Quick Summary

- Student loan forgiveness programs help eligible borrowers reduce or eliminate federal student debt.

- The most popular option in the United States is Public Service Loan Forgiveness (PSLF).

- Income-Driven Repayment (IDR) plans can lead to forgiveness after 20–25 years.

- Private student loans usually do not qualify for federal forgiveness programs.

- Applying correctly and on time is crucial to avoid rejection.

What are student loan forgiveness programs, and who qualifies?

Student loan forgiveness programs are federal or state initiatives that cancel part or all of a borrower’s student loan debt after meeting specific requirements, such as working in public service or enrolling in income-driven repayment plans.

Student loan forgiveness programs in the United States are designed to reduce the burden of federal student debt for qualifying borrowers. According to the definition of student loans, these are funds borrowed to pay for education and must be repaid with interest. However, under certain conditions, a portion — or even all — of that debt may be forgiven.

If you’re struggling with repayment, you should first understand how debt grows. We explain this in detail in our guide on why student loans grow so quickly in the United States.

In short, forgiveness programs provide structured relief pathways — but eligibility rules matter.

Student loan forgiveness cancels eligible federal debt after meeting employment or repayment criteria. Private loans rarely qualify.

Types of Student Loan Forgiveness Programs in the U.S.

What are the main federal student loan forgiveness options?

The top programs include PSLF, IDR Forgiveness, Teacher Loan Forgiveness, and Total & Permanent Disability discharge.

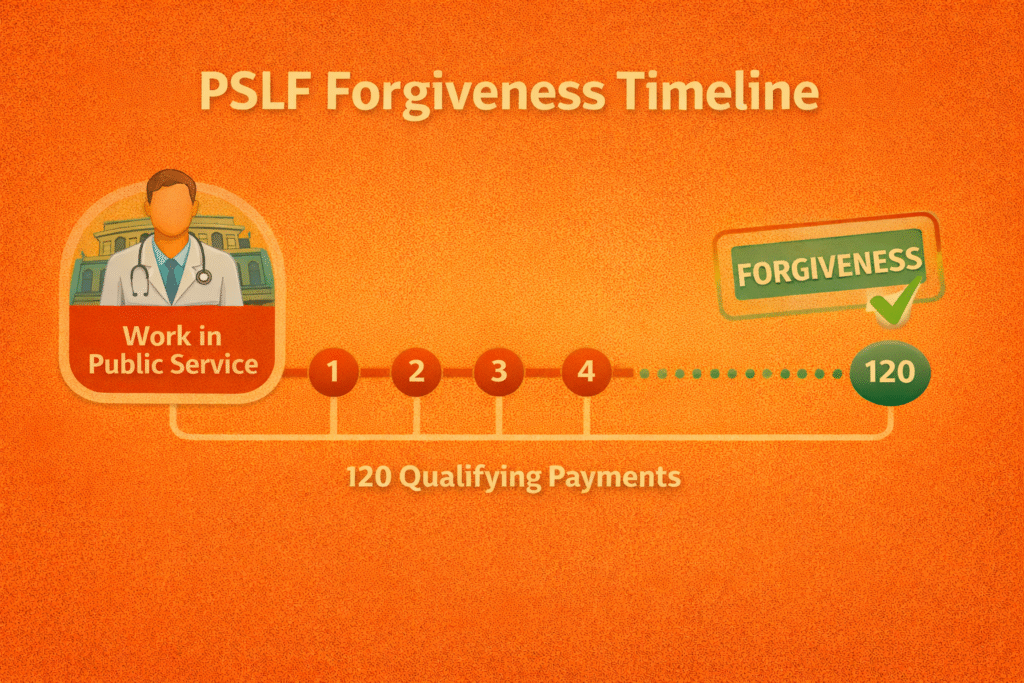

1️⃣ Public Service Loan Forgiveness (PSLF)

PSLF forgives remaining federal student loan balances after 120 qualifying monthly payments while working full-time for a government or nonprofit employer.

Eligibility Requirements:

- Direct Loans only

- Full-time employment in public service

- 120 qualifying payments under the IDR or standard plan

If you’re unsure about repayment plans, see our full breakdown of Income-Driven Repayment (IDR) Plans Explained.

PSLF is one of the fastest forgiveness options — 10 years if all requirements are met.

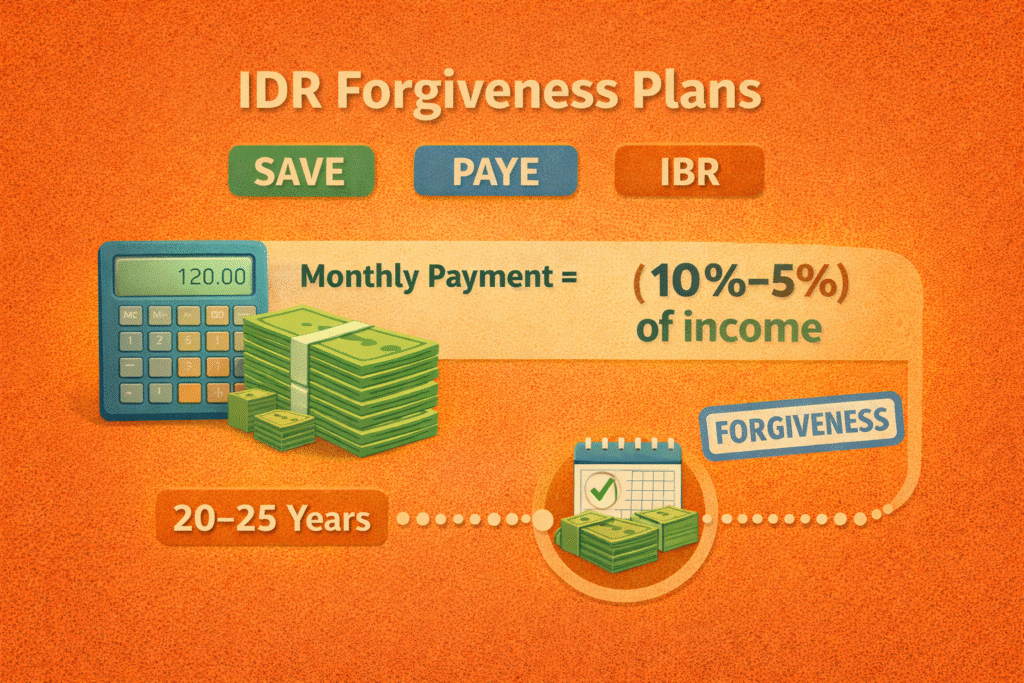

2️⃣ Income-Driven Repayment (IDR) Forgiveness

IDR plans cap monthly payments at a percentage of discretionary income. After 20–25 years of payments, the remaining balance may be forgiven.

IDR Plans Include:

- SAVE Plan

- PAYE

- IBR

- ICR

If you’re comparing loan types first, check our guide on federal vs private student loans.

IDR forgiveness takes longer than PSLF but is accessible to most federal borrowers.

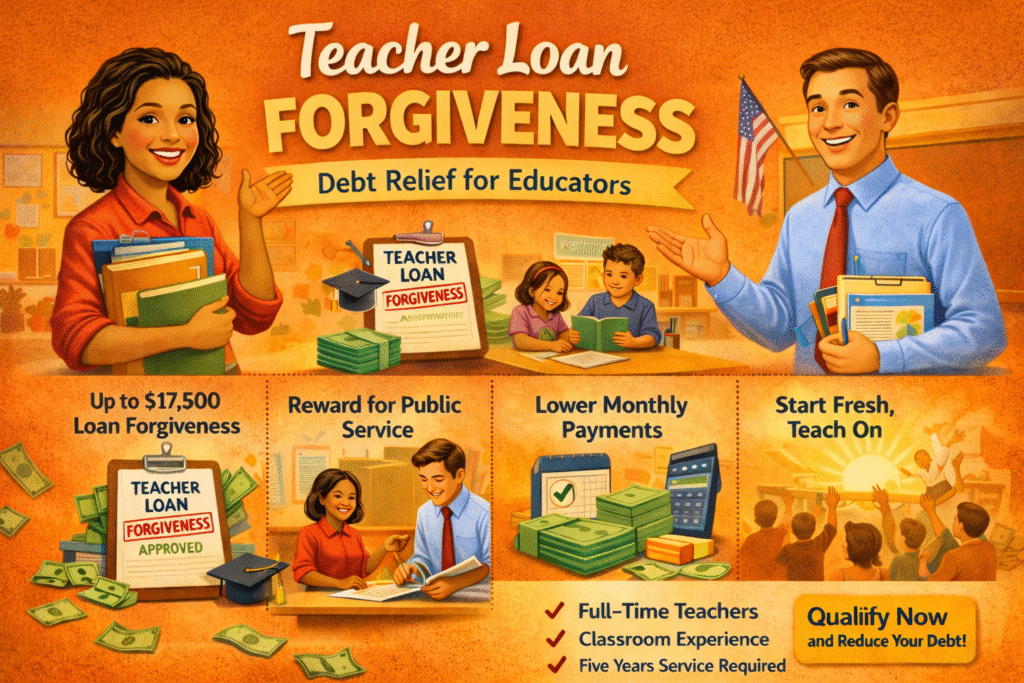

3️⃣ Teacher Loan Forgiveness

Teachers working in low-income schools for five consecutive years may qualify for up to $17,500 in forgiveness.

Eligibility:

- Direct or FFEL loans

- Highly qualified teacher

- Low-income educational institution

So what matters? Service duration and loan type determine eligibility.

4️⃣ Total and Permanent Disability (TPD) Discharge

Borrowers with verified permanent disabilities may have loans fully discharged.

Documentation may include:

- VA determination

- SSA documentation

- Physician certification

Disability discharge provides complete forgiveness for eligible borrowers.

Comparison Table: Major U.S. Student Loan Forgiveness Programs

| Program | Time Required | Loan Type | Amount Forgiven | Taxable? |

| PSLF | 10 Years | Direct Loans | Remaining Balance | No (Federal) |

| IDR Forgiveness | 20–25 Years | Federal Loans | Remaining Balance | Depends on law |

| Teacher Forgiveness | 5 Years | Direct/FFEL | Up to $17,500 | No |

| TPD Discharge | Immediate | Federal Loans | Full Balance | No |

PSLF is fastest; IDR is most flexible; Teacher and TPD are specialized programs.

Are Private Student Loans Eligible for Forgiveness?

Can private student loans be forgiven?

No, private loans generally do not qualify for federal forgiveness programs.

Private student loans lack federal protections. However, some lenders may offer settlement options. Learn more in our guide to private student loan debt settlement options.

If you’re unsure how interest affects your balance, read about how student loan interest works.

Federal loans offer forgiveness; private loans typically require negotiation.

How to Apply for Student Loan Forgiveness

How do I apply for student loan forgiveness?

Confirm eligibility, enroll in the correct repayment plan, submit required forms, and track qualifying payments.

Step 1: Confirm Loan Type

Check whether your loans are federal or private.

Step 2: Enroll in IDR (if required)

PSLF requires IDR enrollment.

Step 3: Submit Certification Forms

For PSLF, submit employment certification annually.

Step 4: Track Payments

Keep documentation for qualifying payments.

If you need personalized guidance, visit our Student Loan Help resource center or reach out via our Contact Page.

Verify loan type → Enroll in correct plan → Submit forms → Track payments carefully.

Common Mistakes That Delay Forgiveness

- Wrong repayment plan

- Missing annual certification

- Consolidating incorrectly

- Assuming private loans qualify

Avoid these pitfalls by reviewing your eligibility annually.

Documentation and repayment structure determine approval success.

Product Recommendation: Student Loan Forgiveness Eligibility Checklist

To simplify your application process, we created a Student Loan Forgiveness Eligibility Checklist (PDF Guide)

Use our structured checklist to track payments, employment, and documentation requirements.

Download the Student Loan Forgiveness Checklist Today

FAQ – Student Loan Forgiveness Programs

1. Does student loan forgiveness affect credit score?

Forgiveness itself does not hurt credit, but missed payments before approval can.

2. Is student loan forgiveness taxable?

Currently, federal forgiveness under PSLF is not taxable. IDR taxation depends on federal law updates.

3. How long does PSLF take?

120 qualifying payments — approximately 10 years.

4. Can I qualify if I switch jobs?

Yes, but only qualifying employers count toward PSLF.

5. Are forgiveness programs guaranteed?

No. You must meet strict eligibility criteria.

Student loan forgiveness programs offer real relief — but only if you understand eligibility, repayment plans, and documentation requirements. Federal borrowers have structured options like PSLF and IDR forgiveness, while private borrowers may need settlement strategies.

If you’re unsure where to start, explore our homepage at

https://federalstudentloandebt.com/

Or contact us directly:

https://federalstudentloandebt.com/contact/