Medical hardship can instantly destroy financial stability. A serious illness, long-term treatment, or permanent disability often reduces income while expenses increase. For borrowers carrying student loan debt, this situation can quickly become overwhelming.

Medical hardship student loan relief exists to protect borrowers whose health conditions prevent them from maintaining regular student loan payments. When used correctly, it can pause collections, reduce costs, or even eliminate student loans.

This guide explains every medical hardship student loan relief option, how each one works, and when legal action may be necessary.

What Is Medical Hardship Student Loan Relief?

Medical hardship student loan relief refers to federal programs, legal protections, and court-based remedies available to borrowers who cannot repay student loans due to illness or disability.

Unlike ordinary financial hardship, medical hardship recognizes that health conditions are often involuntary and long-term. As a result, borrowers may qualify for stronger relief options.

These options may include:

- Temporary payment suspension

- Income-based payment reduction

- Disability-based loan discharge

- Long-term forgiveness

- Bankruptcy-based relief

- Settlement for private student loans

Why Medical Hardship Is Treated Differently

Medical hardship affects more than just cash flow. It often involves:

- Loss of earning ability

- Ongoing treatment costs

- Long or uncertain recovery periods

- Permanent physical or mental limitations

Because of these factors, medical hardship plays a significant role in student loan forgiveness, deferment decisions, and bankruptcy cases.

Medical Conditions That May Qualify for Student Loan Relief

You may qualify for medical hardship student loan relief if you or a dependent suffers from:

- Cancer or chemotherapy treatment

- Chronic autoimmune disease

- Severe mental health conditions

- Neurological disorders

- Permanent physical disability

- Long-term hospitalization

- Terminal illness

What matters most is how the condition affects your ability to work and earn income, not the diagnosis alone.

Federal vs Private Student Loans and Medical Hardship

Before choosing a relief strategy, it is critical to understand the difference between federal and private student loans.

Federal student loans provide access to:

- Disability discharge

- Income-driven repayment plans

- Legal hardship protections

Private student loans generally offer:

- No forgiveness programs

- No disability discharge

- Limited hardship options

This distinction determines which medical hardship relief strategies are available. A detailed explanation of federal vs. private student loans is provided in this guide.

👉 federal vs private student loans

Medical Hardship Student Loan Forgiveness Options

Can Medical Hardship Lead to Forgiveness?

Yes, but only under specific programs.

Medical hardship student loan forgiveness usually occurs through:

- Total and Permanent Disability (TPD) discharge

- Income-driven repayment forgiveness

- Bankruptcy-based discharge under undue hardship

Each option has strict eligibility and documentation requirements.

Total and Permanent Disability (TPD) Student Loan Discharge

TPD discharge allows eligible federal student loans to be forgiven entirely if a borrower cannot engage in substantial work due to disability.

You may qualify if:

- Social Security confirms disability

- A physician certifies long-term impairment

- A Government agency verifies disability status

This option applies only to federal student loans and results in complete loan elimination if approved.

Student Loan Relief Due to Illness (Temporary Options)

Not all medical hardship is permanent. Temporary solutions may be appropriate when recovery is expected.

Medical Hardship Deferment

A deferment allows borrowers to pause payments during recovery. Interest rules vary by loan type. For background and definitions, see this explanation of student loan deferment.

Medical Hardship Forbearance

Forbearance temporarily suspends payments, but interest continues to accrue. It should only be used for short-term use.

Income-Driven Repayment for Medical Hardship

If illness reduces income but does not eliminate employment, income-driven repayment may help.

IDR plans:

- Adjust payments based on income

- Can reduce payments to $0

- Offer forgiveness after long-term participation

However, IDR often increases total debt over time. Many borrowers compare this option with bankruptcy, as explained in this guide on income-driven repayment vs bankruptcy.

👉 income-driven repayment vs bankruptcy

Medical Hardship and Student Loan Collections

Medical hardship does not automatically stop collections. If loans enter default, lenders may garnish wages, seize tax refunds, or file lawsuits.

Understanding how student loans are collected helps borrowers take action before the damage escalates.

👉 how student loans are collected

Stopping Garnishment During Medical Hardship

When illness prevents repayment, legal intervention may be required. Bankruptcy can immediately stop wage garnishment and collection lawsuits.

This process is explained in detail in this guide on how bankruptcy can stop student loan garnishment.

👉 Bankruptcy can stop student loan garnishment

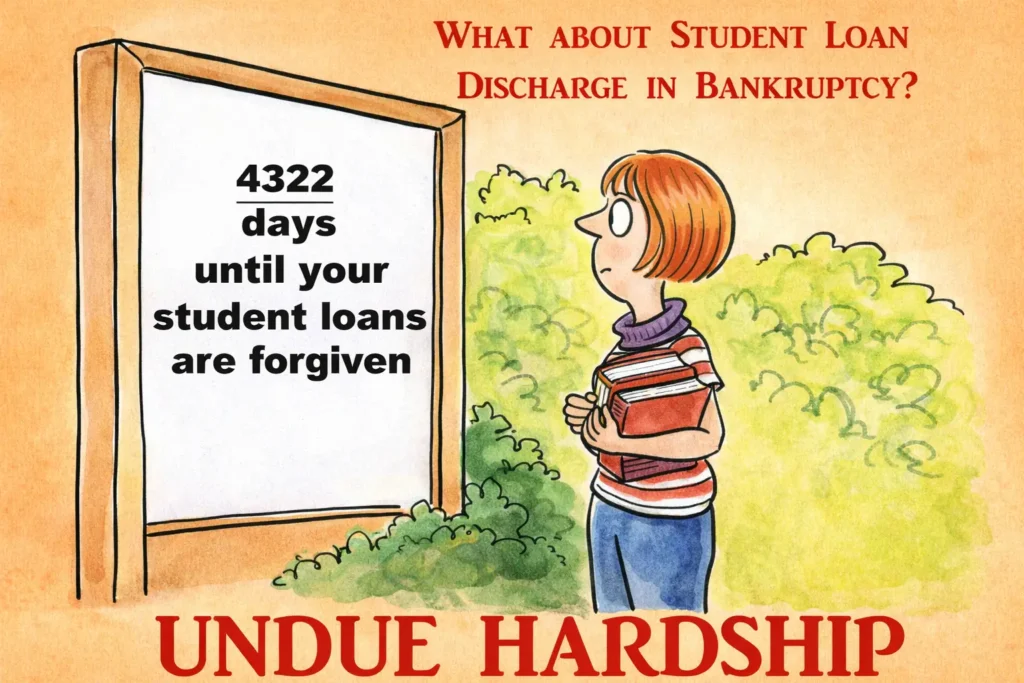

Bankruptcy Student Loan Medical Hardship Relief

Can Medical Hardship Discharge Student Loans in Bankruptcy?

Yes. Medical hardship is one of the strongest grounds for proving undue hardship in court.

Judges evaluate:

- Medical prognosis

- Employment limitations

- Ongoing treatment costs

- Likelihood of future recovery

Medical records often become the deciding evidence. A complete overview is available in this student loan bankruptcy guide.

👉 student loan bankruptcy guide

Adversary Proceedings and Medical Hardship

To discharge student loans in bankruptcy, borrowers must file an adversary proceeding. This lawsuit requires medical documentation, financial records, and legal arguments.

A step-by-step explanation of how to file an adversary proceeding is available in this guide.

👉 How to file an adversary proceeding

Chapter 7 vs Chapter 13 Bankruptcy for Medical Hardship

The type of bankruptcy matters.

Chapter 7 may be best if disability is permanent and the income cannot be recovered.

Chapter 13 may be better if recovery is possible and income stabilizes.

A complete comparison is available in this guide on Chapter 7 vs Chapter 13 bankruptcy for student loans.

👉 Chapter 7 vs Chapter 13 bankruptcy for student loans

Private Student Loans and Medical Hardship

Private lenders do not offer forgiveness or disability discharge. However, medical hardship may still justify negotiated relief.

Borrowers often pursue settlement, which is explained in this guide on private student loan settlement options.

👉 private student loan settlement options

Writing a Medical Hardship Letter for Student Loans

A strong medical hardship letter should explain:

- Diagnosis summary

- Treatment duration

- Impact on employment

- Monthly financial burden

- Supporting physician statement

This letter supports forbearance requests, settlement negotiations, and bankruptcy filings.

Frequently Asked Questions

Can medical hardship qualify for student loan forgiveness?

Yes, through disability discharge, income-driven forgiveness, or bankruptcy.

Does illness count as undue hardship?

Yes, especially if long-term or permanent.

Can private student loans be forgiven for medical reasons?

No, but settlement or bankruptcy relief may apply.

What proof is required?

Medical records, doctor certifications, income documentation, and treatment history.

Final Thoughts

Medical hardship student loan relief is complex, but it can be life-changing. Acting early increases the chances of stopping collections, reducing payments, or achieving permanent relief.

Comments (8)

Student Loan Bankruptcy: Discharge, Relief & Legal Options

[…] Disability Discharge→ Medical Hardship Student Loan Relief (supporting […]

How to Get a Student Loan in 2026 | Complete Step-by-Step Guide

[…] If you later face repayment issues, explore relief options:Student Loan Relief Due to Illness […]

Best Ways to Lower Student Loan Interest Rates

[…] 👉 Learn more here:Student Loan Relief Due to Illness […]

Student Loan Social Security Garnishment: How It Works

[…] Borrowers dealing with medical issues should consider reading:👉 Student Loan Relief Due to Illness […]

Student Loan Consolidation Guide 2026

[…] If you have medical hardship or disability issues, check:👉 Student loan relief due to illness […]

Student Loan Refinance: How It Works, Best Lenders

[…] 👉 Student loan relief due to illness […]

Is Student Loan Bankruptcy Worth It? Pros, Cons & Real Relief

[…] permanently reduced income often have stronger cases. If medical issues play a role, reviewing👉 student loan relief due to illnesscan help clarify how courts view health-related […]

Student Loan Help Guide: Lower Payments, Relief & Forgiveness

[…] Borrowers facing health issues can learn about student loan relief due to illness here:https://federalstudentloandebt.com/student-loan-relief-due-to-illness/ […]