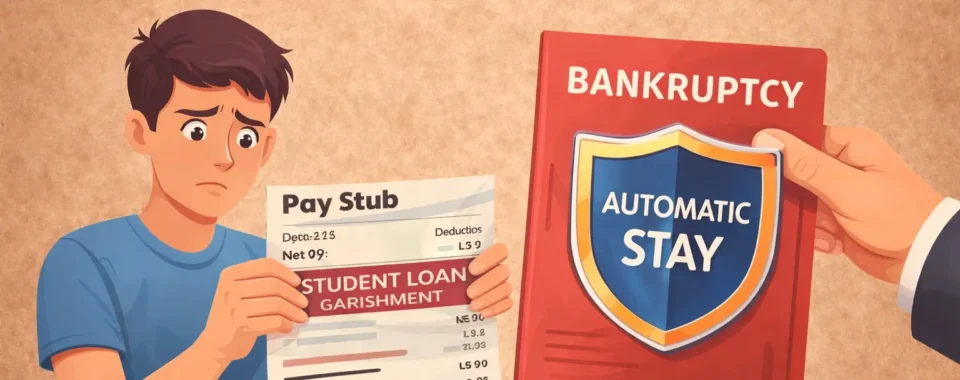

Student loan wage garnishment can seriously disrupt your financial life. When money is taken directly from your paycheck, managing rent, food, and utilities becomes far more difficult. Under this pressure, many borrowers begin searching for immediate legal solutions. At that stage, one question usually comes first: Can bankruptcy stop student…

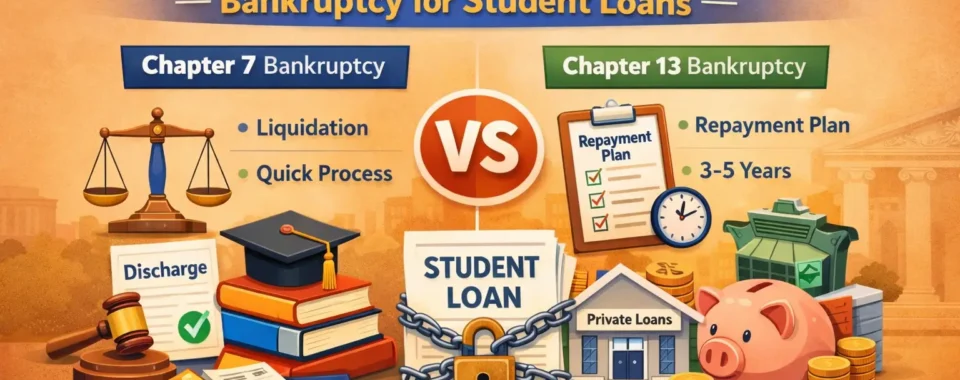

Student loan debt is one of the hardest financial burdens to escape for many borrowers. As a result, people are often told that bankruptcy does nothing for student loans. However, that belief is incomplete and, in many cases, misleading. For borrowers facing collections, wage garnishment, lawsuits, or long-term financial distress,…

Student loan debt has become one of the most difficult financial burdens for borrowers in the United States.As a result, wage garnishment, tax refund seizures, lawsuits, and ongoing collections push many people into financial distress. Because of these pressures, many borrowers believe there is no escape from student loan debt.For…

Always fixed rates determined by Congress and standardized across borrowers.Federal and private student loans are the two primary ways students finance higher education in the United States. While both allow students to borrow money for college or career school, they differ enormously in terms of eligibility, repayment flexibility, protections, and…

Private student loans in the United States are issued by banks, credit unions, and private lenders, and unlike federal loans, they lack federal protections and forgiveness programs. Borrowers often face higher interest rates, stricter repayment terms, and limited flexibility in hardship situations. This can make repayment difficult, especially when financial…

Filing bankruptcy can eliminate or reorganize many debts, but some disputes require more than a simple motion. If you are dealing with student loan discharge, creditor fraud, lien disputes, or challenges to debt dischargeability, you may need to take an additional legal step—filing an adversary proceeding. This in-depth guide explains…