How can you legally settle student loan debt?

You can legally settle student loan debt by negotiating a lump-sum payoff, enrolling in federal forgiveness or IDR plans, or working with lenders for hardship-based settlements. Federal loans follow strict rules, while private lenders may accept negotiated settlements under documented financial hardship.

Summary of This Guide

- Legal student loan settlement depends on whether the loan is federal or private.

- Federal loans rarely settle but offer forgiveness and IDR options.

- Private student loans can often be negotiated after default or hardship.

- Always document income, hardship, and repayment ability before negotiating.

- Avoid illegal debt relief scams; use verified settlement methods only.

Introduction: Why Student Loan Debt Settlement Matters in 2026

Student loan debt continues to rise globally, especially in countries like the United States, Canada, and the UK, where higher education financing relies heavily on borrowing. Many borrowers now seek legal settlement options instead of defaulting or filing bankruptcy.

If you’re overwhelmed by monthly payments, interest growth, or long repayment terms, understanding legal settlement strategies can help you reduce balances responsibly while protecting your credit and financial future.

In this comprehensive guide, we’ll explore legal ways to settle student loan debt, compare federal vs. private settlement rules, and outline actionable negotiation strategies.

For deeper foundational knowledge, see our pillar resource on student loan help resources and strategies.

How to Legally Settle Student Loan Debt

What Does “Student Loan Debt Settlement” Legally Mean?

Student loan settlement legally means negotiating with the lender to accept less than the total balance as full payment due to verified financial hardship.

Student loan settlement refers to an agreement where a lender accepts a reduced lump-sum payment to close the loan account. This option is more common with private student loans and is limited for federal loans due to government regulations.

According to the definition of student loans, these are financial aid funds that must typically be repaid with interest unless forgiven or discharged.

Key Legal Characteristics

- Must be a voluntary agreement with the lender

- Requires documented financial hardship

- Often involves lump-sum payment negotiation

- May impact credit score depending on account status

In short, legal settlement means negotiating repayment terms lawfully—not avoiding repayment or using fraudulent debt relief services.

Can You Legally Settle Federal Student Loan Debt?

Federal student loan settlements are rare; instead, borrowers use forgiveness, IDR plans, or hardship discharge programs legally provided by the government.

Federal student loans follow strict U.S. Department of Education regulations. Direct settlements are uncommon unless the loan is in default and handled by collection agencies.

Instead of settlement, federal borrowers typically use:

Legal Federal Alternatives to Settlement

- Income-Driven Repayment (IDR) Plans

- Public Service Loan Forgiveness (PSLF)

- Closed School Discharge

- Borrower Defense to Repayment

- Total and Permanent Disability Discharge

To understand repayment flexibility, read our detailed guide on Income-Driven Repayment (IDR) plans explained.

So the bottom line is: federal loans rarely allow settlements, but government forgiveness and repayment plans provide legal debt reduction pathways.

Is It Easier to Settle Private Student Loan Debt Legally?

Yes, private student loans are more flexible; lenders may accept negotiated settlements, especially if the borrower shows verified hardship or default risk.

Private lenders (banks, credit unions, or financing companies) operate under contract law, making negotiated settlements legally possible.

When Private Lenders Accept Settlements

- The loan is delinquent or in default

- Borrower demonstrates long-term hardship

- Lump-sum payment available

- Collection risk is high for the lender

For more insight into differences, explore the federal vs private student loans comparison.

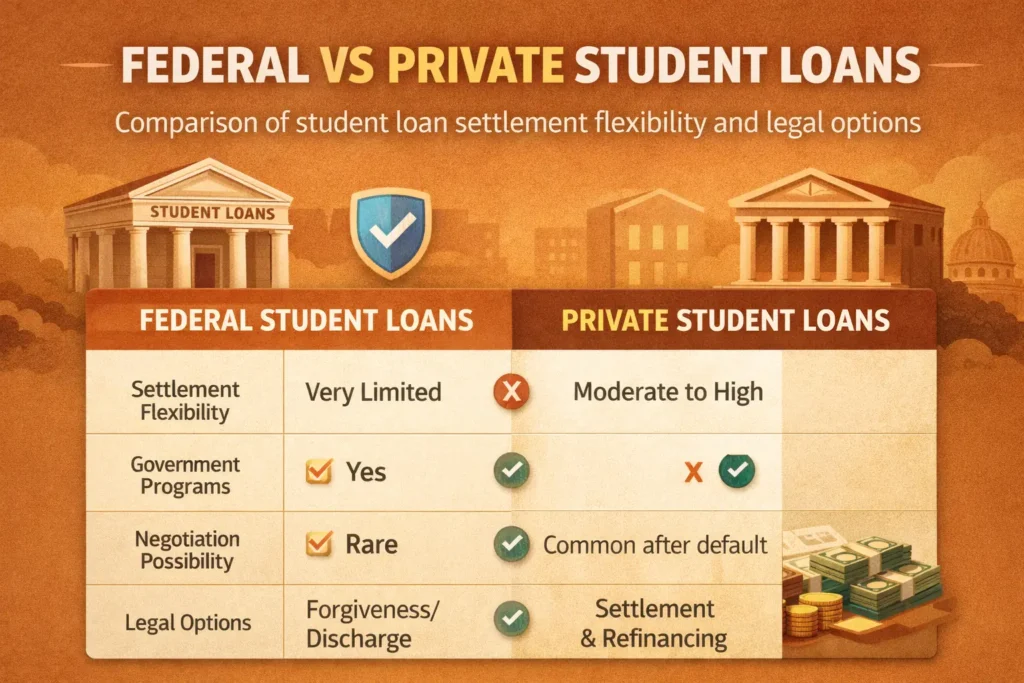

| Factor | Federal Loans | Private Loans |

| Settlement Flexibility | Very Limited | Moderate to High |

| Government Programs | Yes | No |

| Negotiation Possibility | Rare | Common after default |

| Legal Options | Forgiveness/Discharge | Settlement & Refinancing |

Here’s what matters: private student loans offer more legal negotiation opportunities compared to federally regulated loans.

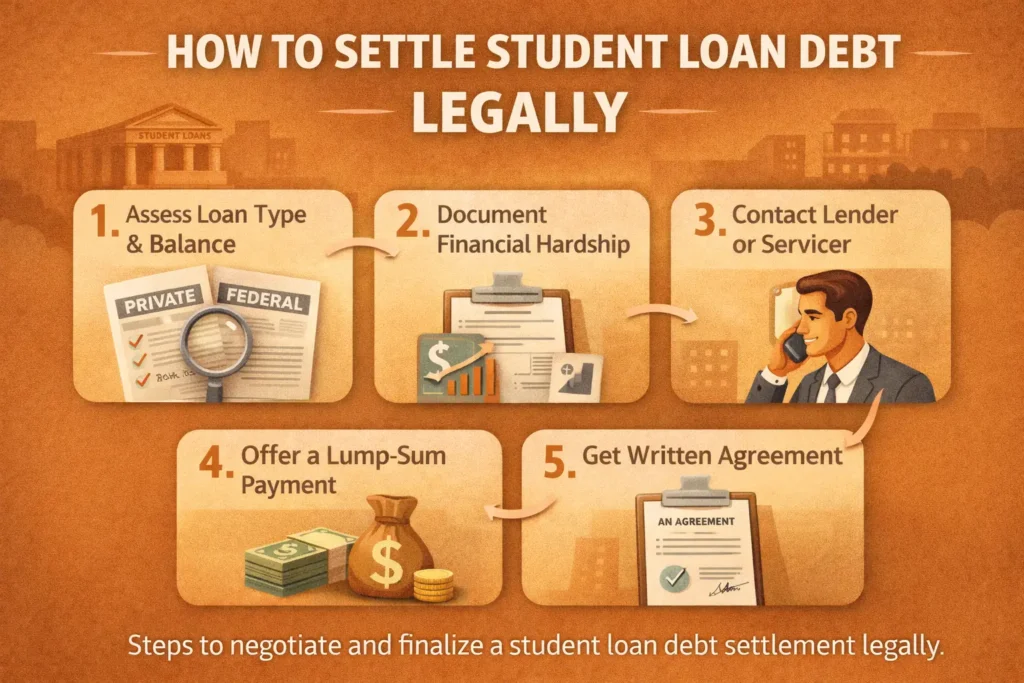

Step-by-Step: How to Legally Negotiate Student Loan Settlement

To legally negotiate a settlement, gather hardship proof, contact the lender directly, propose a lump-sum offer, and obtain a written settlement agreement before payment.

Step 1: Assess Loan Type and Balance

Identify whether your loan is federal or private. Settlement eligibility depends heavily on loan type.

Step 2: Document Financial Hardship

Provide:

- Income statements

- Expense breakdown

- Medical or employment hardship proof

Step 3: Contact Lender or Servicer

Initiate negotiation formally via:

- Email communication

- Certified letter

- Settlement negotiation call

Step 4: Offer a Realistic Lump Sum

Most lenders accept 40%–70% of the balance, depending on default risk.

Step 5: Get Written Legal Agreement

Never pay until you receive:

- Settlement confirmation letter

- “Paid in Full” or “Settled” statement

For interest-related impacts, read how student loan interest works.

In short, legal settlement requires documentation, formal negotiation, and a written agreement before making any payment.

What Happens to Your Credit After Legal Settlement?

A settled student loan may lower your credit score temporarily, but it is still better than ongoing default or delinquency.

Settlement impacts depend on account status:

- Current account → minimal impact

- Delinquent/default → moderate score drop

- Long-term default → settlement improves credit trajectory

Credit Reporting Terms

- “Settled for Less Than Owed”

- “Paid as Settled”

- “Closed Account – Settlement”

So the key takeaway: settlement may hurt credit short-term, but it prevents more serious financial damage from default and collections.

Legal Risks to Avoid When Settling Student Loan Debt

Avoid illegal debt settlement scams, upfront fee companies, and unauthorized consolidation schemes that violate consumer protection laws.

Red Flags

- Guarantees full loan forgiveness instantly

- Requests upfront negotiation fees

- Asks for login credentials to the loan account

- Promises secret government settlement programs

You can contact professional assistance safely through our official contact page for loan guidance.

Here’s what matters: only negotiate directly with lenders or verified advisors to ensure settlement remains fully legal and enforceable.

Comparison: Settlement vs Forgiveness vs Repayment Plans

Settlement reduces principal via negotiation, forgiveness cancels balance through programs, and repayment plans adjust monthly payments without reducing total debt immediately.

| Strategy | Best For | Legal Basis | Debt Reduction |

| Settlement | Private loan hardship | Contract negotiation | Moderate |

| Forgiveness | Public service borrowers | Federal law | High |

| IDR Plans | Low-income borrowers | Federal programs | Gradual |

Also read: Why student loans grow quickly in the United States.

In short, settlement is negotiation-based, while forgiveness and IDR rely on structured legal government programs.

Can You Settle Student Loan Debt Without Defaulting?

Yes, but it’s harder; lenders are more willing to settle after delinquency when they believe full repayment is unlikely.

While settlement is possible before default, lenders typically require:

- Proof of long-term hardship

- Evidence borrower cannot meet future payments

- Lump-sum payment availability

So the bottom line: settlement without default is possible but less common; hardship evidence significantly improves acceptance chances.

Legal Tax Implications of Student Loan Settlement

Settled student loan amounts may be considered taxable income unless excluded under federal hardship or insolvency tax rules.

Potential Tax Effects

- Forgiven amount may be treated as income

- IRS insolvency exclusion may apply

- Disability or PSLF forgiveness may be tax-exempt

Here’s what matters: settlement can reduce debt but may create tax obligations depending on the forgiveness type and financial status.

When Should You Consider Legal Settlement?

You should consider settlement when long-term repayment is impossible, hardship is documented, and lump-sum funds are available to negotiate closure.

Ideal candidates include:

- Long-term unemployed borrowers

- Individuals with medical hardship

- Borrowers facing lawsuits or collections

- Those with high-interest private loans

Explore more legal strategies on our private student loan debt settlement tag guide.

In short, settlement is best for borrowers facing genuine financial hardship with limited ability to repay full balances.

- Federal loans: use forgiveness and IDR instead of settlement

- Private loans: settlement often possible after hardship

- Written agreements are legally essential

- Avoid scams promising instant loan elimination

FAQ Section

Can student loan debt be legally forgiven through a settlement?

Yes, but mostly for private loans. Federal loans rely more on forgiveness programs than negotiated settlements.

How much can you legally settle student loan debt for?

Typically, 40%–70% of the balance, depending on hardship and lender policies.

Does settlement remove student loan debt completely?

Yes, once the lender accepts the negotiated payoff and marks the account as settled or paid in full.

Is student loan settlement better than bankruptcy?

Usually, yes, since bankruptcy discharge for student loans is rare and requires proving “undue hardship” legally.

Can international borrowers settle student loans legally?

Yes, but laws vary by country (USA, UK, Canada). Private lender policies and local consumer laws determine settlement legality.

Final Takeaway: The Safest Legal Path to Student Loan Debt Settlement

Legal student loan settlement is possible, but the strategy depends on the loan type. Federal loans rely on structured forgiveness and repayment programs, while private loans offer negotiation opportunities when hardship is documented.

The safest path includes:

- Understanding loan classification

- Negotiating directly with lenders

- Avoiding illegal settlement companies

- Obtaining written agreements before payment

For ongoing guidance and updates, visit our homepage:

👉 https://federalstudentloandebt.com/