Quick Summary

- Student loan deferment temporarily pauses your loan payments during hardship or qualifying situations.

- Federal loans may subsidize interest during deferment, while private loans usually do not.

- You must meet eligibility criteria such as unemployment, school enrollment, or military service.

- Deferment protects your credit better than default, but still affects long-term repayment timelines.

- Always compare deferment vs forbearance before applying.

How does student loan deferment work?

Student loan deferment works by temporarily suspending required monthly payments when you meet specific eligibility criteria, such as unemployment, economic hardship, or school enrollment. During deferment, federal subsidized loans may not accrue interest, while unsubsidized and private loans usually continue accruing interest.

Understanding Student Loan Deferment

Student loan deferment is a formal repayment pause approved by your loan servicer when you qualify under specific conditions. It is designed to prevent delinquency and default during financial hardship or major life transitions.

According to the official definition of student loan deferment, it refers to a temporary postponement of loan payments granted under eligibility requirements.

In short, deferment means you are still responsible for the loan, but payments are paused legally and reported as current.

Summary:

Deferment = Payment pause + eligibility approval + possible interest benefits depending on loan type.

This makes it a safer option than missing payments or going into default.

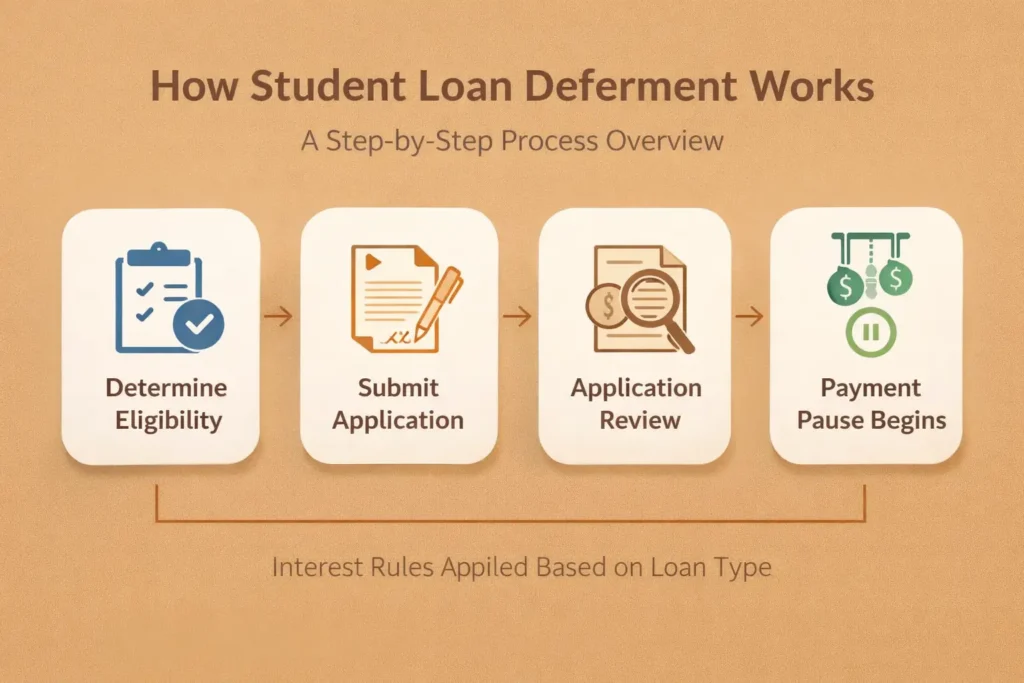

How Student Loan Deferment Works Step by Step

Step 1: Determine Eligibility

You must meet one qualifying condition:

- Unemployment

- Economic hardship

- School enrollment (half-time or more)

- Military service

- Graduate fellowship

Step 2: Submit Application to Loan Servicer

You apply through your loan servicer with documentation proving eligibility.

Step 3: Approval Review

The servicer verifies eligibility and approves or denies the deferment request.

Step 4: Payment Suspension Begins

If approved, payments are paused for a defined deferment period.

Step 5: Interest Treatment Depends on Loan Type

Interest rates vary between subsidized and unsubsidized loans.

Summary:

Eligibility → Application → Approval → Payment Pause → Interest Rules Applied.

Transition: Now, let’s examine the interest rules because they directly impact total repayment cost.

Do Student Loans Accrue Interest During Deferment?

This depends on whether the loan is subsidized or unsubsidized.

Interest Rules Comparison Table

| Loan Type | Interest During Deferment | Who Pays Interest |

| Subsidized Federal Loans | No | Government |

| Unsubsidized Federal Loans | Yes | Borrower |

| PLUS Loans | Yes | Borrower |

| Private Student Loans | Yes | Borrower |

If interest accrues and you do not pay it, it may capitalize, increasing your total loan balance.

Summary:

Subsidized loans = interest paused.

Unsubsidized & private loans = interest continues accumulating.

Transition: Understanding eligibility is crucial before requesting deferment approval.

Who Qualifies for Student Loan Deferment?

Common Eligibility Scenarios

- Enrollment in college at least half-time

- Active military duty

- Graduate fellowship programs

- Temporary unemployment

- Economic hardship (income-based criteria)

Borrowers often confuse deferment eligibility with forgiveness eligibility, which is explained in detail in our guide on federal vs private student loans.

Summary:

Eligibility depends on life events like school, hardship, or service—not just financial stress alone.

Transition: Next, we compare deferment vs forbearance because borrowers frequently mix them up.

Student Loan Deferment vs Forbearance: Key Differences

Comparison Table

| Feature | Deferment | Forbearance |

| Payments Required | No | No |

| Interest Subsidy | Sometimes | No |

| Eligibility Requirements | Strict | Flexible |

| Long-Term Cost Impact | Lower | Higher |

| Best Use Case | Qualifying hardship | Temporary relief without eligibility |

Deferment is generally more beneficial if you qualify because it may reduce interest costs.

Summary:

Deferment = Better long-term option.

Forbearance = Easier approval but more expensive over time.

Transition: Let’s explore how deferment impacts credit and loan status.

Does Student Loan Deferment Affect Credit Score?

Deferment itself does not hurt your credit score because payments are officially paused and reported as current. However, missed payments before approval can still damage credit.

You can also learn how loan collections work in our resource on how student loans are collected.

Summary:

Approved deferment protects credit.

Missing payments before approval may still harm your score.

Transition: Now, let’s walk through the full application process step by step.

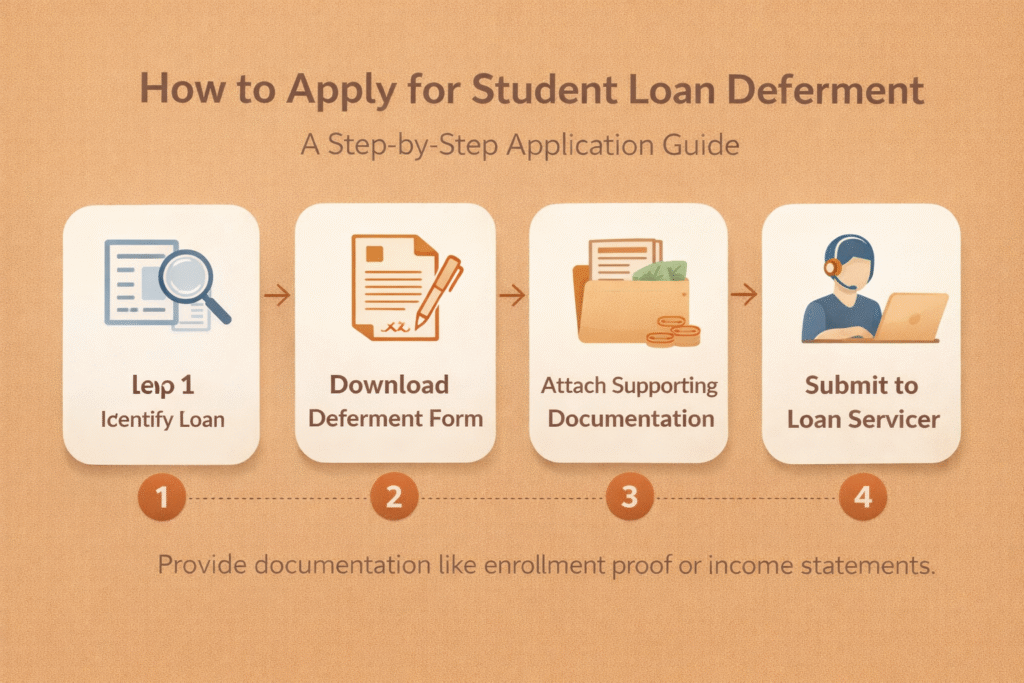

How to Apply for Student Loan Deferment

Step 1: Identify Your Loan Type

Check if your loan is federal or private via your loan servicer dashboard.

Step 2: Download Deferment Request Form

Federal loan borrowers can request deferment directly through their servicer’s website.

Step 3: Attach Supporting Documentation

Provide proof such as:

- School enrollment verification

- Unemployment documentation

- Income hardship proof

Step 4: Submit Application

Submit online or via mail, depending on the servicer’s requirements.

Step 5: Monitor Approval Status

Approval may take 2–4 weeks, depending on verification.

Summary:

Confirm loan type → Submit form → Provide proof → Wait for approval → Payments paused.

Transition: Even with approval, borrowers must understand long-term consequences.

Pros and Cons of Student Loan Deferment

Advantages

- Avoids delinquency and default

- Protects credit standing

- Provides financial breathing room

Disadvantages

- Interest may accumulate

- Extends the loan repayment period

- Increases the total cost if the unpaid interest capitalizes

Summary:

Deferment helps short-term cash flow but may increase long-term loan cost.

Transition: Next, we discuss how deferment compares with forgiveness programs.

Is Student Loan Deferment Better Than Forgiveness?

Deferment pauses payments temporarily, while forgiveness permanently eliminates remaining loan balances under qualifying programs.

One major forgiveness pathway is explained under Public Service Loan Forgiveness, which requires qualifying employment and payment history.

Summary:

Deferment = temporary relief.

Forgiveness = permanent balance elimination after requirements.

Transition: Now, let’s examine private student loan deferment rules.

How Private Student Loan Deferment Works

Private lenders offer deferment at their discretion. Unlike federal loans:

- Interest always accrues

- Eligibility is stricter

- Approval is less predictable

Borrowers facing extreme hardship may explore legal solutions described in our guide on student loan bankruptcy relief options.

Summary:

Private deferment exists but is stricter and often more expensive due to ongoing interest.

Transition: If deferment is denied, legal options may still exist.

What Happens If Your Deferment Request Is Denied?

If denied, you still have alternatives:

- Income-driven repayment plans

- Forbearance

- Legal hardship discharge options

In complex legal cases, borrowers may need guidance on how to file an adversary proceeding for bankruptcy-based discharge attempts.

Summary:

Denied deferment ≠ , no options.

Repayment plans and legal relief paths still exist.

Transition: Let’s explore when deferment is the best strategy.

When Should You Use Student Loan Deferment?

Best scenarios include:

- Returning to school

- Short-term unemployment

- Temporary financial hardship

- Military deployment

Avoid deferment if:

- You can afford payments under income-driven plans

- Interest capitalization would significantly increase the total balance

Summary:

Use deferment for temporary hardship—not long-term repayment avoidance.

Transition: Next, we add practical financial strategy insights.

Learn your eligibility and repayment options by visiting our student loan relief resources hub.

FAQs – Student Loan Deferment

1. How long can a student loan deferment last?

Deferment length varies but usually ranges from 6 months to 3 years, depending on eligibility category.

2. Does deferment forgive any student loan balance?

No. Deferment pauses payments but does not reduce or eliminatethe loan principal.

3. Can private student loans be deferred?

Yes, but approval is lender-specific, and interest usually continues accruing.

4. Is deferment automatic after losing a job?

No. You must apply and receive approval before payments are officially paused.

5. Does deferment stop collections?

Yes, once approved, active deferment can halt collection activity and prevent default escalation.

Final Takeaway

Student loan deferment is a powerful but temporary relief tool that pauses required payments when you meet qualifying conditions. While it protects credit and prevents default, borrowers must understand interest rules and long-term cost implications before applying.