Summary of This Article

- A student loan is money borrowed to pay for education that must be repaid with interest.

- There are two main types: federal student loans and private student loans.

- Interest rates, repayment plans, and forgiveness options differ widely.

- Understanding loan terms helps avoid long-term debt stress.

- Smart repayment strategies can reduce total interest and speed up payoff.

What is a student loan?

A student loan is a type of financial aid borrowed to pay for education expenses such as tuition, books, and living costs. It must be repaid with interest, usually after graduation, with flexible repayment and forgiveness options depending on the loan type.

Student loans have become one of the most common ways students finance higher education in the United States, the UK, Canada, and other countries. But many borrowers take loans without fully understanding how they work, which leads to long-term debt burdens.

If you are planning to study abroad or are curious about education financing, this guide explains everything—from definitions to repayment strategies—in a simple, conversational format.

To understand the legal implications of loan disputes, you can explore our guide on how to start an adversary proceeding in student loan cases:

How to file an adversary proceeding for student loans

What Is a Student Loan and How Does It Work?

A student loan is borrowed money used to pay for college or university expenses and repaid later with interest based on agreed terms.

A student loan is specifically designed to help students cover educational costs. Unlike scholarships or grants, student loans must be repaid. Lenders can be governments (federal loans) or private financial institutions (private loans).

Key Elements of Student Loans

- Borrowed principal amount

- Interest rate (fixed or variable)

- Repayment schedule

- Grace period after graduation

- Forgiveness or discharge options

In simple terms, a student loan works like a contract: the lender pays your education costs now, and you repay later once you start earning.

Student loans are education-focused borrowing tools with delayed repayment and interest accumulation, making them different from personal loans or credit cards.

Why Do Students Take Loans for Education?

Students take loans because tuition, books, and living expenses are often too high to afford without financial assistance.

Higher education costs have increased significantly worldwide. In countries like the USA, average college tuition can exceed $25,000–$50,000 per year. Even in the UK and Canada, international students often rely on loans.

Common Expenses Covered by Student Loans

- Tuition fees

- Accommodation & food

- Study materials & technology

- Transportation

- Health insurance (for international students)

Many students cannot pay these costs upfront, making student loans essential for access to higher education.

Behavioral Insight (Psychological Framing)

If you’re worried about affording college, you’re not alone. Millions of students use loans every year to invest in their future careers.

Summary

Students rely on loans because education costs are high, and loans allow them to invest in their future earning potential.

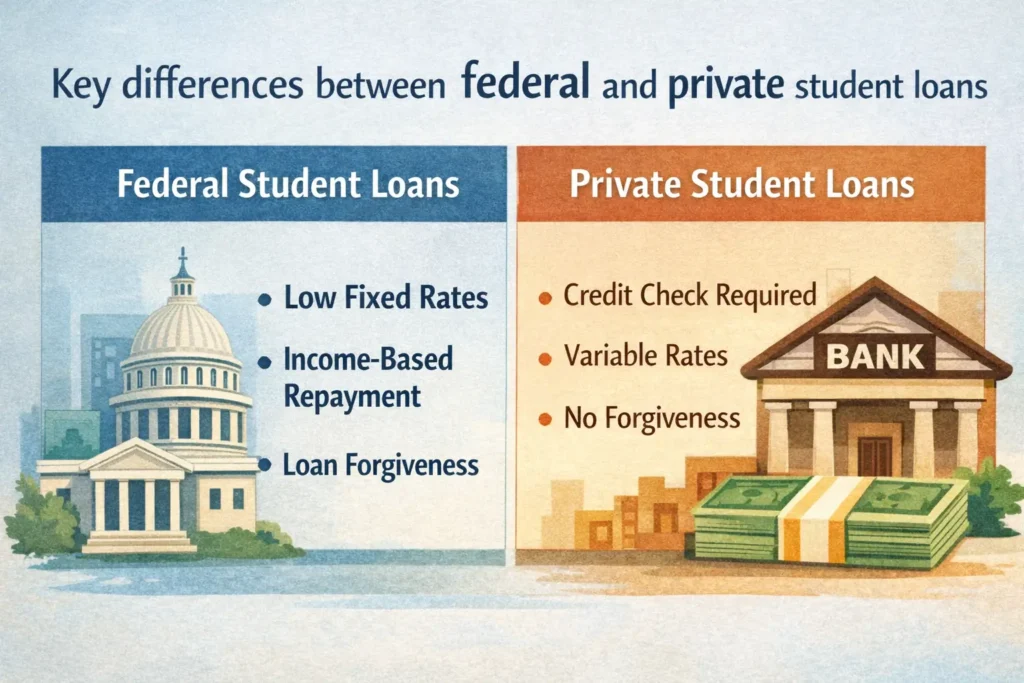

Types of Student Loans: Federal vs Private

There are two main student loan types: federal loans issued by governments and private loans issued by banks or financial institutions.

Understanding the difference is crucial because repayment options, interest rates, and forgiveness eligibility vary significantly.

You can read a deeper comparison here:

Federal vs private student loans comparison guide

Comparison Table: Federal vs Private Student Loans

| Feature | Federal Student Loans | Private Student Loans |

| Issued By | Government | Banks/Private lenders |

| Interest Rate | Fixed | Fixed or Variable |

| Credit Check | Usually No | Yes |

| Repayment Plans | Flexible | Limited |

| Forgiveness Options | Available | Rare |

| Income-Driven Plans | Yes | No |

Summary

Federal loans offer flexible repayment and forgiveness, while private loans depend heavily on credit score and strict repayment terms.

What Expenses Can a Student Loan Cover?

Student loans can cover tuition, housing, books, meals, and essential education-related living expenses.

Student loans are not limited to tuition. Most programs allow funds to cover the total “cost of attendance.”

Eligible Costs Covered

- Tuition & university fees

- Textbooks & supplies

- Dormitory or rental housing

- Internet & study equipment

- Transportation & commuting

However, luxury expenses or unrelated purchases are usually not permitted.

Summary

Student loans can fund nearly all essential academic and living expenses required during your education.

How Interest Works on Student Loans

Interest on student loans is the cost of borrowing money, added to your principal balance over time until fully repaid.

Interest is one of the most important factors affecting your total debt.

Fixed vs Variable Interest Rates

- Fixed: Same interest throughout loan life

- Variable: Changes based on market conditions

Federal loans usually offer fixed rates, while private lenders may offer both.

Interest Accumulation Example

If you borrow $10,000 at 5% interest, your repayment will exceed $10,000 due to accumulated interest over time.

Summary

Interest determines how much extra you pay beyond the borrowed amount, making rate selection extremely important.

When Do You Start Repaying a Student Loan?

Most student loans require repayment after graduation, but interest may begin accumulating while you are still studying.

Most federal student loans provide a grace period of 6 months after graduation before repayment begins. Private loans may require earlier payments.

Repayment Timeline

- Enrollment period → loan disbursed

- Graduation or leaving school

- Grace period (usually 6 months)

- Monthly repayment begins

Summary

Repayment usually starts after graduation, but interest may accumulate earlier depending on the loan type.

Student Loan Forgiveness: Can Loans Be Cancelled?

Yes, some federal student loans can be forgiven through programs like Public Service Loan Forgiveness (PSLF).

Borrowers working in government or nonprofit sectors may qualify for forgiveness after making qualifying payments.

Learn about eligibility from this trusted source:

Public Service Loan Forgiveness program overview

Who Qualifies for Forgiveness?

- Government employees

- Teachers & healthcare workers

- Nonprofit organization staff

Summary

Student loan forgiveness is available primarily for federal loans under specific career and repayment conditions.

What Happens If You Don’t Repay Student Loans?

Failure to repay student loans can lead to penalties, credit damage, wage garnishment, and legal collection actions.

Student loans are difficult to discharge and often remain until fully repaid unless qualifying for legal relief.

You can read more about recovery and collection rules:

How student loans are collected and recovered

Summary

Missing payments can result in serious financial consequences, including damaged credit and legal enforcement actions.

Can Student Loans Be Discharged in Bankruptcy?

Student loans are rarely discharged in bankruptcy, but it is possible under special legal hardship circumstances.

The process usually requires proving “undue hardship” in court.

Explore the full legal guide:

Student loan bankruptcy discharge legal options

Summary

Bankruptcy discharge for student loans is difficult but possible with strong legal evidence of financial hardship.

Smart Strategies to Manage Student Loan Debt

Effective debt management involves choosing income-driven repayment, refinancing wisely, and making early extra payments.

Proven Repayment Strategies

- Choose income-driven repayment plans

- Pay interest during the study to reduce the balance

- Refinance high-interest private loans

- Make extra principal payments early

These strategies reduce lifetime interest and speed up loan payoff.

Summary

Strategic repayment planning significantly lowers total loan cost and prevents long-term debt stress.

Where to Get Help With Student Loan Questions

Borrowers can seek help from loan servicers, financial advisors, or legal professionals for complex repayment or dispute issues.

If you need personalized support, contact our team here:

Contact the student loan legal support team

Summary

Professional guidance helps borrowers avoid mistakes and choose the best repayment or legal strategy.

What Matters Most About Student Loans

In short, a student loan is a powerful financial tool that makes higher education accessible but requires careful planning. Understanding loan types, interest rates, repayment options, and forgiveness programs helps borrowers stay financially secure and avoid overwhelming debt.

Before taking any loan, compare federal and private options, estimate total interest costs, and plan your repayment strategy early.

To explore more educational finance insights, visit the main resource hub:

complete student loan debt resource center

FAQ – People Also Ask

What is a student loan in simple words?

A student loan is money borrowed to pay for education that you must repay later with interest.

Do student loans have interest?

Yes, most student loans include interest, which increases the total repayment amount over time.

Are student loans worth it?

Student loans can be worth it if they help you earn a degree that increases future income potential.

Can student loans be forgiven?

Yes, federal student loans may be forgiven under programs like Public Service Loan Forgiveness.

How long do student loans last?

Most repayment plans last 10–25 years, depending on the repayment program selected.