When student loan payments spiral out of control, most borrowers face one crucial decision: Income-Driven Repayment vs. Bankruptcy.

Both options promise relief—but they work very differently, and the wrong choice can cost you years of financial stability.

This in-depth guide explains how each option works, who qualifies, and which path makes the most sense given your financial reality.

What is Income-Driven Repayment (IDR)?

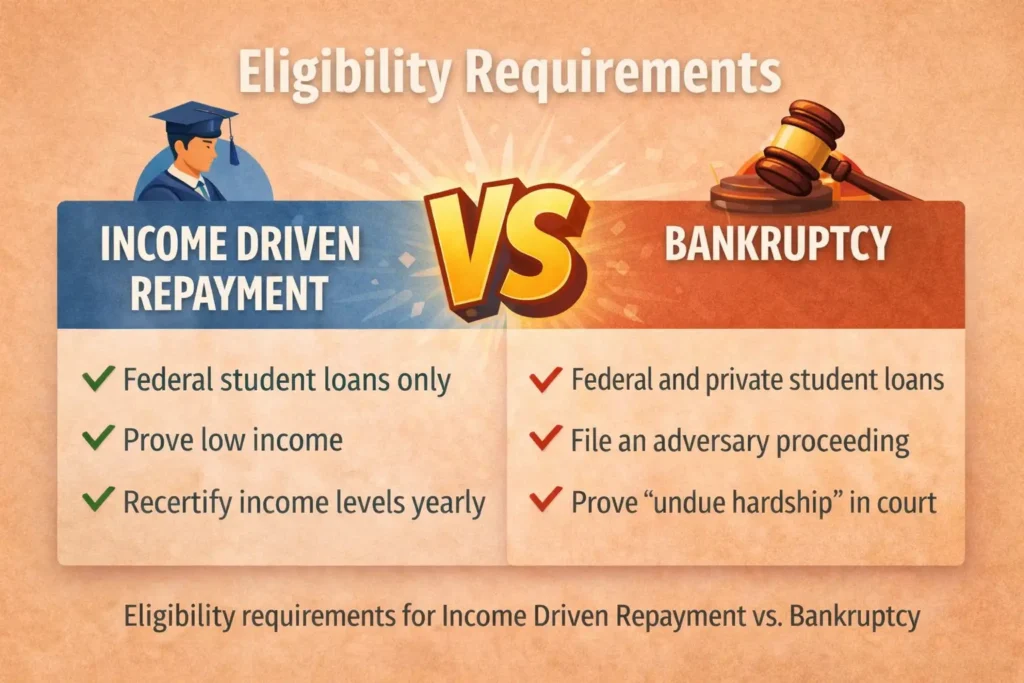

Income-Driven Repayment (IDR) is a federal student loan repayment system that caps your monthly payment based on your income and household size.

Under official income-driven repayment plans, Eligible borrowers may pay as little as $0 per month and qualify for loan forgiveness after a long repayment period.

Key Features of Income-Driven Repayment

- Payments capped at 5%–20% of discretionary income

- Annual income recertification required

- Forgiveness after 20 or 25 years

- Available only for federal student loans

Because IDR applies only to federal loans, understanding the difference between federal and private student loans is critical before relying on this option.

How Income-Driven Repayment Works in Reality

While IDR lowers monthly payments, it does not eliminate debt.

In practice:

- Interest continues to accrue

- Loan balances often increase over time

- Forgiveness may trigger a significant tax liability

- Payments can rise as income increases

For many borrowers, IDR delays financial collapse rather than preventing it.

What Is Student Loan Bankruptcy?

Student loan bankruptcy involves using Chapter 7 or Chapter 13 bankruptcy to obtain legal relief from overwhelming student debt.

Despite common myths, student loans are not entirely immune to bankruptcy. Borrowers may request discharge by filing an adversary proceeding, a separate lawsuit within the bankruptcy case.

A complete legal breakdown is available in this guide on

How to file an adversary proceeding for student loans

Why Student Loan Collections Matter in This Decision

Before choosing Income Driven Repayment vs Bankruptcy, you must understand what happens when loans go unpaid.

Once in default, lenders may:

- Garnish wages

- Seize tax refunds

- Add collection fees

- File lawsuits (exceptionally against private lenders)

This enforcement process is explained step by step in

How student loans are collected

IDR does not stop all collections. Bankruptcy does.

Income Driven Repayment vs Bankruptcy: Side-by-Side Comparison

| Feature | Income Driven Repayment | Bankruptcy |

| Stops Wage Garnishment | ❌ No | ✅ Yes |

| Monthly Payment | Income-based | Court-controlled or eliminated |

| Interest Accrual | Continues | Stops on many debts |

| Credit Impact | Minimal | Temporary but significant |

| Applies to Private Loans | ❌ No | ✅ Yes |

| Legal Protection | Limited | Strong |

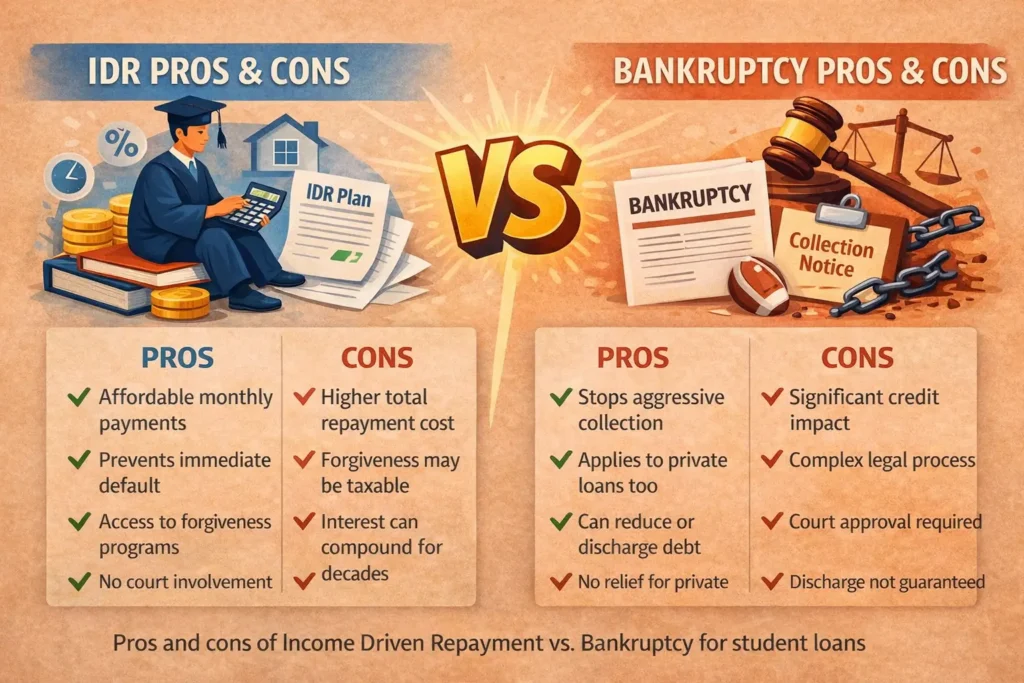

Pros and Cons of Income-Driven Repayment

Advantages

- Affordable monthly payments

- Prevents immediate default

- Access to forgiveness programs

- No court involvement

- Simple enrollment

Disadvantages

- Total repayment cost is often much higher

- Forgiveness may be taxable

- Interest compounds for decades

- No relief for private student loans

- No protection from lawsuits

Pros and Cons of Bankruptcy for Student Loans

Advantages

- The immediate automatic stay stops collections

- Applies to federal and private loans

- Can eliminate other debts simultaneously

- May reduce or discharge student loans

- Stops wage garnishment

If garnishment is already happening, bankruptcy can provide immediate relief, as explained in

Can bankruptcy stop student loan garnishment

Disadvantages

- Credit score impact

- Legal complexity

- Student loan discharge is not guaranteed

- Court approval required

Income Driven Repayment vs Chapter 7 Bankruptcy

Chapter 7 bankruptcy is designed for borrowers with low income and few assets.

It typically:

- Lasts 3–6 months

- Eliminates unsecured debt

- Requires passing a means test

A detailed comparison is available in

Chapter 7 vs Chapter 13 bankruptcy for student loans

Chapter 7 often makes sense when:

- Income is unlikely to increase

- The loan balance is unpayable

- Private lenders are aggressive

Income Driven Repayment vs Chapter 13 Bankruptcy

Chapter 13 bankruptcy creates a structured repayment plan lasting 3–5 years.

It may be better if:

- You have a stable income

- You want to protect assets

- You need legal protection while repaying

Unlike IDR, Chapter 13 offers court-enforced relief.

Student Loan Discharge vs. Income-Driven Repayment

| Factor | IDR | Bankruptcy Discharge |

| Timeframe | 20–25 years | 1–5 years |

| Interest Growth | Yes | No |

| Tax Risk | High | None |

| Legal Certainty | Moderate | Higher |

| Total Cost | Often higher | Often lower |

For deeper insight, review the

complete guide to student loan bankruptcy and discharge options

The Long-Term Cost of Income-Driven Repayment

Many borrowers remain on IDR for decades and still end up worse financially.

Common outcomes include:

- Growing loan balances

- Taxable forgiveness

- Delayed home ownership

- Reduced retirement savings

This is why bankruptcy is sometimes more cost-effective, not more extreme.

Is Income-Driven Repayment Better Than Bankruptcy?

Income-Driven Repayment may be better if:

- You have only federal loans

- Your income is temporarily low

- You qualify for forgiveness programs

Bankruptcy may be better if:

- You face lawsuits or garnishment

- You have private student loans

- Your debt will never be repaid

- You need immediate legal protection

Understanding the

student loan bankruptcy process step by step

Helps clarify what bankruptcy actually involves.

Frequently Asked Questions (People Also Ask)

Is income-driven repayment worth it long-term?

Often no, due to interest growth and tax consequences.

Can bankruptcy replace income-driven repayment?

Yes, especially when IDR only delays financial collapse.

Does bankruptcy stop student loan collections?

Yes. Bankruptcy immediately triggers an automatic stay.

Which option is better overall?

It depends on income stability, loan type, and long-term solvency.

Final Verdict: Income-Driven Repayment vs Bankruptcy

There is no one-size-fits-all answer.

- Income-driven repayment works best for short-term hardship and federal loans.

- Bankruptcy works best for long-term insolvency and legal protection.

The right decision depends on math, law, and your future earning potential.

Comments (8)

Student Loan Bankruptcy: Discharge, Relief & Legal Options

[…] → Chapter 13 Bankruptcy→ Income Driven Repayment vs Bankruptcy […]

Student Loan Relief Due to Illness: Medical Hardship Options

[…] 👉 income-driven repayment vs bankruptcy […]

How to Get a Student Loan in 2026 | Complete Step-by-Step Guide

[…] If you need help comparing post-approval repayment options, see:Income-Driven Repayment vs Bankruptcy […]

Best Ways to Lower Student Loan Interest Rates

[…] 👉 Compare IDR vs bankruptcy:Income-Driven Repayment vs Bankruptcy […]

Student Loan Social Security Garnishment: How It Works

[…] If you’re evaluating repayment vs. bankruptcy, read:👉 Income-Driven Repayment vs Bankruptcy […]

Student Loan Refinance: How It Works, Best Lenders

[…] And if repayment feels overwhelming, compare:👉 Income-driven repayment vs bankruptcy […]

Student Loan Help Guide: Lower Payments, Relief & Forgiveness

[…] If you’re comparing repayment plans with legal options, see this resource on income-driven repayment vs bankruptcy:https://federalstudentloandebt.com/income-driven-repayment-vs-bankruptcy/ […]

Is Student Loan Bankruptcy Worth It? Pros & Cons Explained

[…] Compare carefully:✔ income-driven repayment vs bankruptcy […]