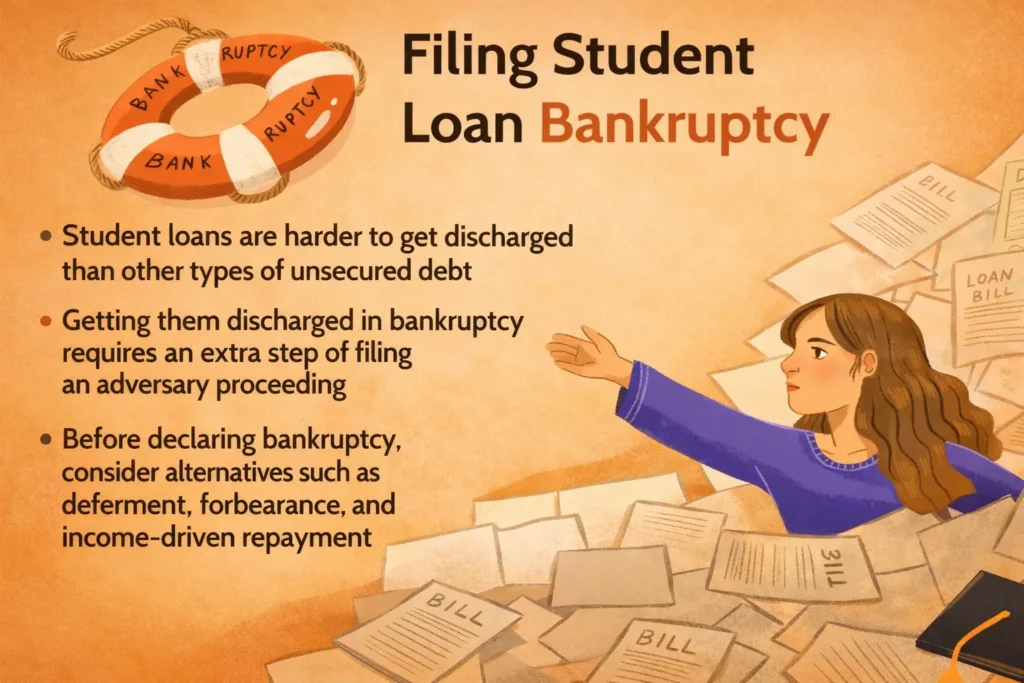

Student loan debt is one of the hardest financial burdens to escape for many borrowers. As a result, people are often told that bankruptcy does nothing for student loans. However, that belief is incomplete and, in many cases, misleading.

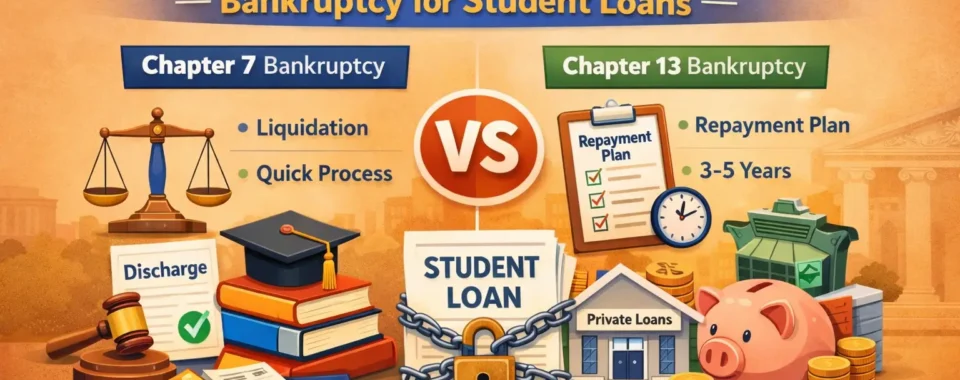

For borrowers facing collections, wage garnishment, lawsuits, or long-term financial distress, understanding Chapter 7 vs Chapter 13 bankruptcy for student loans is extremely important. Although student loan debt is not automatically discharged in bankruptcy, both Chapter 7 and Chapter 13 can still provide meaningful relief when used correctly.

In this comprehensive guide, we explain how each chapter of bankruptcy works. We also explore how Chapter 7 and Chapter 13 affect federal and private student loans. Finally, we help you determine which option may be best for your specific situation.

Important Student Loan Resources

Before diving into the comparison, it is helpful to understand the broader legal framework surrounding student loan debt relief. The following resources provide essential background and practical guidance.

If you are considering suing to discharge student loans, you should first review this detailed guide on how to file an adversary proceeding.

Similarly, borrowers struggling with private lenders may benefit from exploring proven private student loan settlement options.

To better understand enforcement risks, it is also important to know how student loans are collected and what actions lenders can take.

In addition, learning the legal differences between federal vs private student loans can help you choose the right debt relief strategy.

For a broader overview, you may want to read Student Loan Bankruptcy: The Complete Guide to Discharge, Relief, and Legal Options.

Moreover, if you prefer a procedural breakdown, follow the student loan bankruptcy process step by step.

Finally, for statutory context, you can review Chapter 7 bankruptcy law and how it functions under federal law.

What Does Bankruptcy Do for Student Loans?

Bankruptcy does not automatically erase student loans. However, it can still provide several important forms of relief.

For example, bankruptcy can:

- Stop student loan collections immediately

- Halt wage garnishment and lawsuits

- Pause interest accumulation, at least temporarily

- Create leverage for settlement or discharge

- Allow a court-approved repayment structure

- Provide a legal pathway to discharge through undue hardship

Ultimately, the difference between Chapter 7 vs Chapter 13 bankruptcy for student loans lies in how this relief is achieved and how long the protection lasts.

Understanding Chapter 7 Bankruptcy for Student Loans

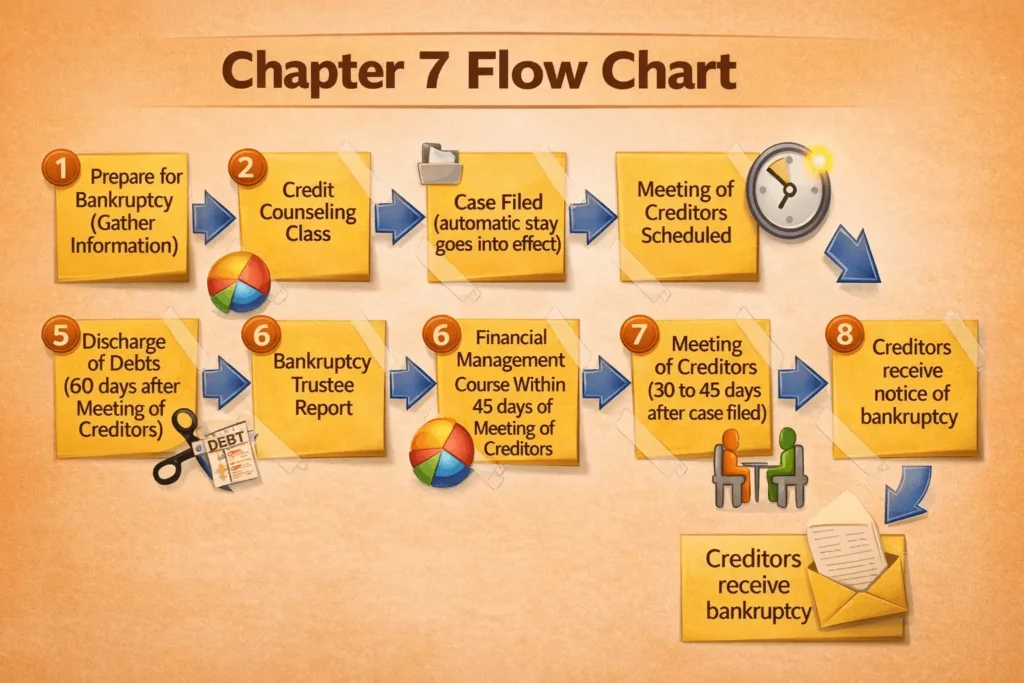

What Is Chapter 7 Bankruptcy?

Chapter 7 bankruptcy is commonly known as “liquidation bankruptcy.” It is designed to eliminate unsecured debts quickly and provide the filer with a financial fresh start.

In most cases, Chapter 7 bankruptcy is completed within three to six months, making it the fastest form of consumer bankruptcy.

How Chapter 7 Treats Student Loans

Student loans are not automatically discharged in Chapter 7. Nevertheless, Chapter 7 can still be helpful in several important ways.

Specifically, Chapter 7 can:

- Stop collections immediately through the automatic stay

- Eliminate other debts, such as credit cards and medical bills, freeing up income

- Allow you to file an adversary proceeding to seek student loan discharge

- Improve your financial position for proving undue hardship

Can Student Loans Be Discharged in Chapter 7?

Yes, student loans can be discharged in Chapter 7. However, discharge is only possible through an adversary proceeding.

To succeed, you must prove undue hardship, most often under the Brunner Test. Courts typically examine whether:

- You cannot maintain a minimal standard of living

- Your financial hardship is likely to continue

- You made good-faith efforts to repay the loans

Advantages of Chapter 7 for Student Loans

- Fast financial relief

- Immediate stop to garnishment

- No repayment plan required

- Strong leverage for settlement negotiations

- Well-suited for borrowers with very low income

Disadvantages of Chapter 7

- Strict income eligibility requirements

- Limited long-term protection

- Student loans remain unless discharged

- Less control once the case closes

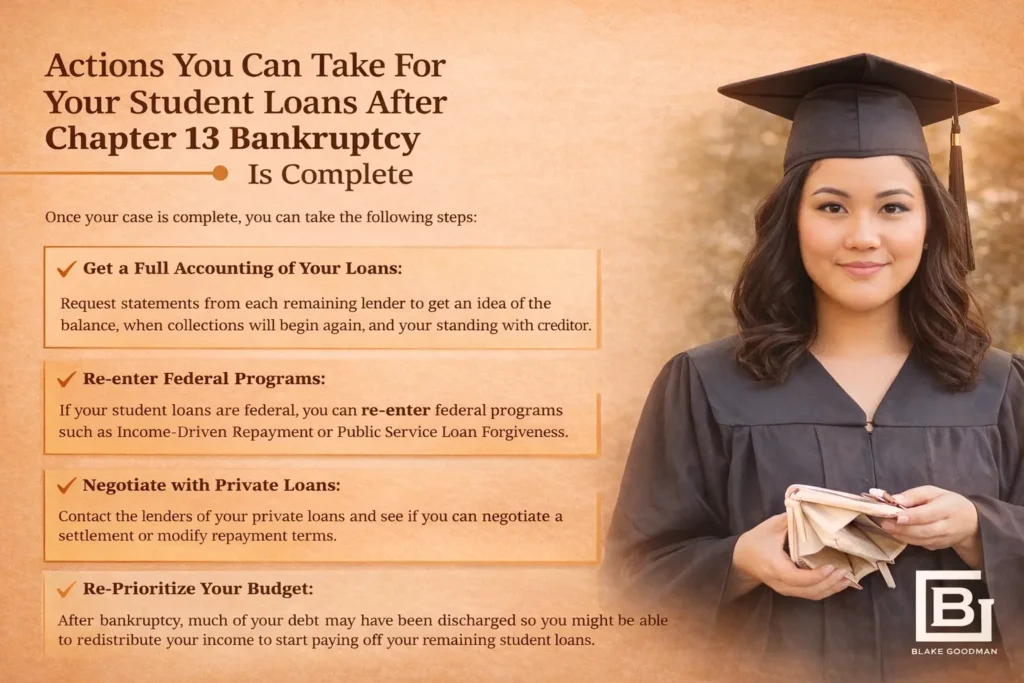

Understanding Chapter 13 Bankruptcy for Student Loans

What Is Chapter 13 Bankruptcy?

Chapter 13 bankruptcy involves a court-approved repayment plan lasting between 3 and 5 years. Instead of liquidating assets, debtors reorganize their debts under court supervision.

How Chapter 13 Treats Student Loans

Under Chapter 13, student loans are included in the repayment plan. However, they are treated differently from most other debts.

In general:

- Student loans are not automatically discharged

- Interest may continue to accrue

- Collections are stopped for the entire plan period

- Borrowers gain long-term payment stability

Can Student Loans Be Discharged in Chapter 13?

Yes, student loans may be discharged in Chapter 13, but only through an adversary proceeding, just as in Chapter 7.

That said, Chapter 13 offers several strategic advantages. For instance:

- Courts can evaluate hardship over multiple years

- Borrowers demonstrate sustained good-faith repayment

- Reduced payments strengthen hardship evidence

- Private lenders are more likely to negotiate settlements

Advantages of Chapter 13 for Student Loans

- Stops collections for three to five years

- Protects co-signers

- Lowers monthly payment pressure

- Prevents default-related penalties

- Provides a strong foundation for discharge litigation

Disadvantages of Chapter 13

- Long-term commitment

- Requires consistent income

- Risk of dismissal if payments fail

- Interest may continue to grow

Chapter 7 vs Chapter 13 Bankruptcy for Student Loans: Comparison

Eligibility

- Chapter 7: Income limits apply

- Chapter 13: Requires steady income

Duration

- Chapter 7: 3–6 months

- Chapter 13: 3–5 years

Student Loan Discharge

- Both chapters require an adversary proceeding

- Neither guarantees discharge

Collection Protection

- Chapter 7: Short-term

- Chapter 13: Long-term

Best Use Cases

- Chapter 7: Severe hardship, limited income

- Chapter 13: Ongoing income, need for extended protection

Final Thoughts

Ultimately, choosing between Chapter 7 vs Chapter 13 bankruptcy for student loans can determine whether you remain stuck in long-term debt or move toward financial recovery.

Both bankruptcy chapters can:

- Stop collections

- Create legal leverage

- Allow discharge through undue hardship

- Protect borrowers from aggressive lenders

The right option depends on your income, loan type, and long-term financial goals.

Comments (4)

Student Loan Bankruptcy: Discharge, Relief & Legal Options

[…] Chapter 7 vs Chapter 13 Bankruptcy for Student Loans→ […]

Can Bankruptcy Stop Student Loan Garnishment? Explained

[…] A detailed comparison is available in this guide on Chapter 7 vs Chapter 13 bankruptcy for student loans. […]

Medical Hardship Student Loan Relief: Eligibility & Options

[…] 👉 Chapter 7 vs Chapter 13 bankruptcy for student loans […]

Income Driven Repayment vs Bankruptcy: Which Saves More?

[…] A detailed comparison is available inChapter 7 vs Chapter 13 bankruptcy for student loans […]