Summary

Student loan consolidation means combining multiple loans into one new loan with a single monthly payment.

- It helps simplify repayment, access IDR plans, and potentially reduce the monthly burden.

- Federal vs private consolidation options have different eligibility, interest rules, and forgiveness impacts.

- Best for borrowers with multiple federal loans or mixed repayment plans.

- Always compare consolidation vs refinancing before deciding.

What is student loan consolidation help?

Student loan consolidation help refers to guidance and strategies that combine multiple student loans into one new loan to simplify payments, potentially extend repayment terms, and access income-driven repayment (IDR) or forgiveness programs, depending on loan type and eligibility.

What Is Student Loan Consolidation Help and How Does It Work?

Student loan consolidation merges multiple student loans into one loan with a single monthly payment and a new repayment schedule.

Student loan consolidation help involves guidance on combining several education loans into a single new loan. Instead of juggling multiple due dates, balances, and interest rates, borrowers get one consolidated loan with one payment plan.

This process is commonly used in the United States for federal student loans through the Direct Consolidation Loan program. According to the official overview of (conceptually similar reference), consolidation simplifies repayment while keeping federal protections intact.

If you’re overwhelmed managing multiple loan accounts, consolidation provides administrative relief and structured repayment clarity.

For broader guidance, see our pillar resource:

Complete student loan help resources

How Consolidation Actually Works?

- All eligible loans are paid off

- A new consolidated loan replaces them

- One monthly payment is created

- Interest becomes weighted average (rounded up)

In short, consolidation replaces multiple loans with one unified loan, making repayment easier but not always cheaper.

Is Student Loan Consolidation a Good Idea in 2026?

Consolidation is helpful if you want simpler payments, IDR eligibility, or forgiveness access, but not ideal if your current interest rates are already low.

Whether consolidation is “good” depends on borrower goals. In 2026, consolidation is especially beneficial for borrowers seeking:

- Income-driven repayment access

- Loan forgiveness qualification

- Single monthly payment simplicity

- Default recovery options

However, consolidation does not lower your interest rate—it averages them.

When Consolidation Makes Sense

- You have multiple federal loans

- You want PSLF eligibility alignment

- You need simpler payment management

- You plan to switch to IDR repayment

When It Might Not Be Ideal

- You already have low interest rates

- You’re close to loan forgiveness progress

- You don’t want an extended repayment term

For understanding interest behavior, read:

How student loan interest works

So the bottom line is: consolidation is a strategic tool, not a universal solution—it depends on your repayment goals and forgiveness timeline.

Federal vs Private Student Loan Consolidation: What’s the Difference?

Federal consolidation keeps government protections, while private consolidation (refinancing) can lower rates but removes federal benefits.

| Feature | Federal Consolidation | Private Consolidation |

| Interest Rate | Weighted average | Based on the credit score |

| Forgiveness Eligibility | Retained | Lost |

| IDR Plans | Available | Not available |

| Credit Check | No | Yes |

| Best For | Federal loan holders | Strong credit borrowers |

Understanding the difference between federal and private loans is essential.

Explore: Federal vs private student loans comparison

Federal consolidation = safety + flexibility

Private consolidation = potential savings + credit-dependent risk

In short, federal consolidation prioritizes borrower protections, while private consolidation focuses on interest savings but sacrifices federal benefits.

Does Student Loan Consolidation Lower Monthly Payments?

Yes, consolidation can lower monthly payments by extending the repayment term, though it may increase total interest paid.

Consolidation lowers payments by spreading repayment over a longer period (up to 30 years). While this reduces monthly pressure, it can increase overall interest costs.

Example Breakdown

| Loan Balance | Before Consolidation | After Consolidation |

| $50,000 | $550/month | $320/month |

| Term | 10 years | 25 years |

| Total Interest | Lower | Higher |

This trade-off must be carefully evaluated depending on long-term financial goals.

Here’s what matters: lower monthly payments often come at the cost of paying more total interest over time.

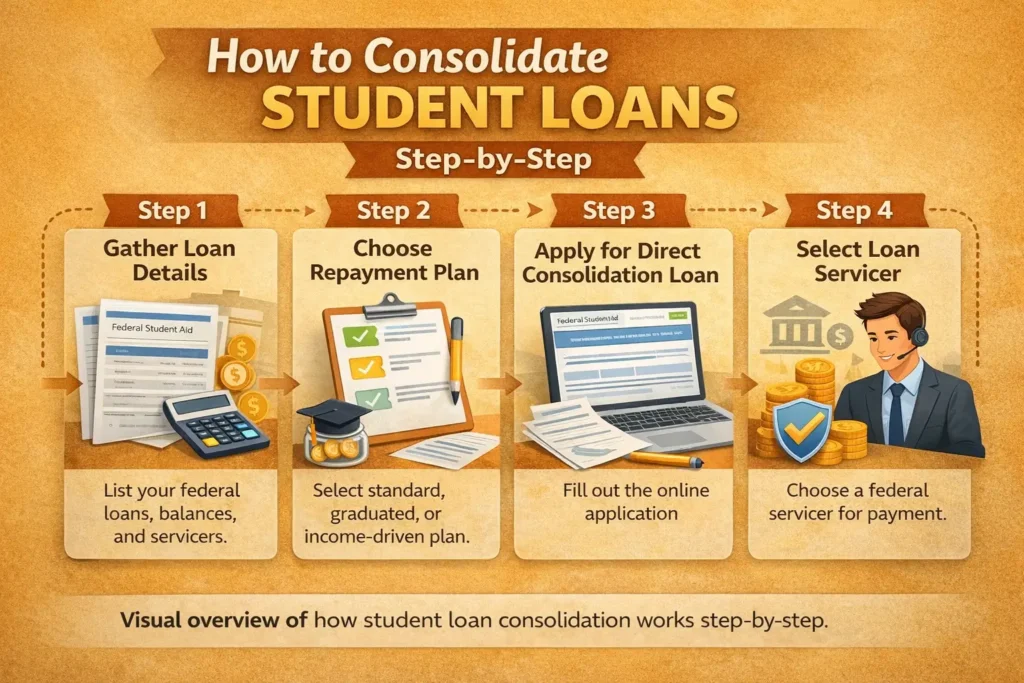

How to Consolidate Student Loans Step-by-Step

Apply online, choose a repayment plan, select a servicer, and complete consolidation within 30–60 days.

Step-by-Step Guide

Step 1: Gather Loan Details

List all federal loan balances, rates, and servicers.

Step 2: Choose Repayment Plan

Select standard, graduated, or income-driven plan.

Step 3: Apply for a Direct Consolidation Loan

Apply through the federal student aid portal.

Step 4: Select Loan Servicer

Pick a federal servicer to manage payments.

Step 5: Continue Payments During Processing

Processing takes 30–60 days.

For personalized help, visit:

Contact our student loan guidance team

In short, consolidation is a simple online application process that restructures your repayment timeline.

Will Consolidation Affect Loan Forgiveness or IDR Plans?

Yes, consolidation can reset forgiveness progress but also make loans eligible for IDR and PSLF programs.

Consolidating federal loans can:

- Qualify loans for IDR

- Enable PSLF eligibility alignment

- Potentially reset forgiveness timeline (in some cases)

For deeper strategy insights:

Income-driven repayment plans explained

Important Consideration

If you’re already close to forgiveness milestones, consolidation may restart qualifying payment counts.

So the key takeaway is: consolidation can unlock forgiveness options but might reset progress depending on loan history.

Pros and Cons of Student Loan Consolidation

Consolidation simplifies payments and improves flexibility but may increase total interest and extend repayment duration.

Pros

- Single monthly payment

- Access to IDR & PSLF

- Simplified loan tracking

- Lower monthly payment option

Cons

- Interest rate not reduced

- Longer repayment term

- Possible forgiveness reset

- More total interest paid

Here’s what matters: consolidation improves management but may cost more long-term interest.

Comparison Table: Consolidation vs Refinancing

| Factor | Consolidation | Refinancing |

| Loan Type | Federal loans | Federal + Private |

| Interest Rate | Weighted avg | Potentially lower |

| Credit Requirement | None | Required |

| Forgiveness Eligibility | Yes | No |

| Risk Level | Low | Moderate |

In short, consolidation focuses on flexibility, while refinancing focuses on saving money through lower interest rates.

At our research desk, we’ve analyzed hundreds of borrower cases. Most borrowers benefited from consolidation when they needed IDR access or simpler payments, especially with multiple federal loans.

FAQ – Student Loan Consolidation Help

1. Is student loan consolidation a good idea?

Yes, if you want simpler payments and access to IDR or forgiveness programs, but compare long-term interest costs first.

2. Will consolidation reduce my interest rate?

No. Federal consolidation uses a weighted average rate, which typically does not reduce interest.

3. Can I consolidate private and federal loans together?

Not in federal consolidation. Mixing both requires private refinancing, which removes federal protections.

4. How long does consolidation take?

Usually, 30–60 days from application to final approval.

5. Does consolidation affect credit score?

Federal consolidation does not require credit checks, so the credit impact is minimal.

Should You Get Student Loan Consolidation Help?

Student loan consolidation help is most valuable for borrowers seeking payment simplicity, IDR eligibility, and federal forgiveness pathways. It’s not designed to reduce interest rates but rather to improve manageability and repayment flexibility.

Before consolidating, compare your current repayment progress, interest costs, and long-term forgiveness goals. Strategic consolidation can be powerful—but only when aligned with your financial plan.

Next best action: Explore complete student debt solutions here:

Visit our main student loan resource hub