Student loan forgiveness has become one of the most closely watched issues in U.S. politics. Millions of borrowers are tracking every student loan forgiveness House vote to understand whether real relief is coming—or whether they need to take action on their own.

This in-depth guide explains what the House vote on student loan forgiveness really means, what borrowers should realistically expect, and which legal and financial relief options exist right now, even if Congress takes no action.

Necessary Student Loan Relief Resources

Before focusing only on Congress, borrowers should understand the whole legal framework surrounding student debt. For example, many borrowers do not realize that they can challenge student loans in bankruptcy by filing an adversary proceeding, which is often used to seek discharge of student loans.

If you hold private loans, waiting for Congress may not help at all. In that case, understanding proven private student loan settlement options can be far more effective than relying on forgiveness legislation.

Borrowers already facing collections should immediately learn how student loans are collected, since wage garnishment, tax refund offsets, and lawsuits can begin long before any forgiveness bill becomes law.

It is also critical to understand the legal protections available in federal vs private student loans, because only federal loans are affected by House forgiveness votes.

What Is the Student Loan Forgiveness House Vote?

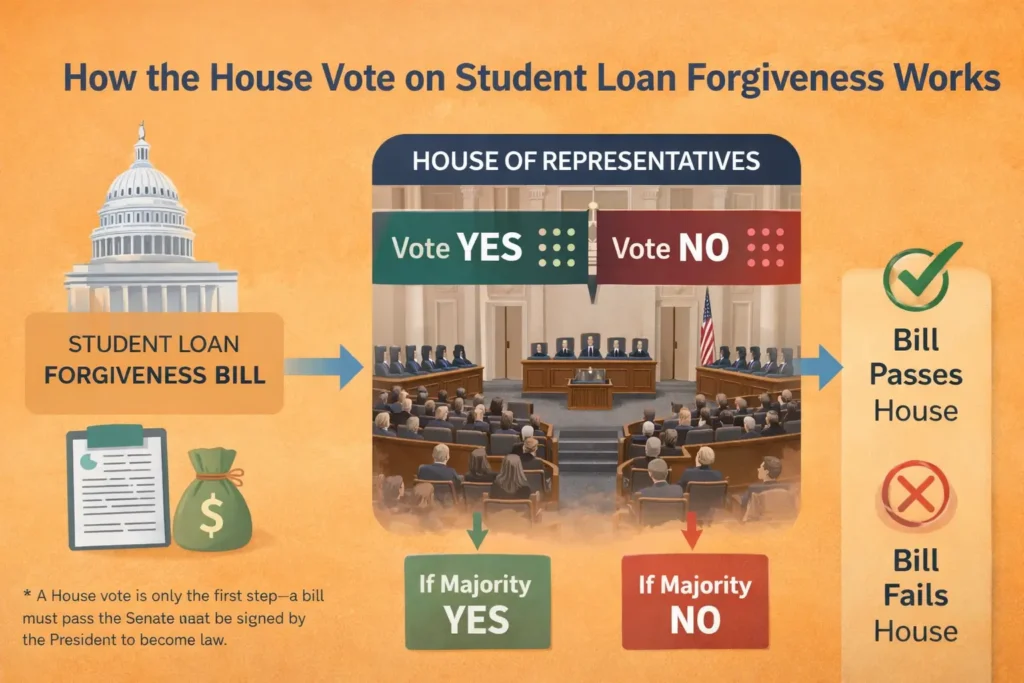

The student loan forgiveness House vote refers to legislative action by the U.S. House of Representatives on bills or resolutions that would cancel, limit, or block student loan debt relief.

A House vote may:

- Approve a forgiveness program

- Restrict the Department of Education’s authority

- Block funding for relief efforts

- Overturn executive forgiveness plans

However, a House vote alone does not automatically forgive student loans.

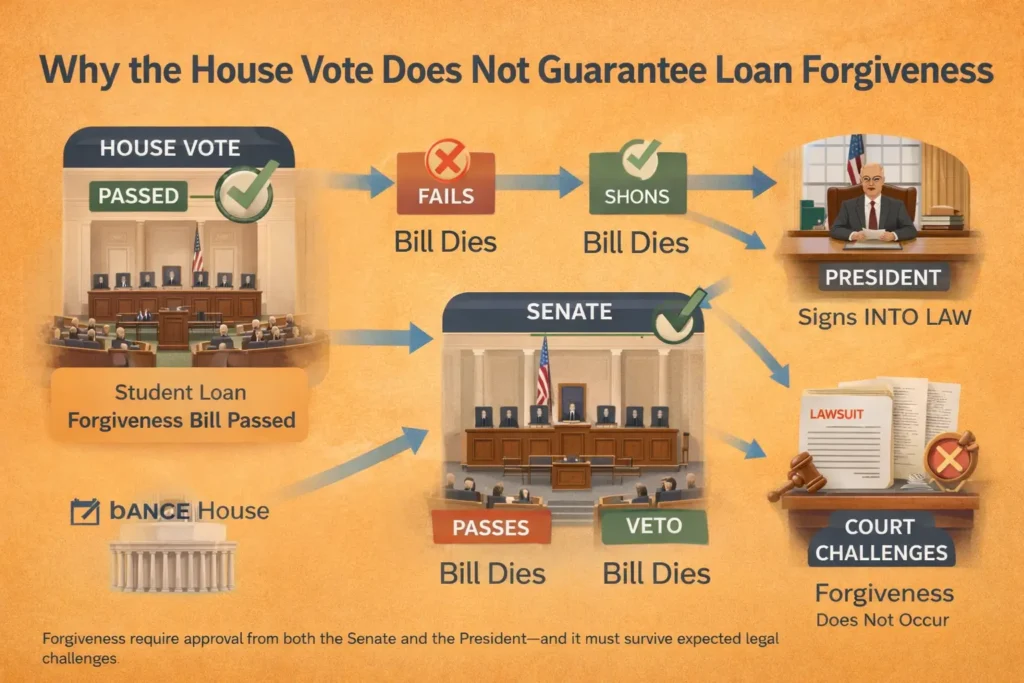

Why the House Vote Does Not Guarantee Loan Forgiveness

Many borrowers assume that once the House votes, forgiveness is guaranteed. This is incorrect.

For student loan forgiveness to become law:

- The bill must pass both the House and the Senate

- The President must sign it

- The policy must survive legal challenges

This is why borrowers should not ignore existing solutions, such as student loan bankruptcy discharge and legal relief options, which are already available under current law.

Federal vs Private Student Loans: Why This Difference Matters

One of the biggest misconceptions is that all student loans are treated the same.

Federal student loans may qualify for forgiveness programs debated in Congress. Private student loans, however, are not eligible for federal forgiveness—regardless of how the House votes.

That is why borrowers with private debt often turn to private student loan settlement strategies or bankruptcy-based relief rather than wait for political action.

What Happens If Student Loan Forgiveness Fails?

If forgiveness legislation stalls or is overturned, borrowers may face:

- Restarted collections

- Wage garnishment

- Accruing interest

- Credit damage

At that stage, learning how bankruptcy can stop wage garnishment for student loan debt can be critical for financial survival.

Student Loan Forgiveness vs Bankruptcy: Which Is More Reliable?

Forgiveness depends on politics. Bankruptcy depends on the law.

Many borrowers benefit more from comparing income-driven repayment vs bankruptcy, especially when loans have been in repayment for years with no end in sight.

In some cases, filing under Chapter 7 vs Chapter 13 bankruptcy for student loans can provide immediate relief—long before Congress acts.

Can Student Loans Be Discharged in Bankruptcy?

Yes, student loans can be discharged, but they require an additional legal step called an adversary proceeding.

Borrowers serious about relief should understand the student loan bankruptcy process step by step, including how courts evaluate hardship and repayment history.

Student Loan Relief Due to Illness or Disability

Borrowers suffering from severe medical conditions may qualify for relief even without a House vote. In fact, student loan relief due to illness or disability is already available under existing programs and legal standards.

Some borrowers may also qualify for temporary relief through student loan deferment while exploring long-term solutions.

People Also Ask

Did the House vote on student loan forgiveness?

Yes. The House has voted multiple times on student loan forgiveness-related legislation, including bills that support or oppose relief programs.

Does a House vote cancel student loans?

No. A House vote alone does not cancel student loans. Forgiveness requires Senate approval, presidential action, and legal validation.

Are private student loans included in forgiveness bills?

No. Private student loans are not included in the federal forgiveness legislation passed by the House.

What should borrowers do while waiting for forgiveness?

Borrowers should explore repayment plans, settlement options, deferment, or bankruptcy-based relief rather than wait indefinitely.

Final Thoughts: Don’t Wait on Congress Alone

The student loan forgiveness House vote is essential—but it should never be your only plan.

Borrowers who rely entirely on politics often lose valuable time while interest grows and collections continue. Those who explore legal options early—such as settlement, bankruptcy relief, or hardship-based discharge—are often in a far stronger financial position.

Comments (5)

Federal Student Loan Forgiveness Public Service Application

[…] Track legislative changes affecting forgiveness, including the student loan forgiveness House vote […]

Student Loan Deferment Guide 2026: Eligibility, Hardship & Steps

[…] Some teachers may qualify for deferment, but forgiveness is more common.Latest legislative updates:👉 Student Loan Forgiveness House Vote […]

Student Loan Debt Help: Relief, Forgiveness & Repayment Options Las Vegas Student Loan Lawyer | Federal Student Loan Debt Relief

[…] Stay informed about forgiveness law changes here:👉 Student Loan Forgiveness House vote updatehttps://federalstudentloandebt.com/student-loan-forgiveness-house-vote/ […]

Student Loan Forgiveness Programs: The Complete 2026 Guide to Eligibility, Types, Applications & Legal Relief OptionsStudent Loan Forgiveness Programs: Eligibility, Types & Relief Guide - Las Vegas Student Loan Lawyer | Federal Student Loan Debt R

[…] To follow the latest Government decisions, see:👉 Student Loan Forgiveness House Vote – Current Status & Updateshttps://federalstudentloandebt.com/student-loan-forgiveness-house-vote/ […]

Student Loan Payment Plan: Complete Guide to Repayment Options, Forgiveness, Interest, and Strategies - Las Vegas Student Loan Lawyer | Federal Student Loan Debt Relief

[…] Finally, forgiveness policies are evolving. Legislative updates can be tracked here:👉 Student Loan Forgiveness House vote updates […]