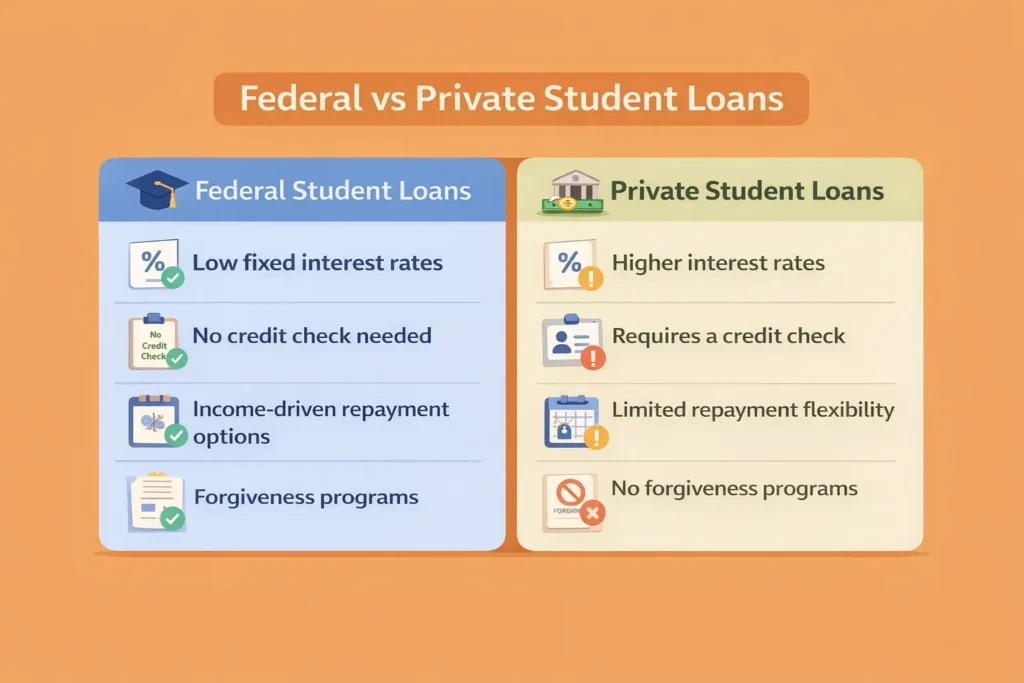

Before applying, you must understand the difference between federal and private student loans. This affects your interest rates, repayment options, eligibility for forgiveness, and the ease of approval.

1.1 Federal Student Loans

Federal student loans are issued by the U.S. Department of Education. They offer:

- Low fixed interest rates

- No credit check (for most loans)

- Income-driven repayment options

- Forgiveness programs

- Flexible deferment options

If you need help comparing loan types, read:

Federal vs Private Student Loans

1.2 Private Student Loans

Private loans come from:

- Banks

- Credit unions

- Online lenders

These typically require:

- A credit check

- A cosigner

- Higher interest rates

But they can fill funding gaps when federal loans are insufficient.

Private loan borrowers often explore settlement options later. Learn more:

Private Student Loan Settlement

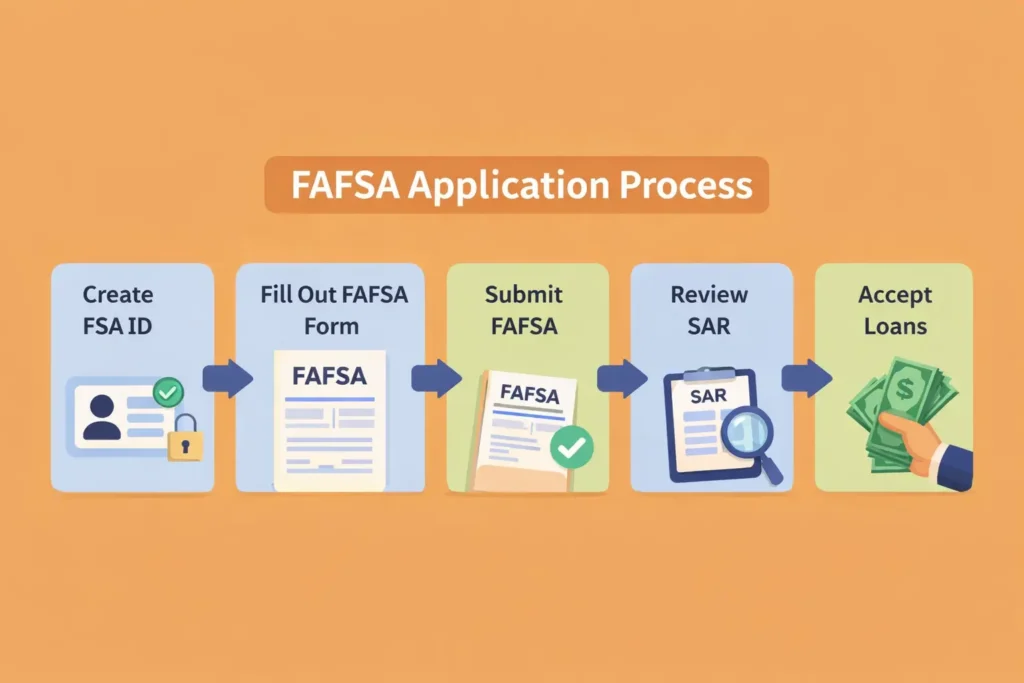

2. How to Get a Federal Student Loan

Federal loans are the simplest and most affordable option. Here is the exact process for 2026.

Step 1: Create Your FAFSA Account

Visit studentaid.gov and create an FSA ID.

You will need:

- Social Security number

- Phone number

- Email address

Step 2: Fill Out the FAFSA

The FAFSA (Free Application for Federal Student Aid) determines your eligibility for:

- Pell Grants

- Federal student loans

- Work-study

- Other institutional aid

Key documents needed:

- Tax returns

- W-2 forms

- Bank statements

- Income records

If you need help comparing post-approval repayment options, see:

Income-Driven Repayment vs Bankruptcy

Step 3: Review Your Student Aid Report (SAR)

Your SAR will summarize:

- Expected Family Contribution

- Pell Grant eligibility

- Federal loan amounts

- Errors you need to correct

Step 4: Accept Your Federal Loans

Your school will send a financial aid package. You can accept:

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- PLUS Loans (for parents or grad students)

Step 5: Complete Entrance Counseling + MPN

The Master Promissory Note is your binding loan contract.

Entrance counseling ensures you understand:

- Your interest rate

- Repayment obligations

- Loan limits

Step 6: Receive Your Loan Disbursement

Funds go directly to your school to cover:

- Tuition

- Fees

- Housing

Excess money is refunded to you.

3. How to Get a Private Student Loan

If federal loans aren’t enough—or you don’t qualify—you may need a private student loan.

Here is how the process works.

3.1 Check Your Credit Score

Most lenders require:

- 650+ credit score

- Low debt-to-income ratio

If your credit is poor, you may still qualify with a cosigner.

3.2 Compare Lenders

Look for lenders with:

- Low APR

- Fixed-rate options

- Flexible repayment terms

Always compare student loan offers before applying.

3.3 Apply Online

You will need:

- ID

- Income proof

- School information

- Cosigner details (if needed)

3.4 Complete Certification With Your School

Your lender confirms your:

- Enrollment status

- Loan amount

- Academic standing

3.5 Receive Your Funding

Just like federal loans, funds go to your school first.

If you later face repayment issues, explore relief options:

Student Loan Relief Due to Illness

4. Student Loan Requirements You Must Meet

Before applying, make sure you meet these requirements.

4.1 Federal Loan Requirements

You must:

- Be a U.S. citizen or eligible noncitizen

- Have a valid Social Security number

- Be enrolled at least half-time

- Maintain satisfactory academic progress

- Not be in default on federal loans

- Complete the FAFSA

4.2 Private Loan Requirements

Private lenders require:

- Good credit

- Stable income

- Cosigner (usually)

- Enrollment in an eligible school

5. Documents Needed to Get a Student Loan

Here are all the required documents for federal and private loans.

For FAFSA

- SSN

- Driver’s license (optional)

- Tax returns

- W-2 forms

- Bank statements

- Investment records

For Private Loans

- Government ID

- Social Security number

- Proof of address

- School acceptance letter

- Pay stubs/income verification

6. How to Get a Student Loan Fast

If you need funding quickly, follow these steps:

6.1 Submit FAFSA Early

Early applicants get faster processing.

6.2 Have All Documents Ready

This reduces delays.

6.3 Choose a Lender With Quick Approval

Many private lenders offer instant prequalification.

6.4 Maintain Good Credit

Higher credit = faster approval.

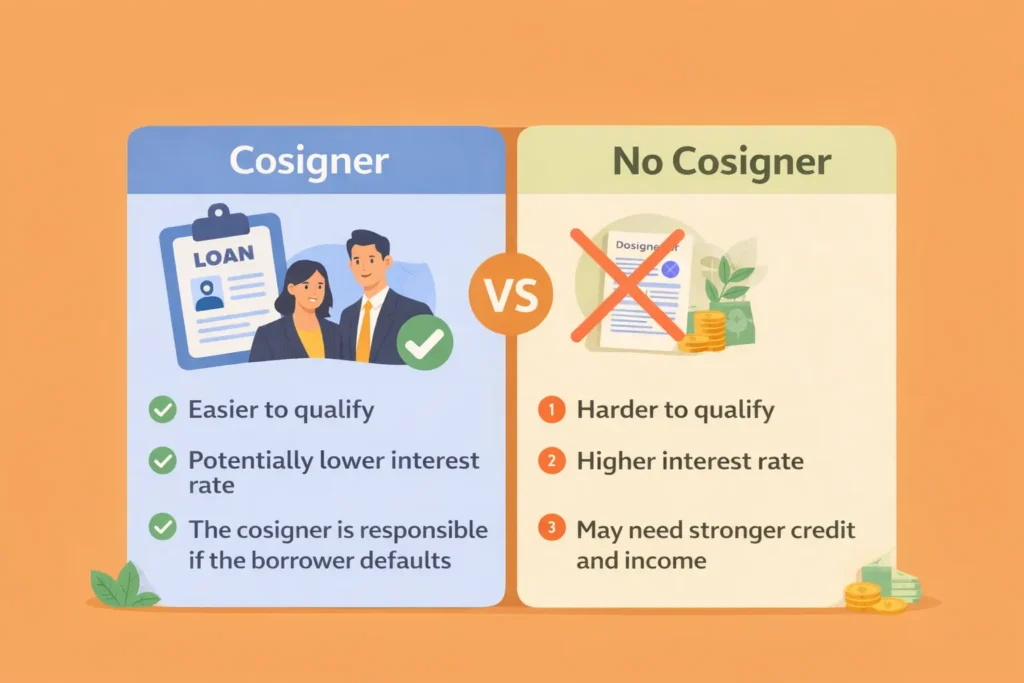

7. How to Get a Student Loan Without a Cosigner

Not having a cosigner is common. You may still qualify.

7.1 Choose Federal Loans (No Cosigner Needed)

Federal loans never require a cosigner.

7.2 Choose Private Lenders With Non-Cosigner Loans

A few lenders offer no-cosigner student loans for:

- Graduate students

- Medical students

- Law students

7.3 Build Your Credit

Higher credit improves approval odds.

8. How to Get a Student Loan With Bad Credit

Bad credit makes approval harder, but still possible.

8.1 Federal Loans Don’t Check Credit

Except for PLUS loans.

8.2 Use a Cosigner

Increases approval chances dramatically.

8.3 Compare Lenders for Bad-Credit Loans

Some lenders specialize in low-credit borrowers.

8.4 Improve Credit Before Applying

Pay off small debts

Reduce credit utilization

Correct errors on your credit report

9. How Much Student Loan Can You Get?

Federal loan limits depend on:

- Grade level

- Dependency status

- Subsidized vs unsubsidized eligibility

Annual Federal Loan Limits

- Dependent freshmen: $5,500

- Independent freshmen: $9,500

- Undergraduates: Up to $12,500/year

- Graduate students: Up to $20,500/year

Private loans typically allow up to the full cost of attendance.

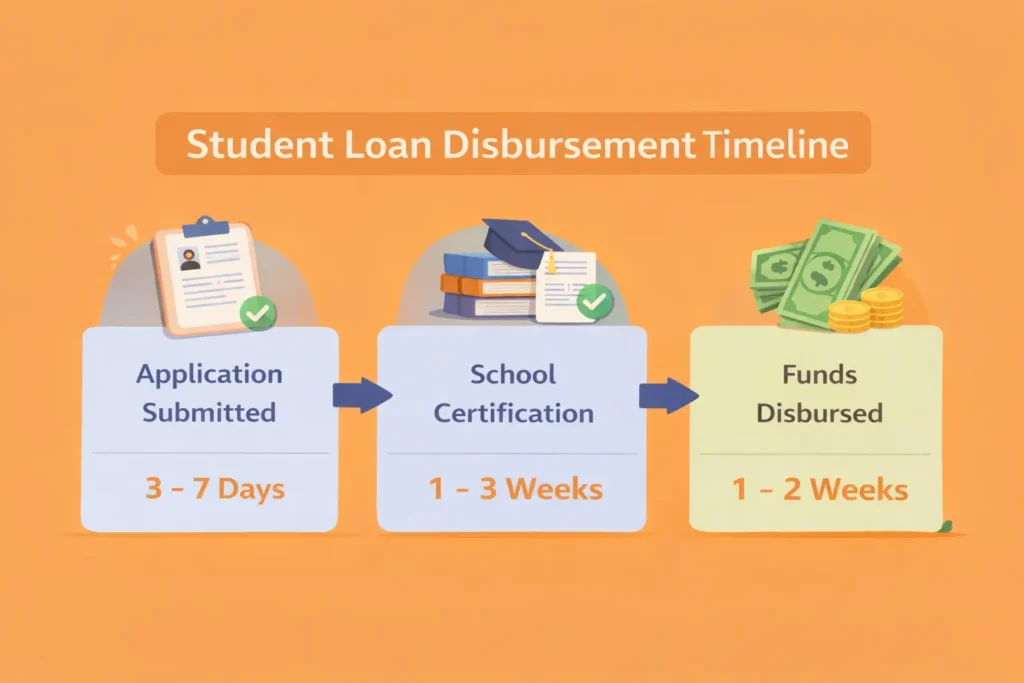

10. Timeline: How Long Does It Take to Get a Student Loan?

FAFSA Loans

- Processing: 3–5 days

- Aid package: 1–3 weeks

- Disbursement: Start of semester

Private Loans

- Prequalification: Minutes

- Full approval: 2–7 days

- Disbursement: 1–3 weeks

11. Mistakes to Avoid When Applying for Student Loans

- Waiting too long to complete FAFSA

- Borrowing more than needed

- Ignoring interest rate differences

- Not comparing lenders

- Not understanding repayment options

- Not checking the credit before applying

If payments become difficult later, explore discharge options:

Student Loan Bankruptcy Guide

Also see the full step-by-step breakdown:

Student Loan Bankruptcy Process

Some borrowers also explore:

Chapter 7 vs Chapter 13 Bankruptcy

12. How Interest Rates Work for Student Loans

Federal Loans

Rates are set each year and fixed.

Private Loans

Rates depend on:

- APR

- Credit score

- Variable or fixed options

- Market conditions

Comparing lenders matters. If refinancing later:

Student Loan Refinance Guide

13. Repayment Options After Getting a Loan

Federal loans offer:

- Standard repayment

- Graduated repayment

- Extended repayment

- Income-driven repayment

Income-driven plans include:

- SAVE plan

- PAYE

- REPAYE (older version)

- IBR

If you fall behind, read:

How Student Loans Are Collected

If your wages are being garnished, see:

Can Bankruptcy Stop Student Loan Garnishment?

14. What to Do If Denied for a Student Loan

Here are options:

- Add a cosigner

- Improve credit

- Apply for federal loans

- Choose a school with lower tuition

- Explore income-driven repayment if struggling later

- Appeal the school’s decision

15. People Also Ask

How do I qualify for a student loan?

You need to complete the FAFSA to qualify for federal loans. Private loans require good credit, income, and sometimes a cosigner.

What documents do I need?

Tax returns, ID, income records, school information, and credit details for private loans.

Can I get a student loan without parents?

Yes. Federal loans do not require parents. Private lenders may require a cosigner if your credit is low.

Can I get a student loan fast?

Yes. Private lenders offer quick prequalification. FAFSA should be completed early for the fastest approval.

Can I get a student loan with bad credit?

Yes. Federal loans allow it. Private loans require a cosigner or improved credit.

How much can I borrow?

Undergraduates can borrow up to $12,500 per year from the federal Government. Private loans can cover the full cost of attendance.

Do I need credit for FAFSA?

No. Federal loans do not require credit checks (except PLUS loans).

16. Choose Loans Carefully

Student loans can help you complete your degree, but borrowing wisely is essential. Always begin with federal loans, compare lenders, understand repayment plans, and avoid borrowing more than needed.

If you ever face financial hardship later in life, explore forgiveness, settlement, refinancing, or bankruptcy options using the internal resources linked in this guide.

1 Comment

Best Student Loan Refinance Companies - Las Vegas Student Loan Lawyer | Federal Student Loan Debt Relief

[…] you are new to borrowing, this guide to getting a student loan explains the basics in […]