Student loan debt continues to rise, and millions of borrowers in the United States are searching for real, reliable, and effective student loan help. Whether you are struggling with high monthly payments, facing wage garnishment, dealing with default, or exploring forgiveness programs, understanding your options can make a life-changing difference.

This comprehensive guide explains every major student loan relief option available in 2026, including repayment strategies, consolidation, forgiveness, refinancing, settlement, bankruptcy, and more.

What Is Student Loan Help?

Student loan help refers to any program, financial strategy, or legal tool that reduces your monthly payments, lowers interest, stops collection actions, provides forgiveness, or eliminates debt entirely.

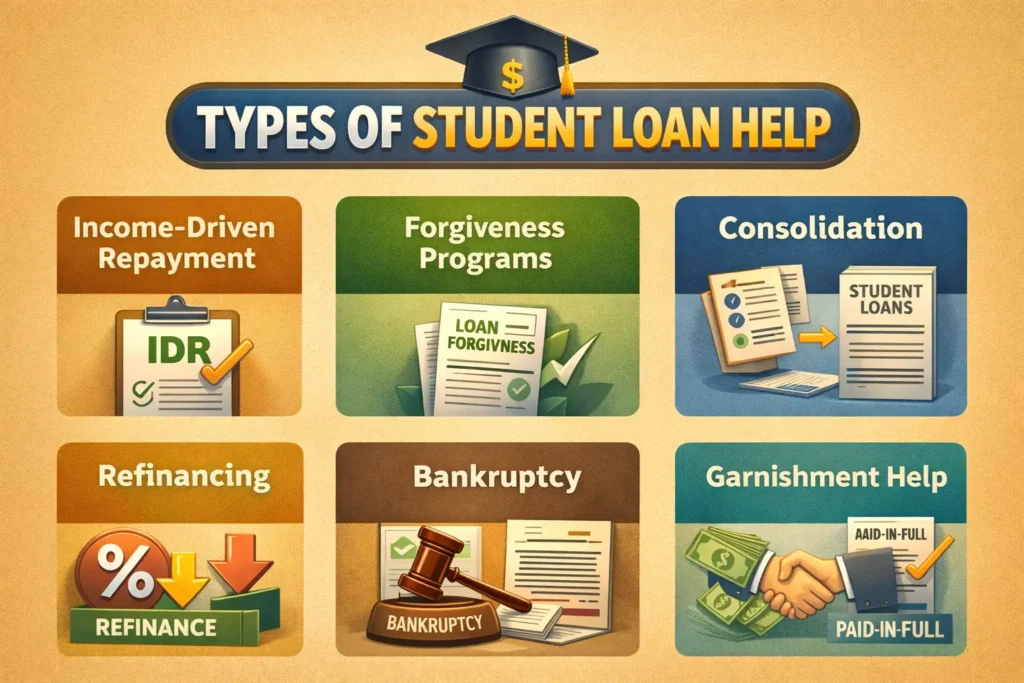

Student loan help includes:

- Income-driven repayment plans

- Federal loan forgiveness

- Student loan consolidation

- Student loan refinancing

- Hardship relief

- Settlement (for private loans)

- Default recovery options

- Wage garnishment protection

- Bankruptcy discharge (in certain cases)

These relief methods vary depending on your loan type, income, financial stability, and long-term goals.

Federal vs Private Student Loans (First Step Before Any Help)

Before choosing the right type of student loan help, you must know whether your loans are federal or private. Each has different relief options.

You can learn more in this guide on federal vs private student loans:

https://federalstudentloandebt.com/federal-vs-private-student-loans/

Income-Driven Repayment (IDR): The Most Accessible Student Loan Help

IDR plans are among the most powerful ways to reduce monthly payments because they calculate your payment based on your income and family size. Many borrowers pay significantly less, and some pay as little as $0 per month.

Main IDR Plans in 2026

- SAVE Plan

- PAYE (old borrowers)

- IBR

- ICR (Parent PLUS consolidation required)

Benefits of IDR:

- Payments adjust to your income

- Payments can be $0

- Interest benefits under SAVE

- Protection from default

- Forgiveness after 20–25 years

If you’re comparing repayment plans with legal options, see this resource on income-driven repayment vs bankruptcy:

https://federalstudentloandebt.com/income-driven-repayment-vs-bankruptcy/

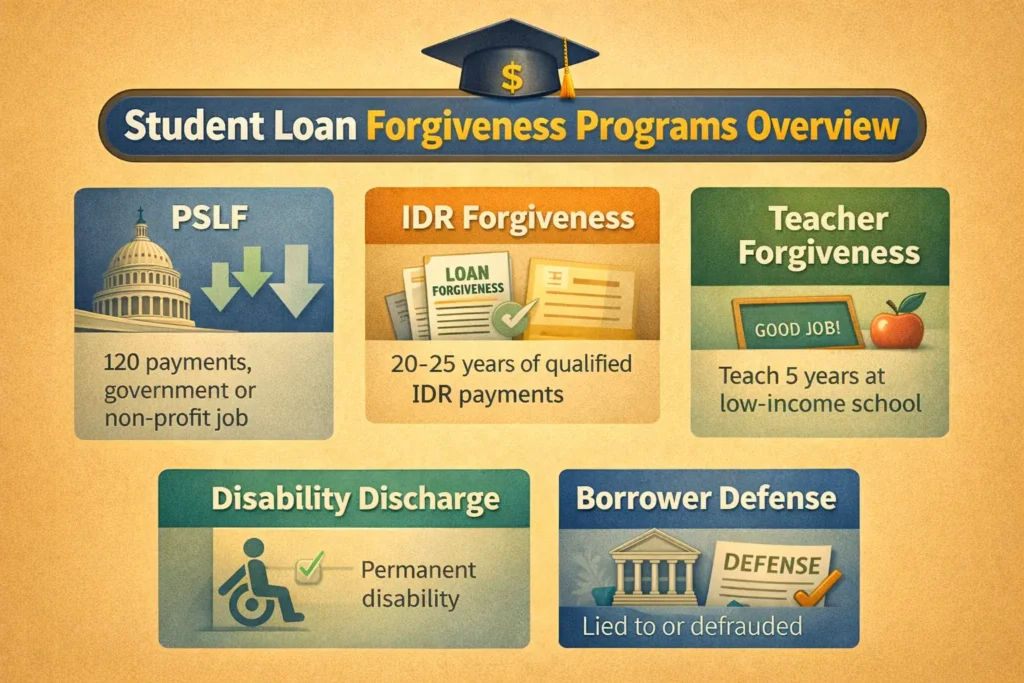

Student Loan Forgiveness Programs

Forgiveness programs discharge your federal student loan balance completely if you meet specific requirements.

Major Forgiveness Types:

- Public Service Loan Forgiveness (PSLF)

- IDR Forgiveness

- Teacher Loan Forgiveness

- Borrower Defence to Repayment

- Disability-Based Forgiveness

- Perkins Loan Cancellation

Borrowers facing health issues can learn about student loan relief due to illness here:

https://federalstudentloandebt.com/student-loan-relief-due-to-illness/

Student Loan Consolidation: A Smart Step for Many Borrowers

Federal consolidation combines multiple federal loans into a single new Direct Consolidation Loan.

Why Consolidation Helps:

- Makes loans eligible for IDR

- Qualifies loans for PSLF

- Simplifies payments

- Can remove the default quickly

- Converts some older loans into new Direct Loans

Consolidation is often the first step for borrowers wanting IDR or forgiveness.

Student Loan Refinancing: Lower Interest for Strong Borrowers

Refinancing replaces your federal and/or private loans with a new loan from a private lender.

Benefits:

- Lower interest rate

- Smaller monthly payment

- Faster payoff timeline

Risks:

- Loss of federal protections

- No more IDR

- No PSLF eligibility

Learn more through this detailed student loan refinance guide:

https://federalstudentloandebt.com/student-loan-refinance-guide/

Refinancing is best for borrowers with strong income, stable careers, and excellent credit.

Hardship Programs for Temporary Student Loan Help

If you are facing temporary financial hardship, the following programs provide short-term relief:

Hardship Options:

- Economic hardship deferment

- General forbearance

- Administrative forbearance

- Disaster deferment

These options pause payments but often allow interest to continue growing.

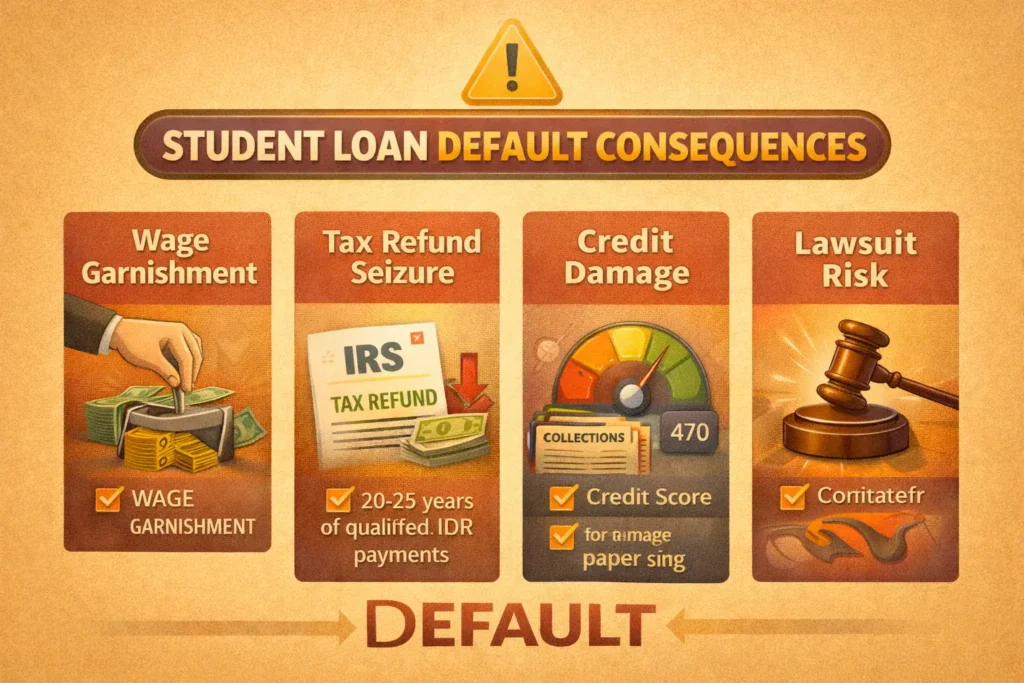

Help for Defaulted Student Loans

Student loan default can lead to serious consequences, including wage garnishment, collection fees, and credit damage.

You can learn more about how the system handles defaults in this guide on how student loans are collected:

https://federalstudentloandebt.com/student-loans-are-collected/

Ways to Get Out of Default:

1. Loan Rehabilitation

Make 9–12 affordable payments and remove the default status entirely.

2. Consolidation Out of Default

Immediately exit default by consolidating into a Direct Loan and entering IDR.

3. Bankruptcy (in rare but increasing cases)

More borrowers now qualify for hardship-based discharge.

Student Loan Garnishment Help

Wage garnishment can take up to 15% of your paycheck for federal student loan collection.

Ways to Stop Garnishment Quickly:

- Enter an income-driven repayment plan

- Consolidate the loan

- Complete rehabilitation

- File bankruptcy (special situations)

More detailed protection options can be found here:

https://federalstudentloandebt.com/an-bankruptcy-stop-student-loan-garnishment/

Stopping garnishment early prevents long-term financial damage.

Bankruptcy for Student Loan Help

Bankruptcy used to be extremely difficult for student loans, but updated legal guidelines now make it easier for borrowers to qualify for discharge under the “undue hardship” standard.

Two Types of Bankruptcy:

- Chapter 7 — eliminates debt quickly

- Chapter 13 — repayment plan over 3–5 years

Learn the key difference here:

https://federalstudentloandebt.com/chapter-7-vs-chapter-13-bankruptcy-for-student/

The Bankruptcy Process

A detailed timeline is available here:

https://federalstudentloandebt.com/student-loan-bankruptcy-process-step-by-step/

Complete Bankruptcy Guide

For full legal options and relief details:

https://federalstudentloandebt.com/student-loan-bankruptcy-the-complete-guide-to-discharge-relief-and-legal-options/

Adversary Proceeding Help

To request discharge, borrowers must file an adversary proceeding:

https://federalstudentloandebt.com/how-to-file-an-adversary-proceeding/

Bankruptcy is a powerful tool for borrowers facing extreme hardship, medical issues, or private loan collection.

Private Student Loan Help

Private student loans don’t have federal protections. Relief options depend on your lender’s policies.

Options for Private Loan Help:

- Settlement

- Refinancing

- Negotiation

- Hardship repayment plans

- Bankruptcy discharge

This guide explains how to negotiate a private student loan settlement:

https://federalstudentloandebt.com/private-student-loan-settlement/

Private loans are more flexible when lenders believe settlement is cheaper than pursuing collection.

People Also Ask (PAA)

1. What is the best student loan help option?

The best option depends on your income, loan type, and financial condition. Most borrowers start with income-driven repayment.

2. Can student loan payments be lowered?

Yes. IDR plans can drastically reduce payments—sometimes to $0.

3. Can student loans be forgiven?

Yes. Popular programs include PSLF, IDR forgiveness, and disability discharge.

4. Does bankruptcy eliminate student loans?

In many cases, yes. Changes in legal standards allow more borrowers to qualify.

5. How do I stop student loan wage garnishment?

You can stop garnishment through IDR, consolidation, rehabilitation, or bankruptcy.

6. Can private student loans be settled?

Yes. Settlement is often possible if you can demonstrate financial hardship.

Comprehensive Action Plan for Borrowers

Here’s the best step-by-step method for receiving student loan help:

Step 1: Confirm your loan type

This determines your relief options.

Step 2: Start an income-driven repayment plan

This is the fastest way to reduce payments.

Step 3: Review forgiveness eligibility

Check PSLF, IDR forgiveness, or special discharge programs.

Step 4: Consider consolidation

If needed to access IDR or exit default.

Step 5: Protect yourself from garnishment

Act quickly if wages are being taken.

Step 6: Evaluate refinancing

Only if you have a stable income and don’t need federal protections.

Step 7: Explore settlement options for private loans

Especially if you’re behind on payments.

Step 8: Consider bankruptcy (if extreme hardship applies)

Use the guides above for legal relief strategies.

Conclusion

Student loan help takes many forms, and the best option depends on your unique financial situation. By understanding repayment programs, forgiveness paths, refinancing opportunities, settlement strategies, and bankruptcy protections, you can make confident decisions and take back control of your financial future.

Whether you want to reduce your payments, qualify for forgiveness, stop garnishment, or discharge loans through bankruptcy, the right information empowers you to move forward.