Student loan debt has become one of the most difficult financial burdens for borrowers in the United States.

As a result, wage garnishment, tax refund seizures, lawsuits, and ongoing collections push many people into financial distress.

Because of these pressures, many borrowers believe there is no escape from student loan debt.

For this reason, student loan bankruptcy has become one of the most searched legal topics.

However, it is also one of the least understood.

Many borrowers hear that student loans can never be discharged.

In reality, this claim is misleading rather than absolute.

This guide explains the student loan bankruptcy process step by step using precise language, legal accuracy, and real-world strategy.

By the end, you will be able to decide whether bankruptcy is the right option for your situation.

What Is Student Loan Bankruptcy?

Student loan bankruptcy is a legal process in which a borrower asks a bankruptcy court to reduce or eliminate student loan debt due to extreme financial hardship.

Before focusing on student-loan-specific rules, it is essential to understand bankruptcy in general.

➡️ What Is Bankruptcy? Definition, Types, and Legal Meaning

However, student loans follow different rules.

Unlike credit cards or medical bills, the law treats student loans as non-dischargeable by default.

Because of this rule, borrowers must take additional legal steps to qualify for relief.

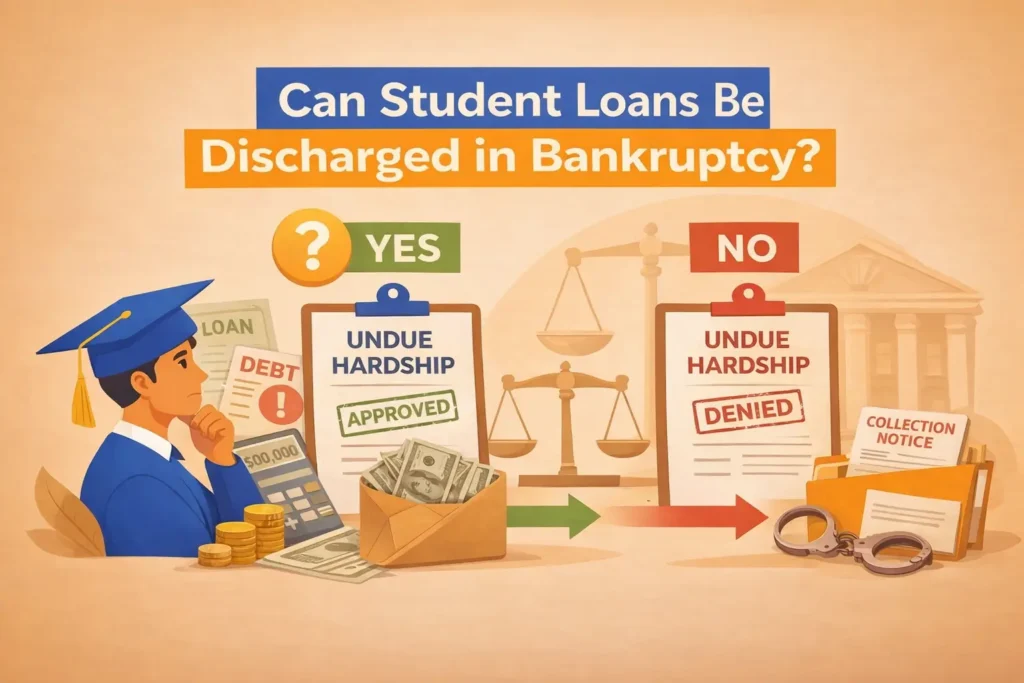

Can Student Loans Be Discharged in Bankruptcy?

Yes, student loans can be discharged in bankruptcy.

However, courts only grant relief when the borrower proves undue hardship.

Courts do not automatically erase student loan debt.

Instead, borrowers must complete several steps:

- First, file a bankruptcy case

- Next, file a separate lawsuit within that case

- Finally, prove that repayment would cause long-term financial hardship

For a complete legal explanation, see:

➡️ Student Loan Bankruptcy: Discharge, Relief, and Legal Options

Federal vs. Private Student Loans in Bankruptcy

Not all student loan debt behaves the same way in bankruptcy.

Because of this difference, understanding the loan type is critical before filing.

➡️ Federal vs. Private Student Loans: Legal Differences Borrowers Must Know

Federal Student Loans

The U.S. Government backs federal student loans.

As a result, these loans come with powerful collection tools.

For example, the Government may garnish wages or seize tax refunds without a lawsuit.

Because of these powers, federal loans are harder—but not impossible—to discharge.

Private Student Loans

Banks and private lenders issue private student loans.

Unlike federal loans, they follow contract law.

Because of this structure, private loans are often easier to negotiate, settle, or partially discharge.

Why Student Loans Are Harder to Discharge

Congress created strict bankruptcy rules to prevent misuse.

For this reason, courts require strong and clear proof.

In most cases, judges look for three key factors:

- The hardship is not temporary

- The borrower cannot maintain a minimal standard of living

- The borrower made good-faith efforts to repay

Together, these factors shape the entire bankruptcy process.

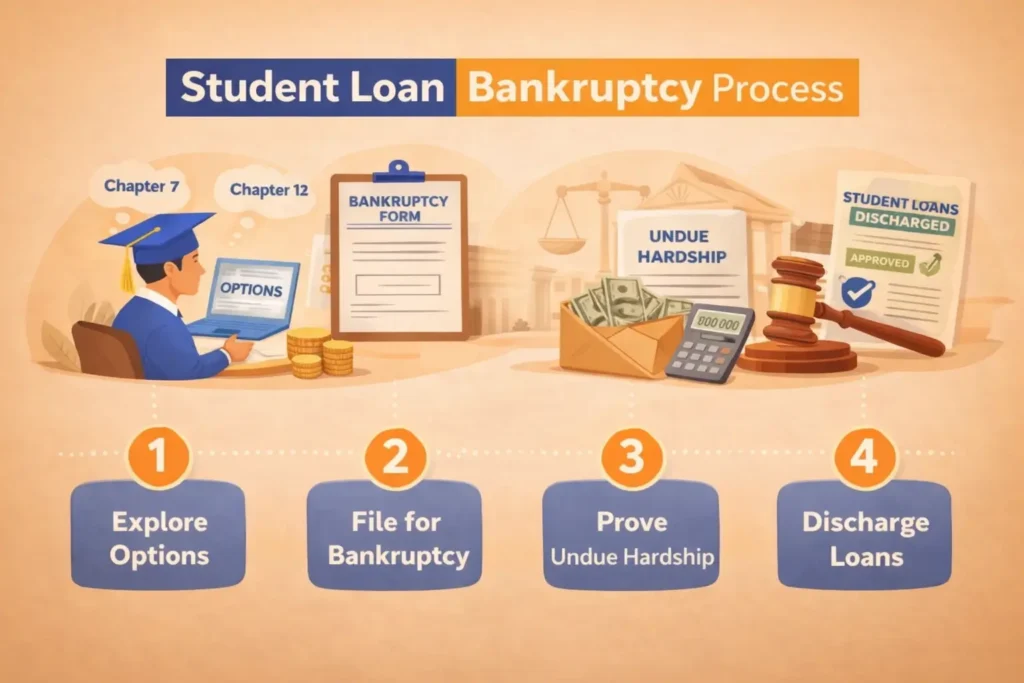

Student Loan Bankruptcy Process Step by Step

Below is the complete student loan bankruptcy process step by step, explained clearly and practically.

Step 1: Review Your Financial Situation Thoroughly

Before filing for bankruptcy, borrowers should carefully review their finances.

Start by examining:

- Total student loan balance

- Federal versus private loan breakdown

- Income sources

- Monthly living expenses

- Assets and property

- Current collection status

If loans are already in collections, timing becomes critical.

➡️ How Student Loans Are Collected: From Missed Payments to Lawsuits

Step 2: Decide Whether Bankruptcy Is Appropriate

Bankruptcy is not the first solution for most borrowers.

However, it becomes necessary when other options fail.

For example, bankruptcy is often considered when:

- Collection efforts become aggressive

- Wage garnishment begins

- Tax refunds are repeatedly seized

- Settlement attempts no longer work

For private loans, settlement may still be possible.

➡️ Private Student Loan Settlement Options: How Borrowers Reduce Debt

Step 3: Choose the Correct Bankruptcy Chapter

Most borrowers file under one of two bankruptcy chapters.

Chapter 7 Bankruptcy

Chapter 7 works best for borrowers with limited income.

It moves quickly and may remove unsecured debt.

However, asset liquidation may occur in some cases.

Chapter 13 Bankruptcy

Chapter 13 uses a court-approved repayment plan.

This option protects assets and spreads payments over three to five years.

Because of this flexibility, many borrowers choose Chapter 13.

Step 4: File the Bankruptcy Petition

Once the bankruptcy petition is filed, the court issues an automatic stay.

As a result:

- Collection calls stop immediately

- Wage garnishment pauses

- Lawsuits are frozen

⚠️ Important:

At this stage, student loans are not discharged.

Step 5: File an Adversary Proceeding (Critical Step)

This step forms the core of student loan bankruptcy.

To discharge student loans, borrowers must file a formal lawsuit within the bankruptcy case.

This lawsuit is known as an adversary proceeding.

➡️ How to File an Adversary Proceeding in Bankruptcy (Step-by-Step Guide)

Without this step, student loans are not discharged in bankruptcy.

Step 6: Prove Undue Hardship in Court

During the adversary proceeding, the court reviews the hardship claim.

Most courts apply the Brunner Test, which examines:

- Whether the borrower can maintain a minimal standard of living

- Whether the hardship is likely to continue long-term

- Whether good-faith repayment efforts were made

To support the claim, borrowers may submit:

- Income records

- Medical documentation

- Employment history

- Detailed expense reports

Step 7: Court Decision on Student Loan Discharge

After reviewing all the evidence, the judge issues a ruling.

The court may take several actions:

- It may fully discharge the student loans

- In some cases, it may partially discharge the balance

- In other situations, it may modify repayment terms

- If requirements are not met, it may deny discharge

Even partial relief can significantly reduce debt pressure.

Step 8: Life After Student Loan Bankruptcy

If the court discharges the loans:

- The balance becomes zero

- As a result, collections stop permanently

- Over time, credit rebuilding can begin

If the court denies discharge:

- Settlement or repayment options may still remain

- However, bankruptcy protection still provided temporary relief

Timeline: How Long Does Student Loan Bankruptcy Take?

The timeline varies by case.

In most situations:

- Bankruptcy filing takes effect immediately

- Adversary proceedings last between 3 and 12 months

- Court decisions depend on case complexity

More complex cases may take longer.

Pros and Cons of Student Loan Bankruptcy

Advantages

- Possible full or partial discharge

- Permanent relief from collections

- Strong legal protection

Disadvantages

- Complex legal process

- No guaranteed outcome

- Possible credit impact

Common Myths About Student Loan Bankruptcy

Myth: Student loans can never be discharged

Truth: Courts can discharge them under undue hardship

Myth: Bankruptcy ruins your life

Truth: Many borrowers rebuild credit within a few years

Myth: Only unemployed people qualify

Truth: Many working borrowers succeed

Who Should Consider Student Loan Bankruptcy?

Student loan bankruptcy may be appropriate when:

- Income cannot cover basic living costs

- Medical or disability issues limit earning ability

- Loan balances exceed realistic income

- Collection pressure feels permanent

Frequently Asked Questions

Can student loans really be discharged in bankruptcy?

Yes. However, an adversary proceeding is required.

Do I need a lawyer?

Legal help is strongly recommended due to the complexity.

Does bankruptcy stop wage garnishment immediately?

Yes. The automatic stay begins after filing.

Is Chapter 7 or Chapter 13 better?

The correct option depends on income, assets, and loan type.

Final Thoughts: Is Student Loan Bankruptcy Worth It?

The student loan bankruptcy process, step by step, is challenging.

However, for borrowers facing long-term hardship, it can be life-changing.

Before filing, borrowers should:

- Understand their loan type

- Explore settlement options

- Gather hardship documentation

- Seek legal advice

Student loan bankruptcy is not a loophole.

Instead, it is a legal relief tool designed for extreme financial situations.

Comments (3)

Student Loan Bankruptcy: Discharge, Relief & Legal Options

[…] How to File an Adversary ProceedingStudent Loan Bankruptcy Process Step by Step […]

Can Bankruptcy Stop Student Loan Garnishment? Explained

[…] Before filing, it is important to understand the student loan bankruptcy process step by step. […]

How to Get a Student Loan in 2026 | Complete Step-by-Step Guide

[…] Also see the full step-by-step breakdown:Student Loan Bankruptcy Process […]