Student loan debt in the United States has become one of the most persistent and confusing financial burdens for millions of borrowers. One of the most common—and alarming—experiences reported by federal student loan borrowers is this:

“I’ve been making payments for years, but my loan balance is higher than when I started.”

This article explains why federal student loans grow so quickly, using verified federal rules, policies, and borrower protections published by the U.S. Department of Education, Federal Student Aid, the Consumer Financial Protection Bureau (CFPB), and other trusted institutions.

This is not an opinion piece. It is a fact-based breakdown of how the federal student loan system works—and why balance growth is often a built-in outcome rather than borrower failure.

Understanding Federal Student Loans in the U.S.

Before explaining why balances grow, it is essential to understand how federal student loans are structured.

Types of Federal Student Loans

According to the Federal Direct Loan Program administered by the U.S. Department of Education, the main federal loan categories are:

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- Direct PLUS Loans (Graduate PLUS and Parent PLUS)

- Direct Consolidation Loans

Each of these loans follows the same core interest and repayment framework, but interest timing and capitalization rules differ, which directly affects loan growth.

👉 Supporting Content Opportunity:

“Federal Student Loan Types Explained: Which Loan Fits Your Needs?”

Learn the differences between subsidized, unsubsidized, PLUS, and consolidation loans, and how each impacts interest accrual and repayment.

What Does It Mean When a Federal Student Loan “Grows”?

A student loan is considered to be “growing” when:

- The total outstanding balance increases over time

- The borrower owes more than the original principal

- Monthly payments fail to reduce the principal balance

This growth occurs primarily due to interest accrual and capitalization, both explicitly defined and regulated by federal student loan policy.

Daily Interest Accrual: The Foundation of Loan Growth

Interest Accrues Every Single Day

Federal student loan interest accrues daily, using a simple interest formula established by the Department of Education:

Daily interest = (Outstanding principal × interest rate) ÷ 365.25

This calculation method is confirmed by Federal Student Aid and federal loan servicers such as EdFinancial.

Why Daily Accrual Matters

Daily accrual means that:

- Interest does not wait for monthly billing cycles

- Even short delays increase total interest

- Larger balances generate interest faster

If a borrower’s payment does not exceed the interest accrued since the last payment, the principal balance does not decrease.

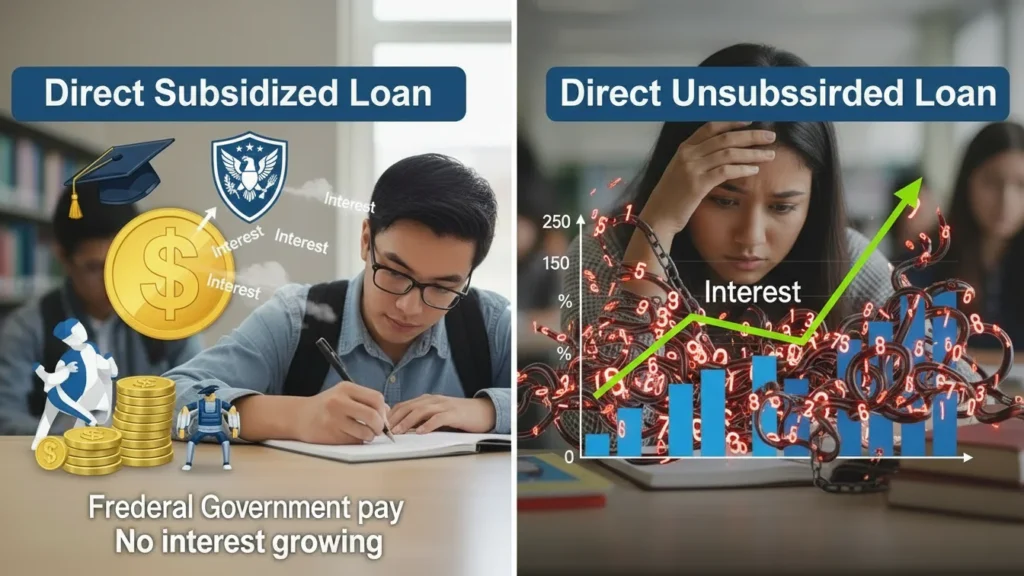

Subsidized vs. Unsubsidized Loans: A Critical Difference

Direct Subsidized Loans

For Direct Subsidized Loans:

- The federal government pays the interest while the borrower is enrolled at least half-time, in the grace period, or in qualifying deferment

- This structure prevents balance growth during those periods

Direct Unsubsidized Loans

For Direct Unsubsidized Loans:

- Interest accrues from the moment the loan is disbursed

- No interest subsidy applies during school, grace, or deferment

- Unpaid interest accumulates continuously, creating balance growth even before repayment begins

Graduate and professional students rely heavily on unsubsidized and PLUS loans, which explains why their balances tend to grow more quickly.

👉 Supporting Content Opportunity:

“Subsidized vs. Unsubsidized Loans: How Interest Impacts Your Balance”

A detailed guide to understanding interest accrual differences and how to manage loan growth during school and grace periods.

Interest Accrual During School and the Grace Period

In-School Period

Most borrowers are not required to make payments while enrolled in school. However:

- Interest still accrues on unsubsidized loans

- Borrowers are not required—or strongly prompted—to pay that interest

- As a result, interest accumulates quietly for several years

Grace Period Capitalization

Federal loans typically include a six-month grace period after graduation or dropping below half-time enrollment. According to Federal Student Aid:

- Interest continues to accrue during the grace period on unsubsidized loans

- Unpaid interest may be capitalized at the end of the grace period

This means borrowers often begin repayment with a balance significantly higher than the amount originally borrowed.

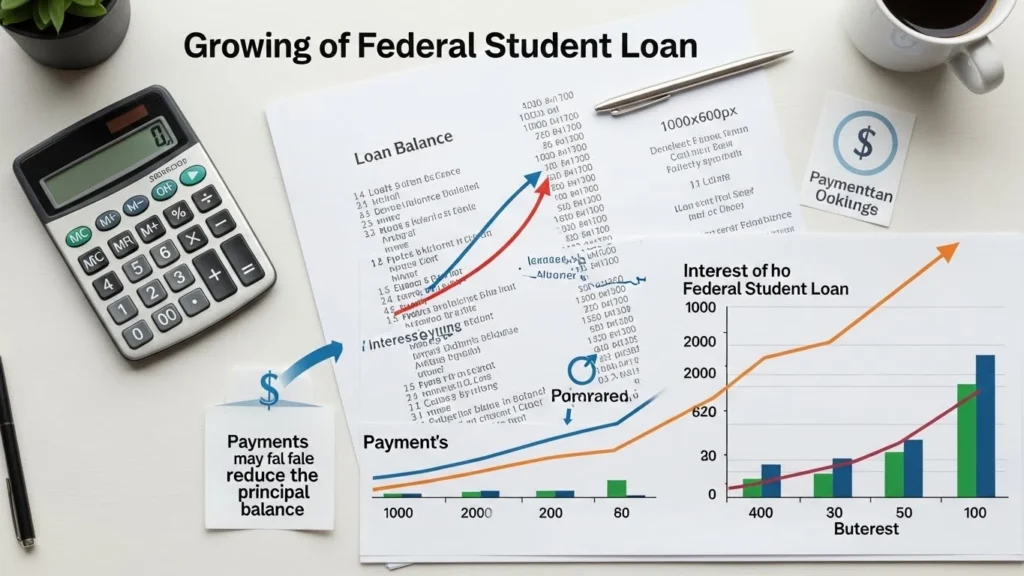

Capitalization: When Interest Becomes Principal

What Is Interest Capitalization?

Federal Student Aid defines capitalization as:

The process by which unpaid interest is added to the principal balance of a loan.

Once capitalized:

- Interest is charged on a larger principal

- Future interest costs increase permanently

Why Capitalization Accelerates Growth

Capitalization changes the mathematical base of the loan. Instead of interest accruing on the original principal, it accrues on:

- Original principal

- Plus previously unpaid interest

This creates compound-like growth, even though federal loans use simple interest.

Events That Trigger Capitalization

According to Federal Student Aid and Pew Charitable Trusts, capitalization may occur when a borrower:

- Enters repayment after the grace period

- Leaves deferment or forbearance

- Switches repayment plans

- Fails to recertify income under certain IDR plans

- Consolidates loans

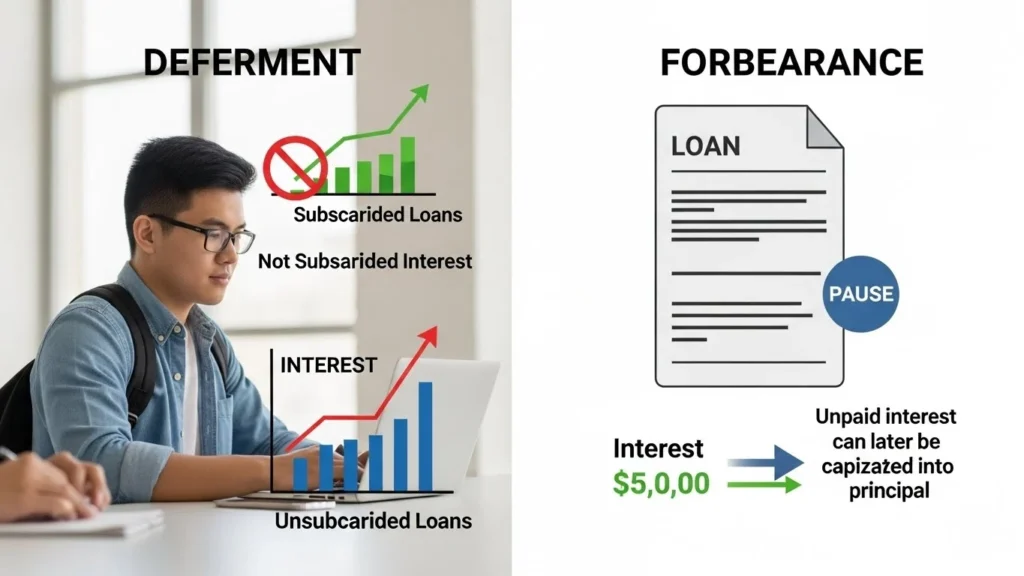

Deferment and Forbearance: Relief With Long-Term Costs

Deferment

- Subsidized loans do not accrue interest

- Unsubsidized loans continue to accrue interest

- Unpaid interest during deferment may capitalize

Forbearance

- Allows temporary payment suspension

- Interest accrues on all federal loans

- Unpaid interest can later be capitalized

Repeated use of forbearance often leads to substantial loan growth.

Income-Driven Repayment (IDR): Affordability vs. Balance Growth

How IDR Plans Work

IDR plans calculate payments based on:

- Borrower income

- Family size

- Federal poverty guidelines

Plans include:

- IBR

- PAYE

- REPAYE / SAVE

- ICR

Negative Amortization Under IDR Plans

When payments do not cover interest:

- Unpaid interest accumulates

- Loan balance increases over time

This phenomenon, negative amortization, is explicitly acknowledged by the CFPB.

The SAVE Plan and Recent Policy Changes

- SAVE plan reduces unpaid interest being added monthly

- Legal challenges affected implementation

- Interest accrual and balance growth resumed for some borrowers

👉 Supporting Content Opportunity:

“Understanding Income-Driven Repayment Plans and SAVE: How They Affect Your Balance”

Learn how IDR plans calculate payments, prevent default, and why balances may still grow.

Extended Repayment Terms Increase Total Interest

- Standard repayment lasts 10 years

- IDR plans extend repayment to 20–25 years

- Longer repayment periods result in more total interest paid

Loan Origination Fees Increase Balances Immediately

- Fees are deducted from disbursement but added to loan balance

- Borrowers receive less than borrowed but accrue interest on full amount

- Creates immediate balance inflation

Loan Consolidation and Balance Growth

Direct Consolidation Loans:

- Combine multiple federal loans

- Capitalize unpaid interest at consolidation

- Extend repayment terms

While simplifying payments, consolidation can increase total interest paid over time.

Psychological and Structural Factors Borrowers Face

Borrowers often:

- Focus on monthly payment affordability

- Assume balances will decline automatically

- Do not understand capitalization timing

- Rely on forgiveness expectations

Federal agencies acknowledge that loan complexity makes it difficult to predict balance growth.

Why Federal Student Loans Feel “Endless”

Federal loans are designed to:

- Prevent default

- Offer payment flexibility

- Adjust to income fluctuations

They are not designed primarily to minimize balances quickly, which explains why borrowers may experience persistent growth despite compliance.

Can Federal Student Loans Grow Indefinitely?

- Balances can continue to grow under IDR plans

- Forgiveness may occur after 20–25 years

- Until forgiveness is granted, interest continues to accrue

How Borrowers Can Reduce or Control Balance Growth

Federal guidance recommends:

- Paying interest during school when possible

- Making payments during the grace period

- Avoiding unnecessary forbearance

- Paying above the minimum when income allows

- Monitoring capitalization events

- Reviewing repayment plans annually

👉 Supporting Content Opportunity:

“Practical Tips to Control Federal Student Loan Growth”

Step-by-step strategies for borrowers to slow or prevent balance growth and minimize long-term costs.

Key Takeaways

- Interest accrues daily on outstanding balances

- Unsubsidized loans accrue interest immediately

- Capitalization permanently increases principal

- IDR plans can result in negative amortization

- Extended repayment terms magnify interest

- Federal protections reduce default risk, not balance size

Important: Federal student loan growth is not primarily due to borrower irresponsibility, but is a predictable outcome of the loan system’s design.

Frequently Asked Questions (AEO-Optimized)

Q1: Why does my federal student loan balance increase even when I pay monthly?

A1: Payments may not cover all accrued interest, causing unpaid interest to accumulate or capitalize.

Q2: Do federal student loans grow faster than private loans?

A2: They can, due to longer repayment terms, capitalization rules, and income-based payments.

Q3: Does loan forgiveness stop balance growth?

A3: Forgiveness ends repayment, but balances may grow significantly before forgiveness applies.

Q4: Is balance growth considered default?

A4: No. Balance growth can occur even when a borrower is fully compliant.