Private Student Loan Settlement Options: A Complete Guide to Reducing Your Debt

Private student loan debt can quickly become overwhelming—especially when payments spiral out of control, and lenders refuse flexible relief. Unlike federal student loans, private loans are governed by lender-defined rules, leaving borrowers with fewer protections and fewer relief options.

To understand why settlement is often the only realistic path, it’s essential first to understand how private student loans differ from federal loans.

➡️ Federal vs. Private Student Loans: Key Differences Borrowers Must Understand

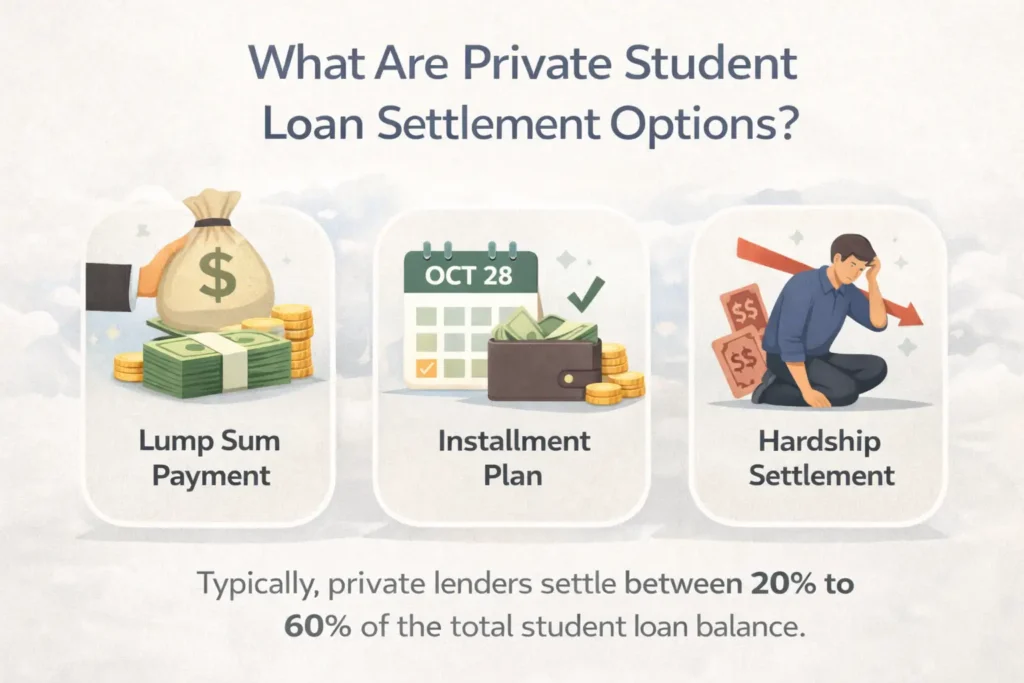

What are Private Student Loan Settlement Options?

Private student loan settlement options are strategies that allow borrowers to negotiate directly with a lender or collection agency to pay less than the full loan balance.

Instead of repaying 100% of the debt, borrowers may agree to:

- A one-time lump-sum payment, or

- A short-term structured settlement plan

Once the agreed amount is paid, the remaining balance is forgiven, and the account is permanently closed.

How Private Loan Settlement Differs From Federal Student Loans

Private loan settlement works very differently from federal student loan relief because:

- There are no government-backed forgiveness programs

- Each lender sets its own internal settlement rules

- Negotiations usually occur after delinquency or default

To better understand lender behavior, you should also understand how student loan collections proceed once payments stop.

➡️ How Student Loans Are Collected: From Missed Payments to Collections

Can Private Student Loans Be Settled?

Yes, private student loans can be settled, but approval is never guaranteed.

Lenders are more likely to consider settlement when:

- The loan is seriously delinquent or in default

- The borrower demonstrates long-term financial hardship

- The lender believes full repayment is unlikely

Private lenders focus on risk versus recovery, not borrower hardship alone.

When Settlement Is Most Likely

Settlement chances increase if:

- You’ve missed payments for 6–12 months

- The loan has gone to collections

- The debt has been charged off

Private lenders act based on risk vs recovery, not borrower hardship alone.

When is Private Student Loan Settlement Most Likely?

Settlement chances increase significantly when:

- Payments have been missed for 6–12 months

- The loan has entered collections

- The account has been charged off

At this stage, lenders may accept a reduced payoff rather than risk no recovery.

Private Student Loan Settlement vs Debt Settlement Companies

Many borrowers confuse direct settlement with third-party debt settlement services.

Private Loan Settlement

- Negotiated directly with the lender

- Often occurs after default

- Results in partial balance forgiveness

Private Student Loan Debt Settlement Companies

- Use third-party negotiators

- Often charge high fees

- May provide no guaranteed results

⚠️ Be cautious of companies promising guaranteed settlements.

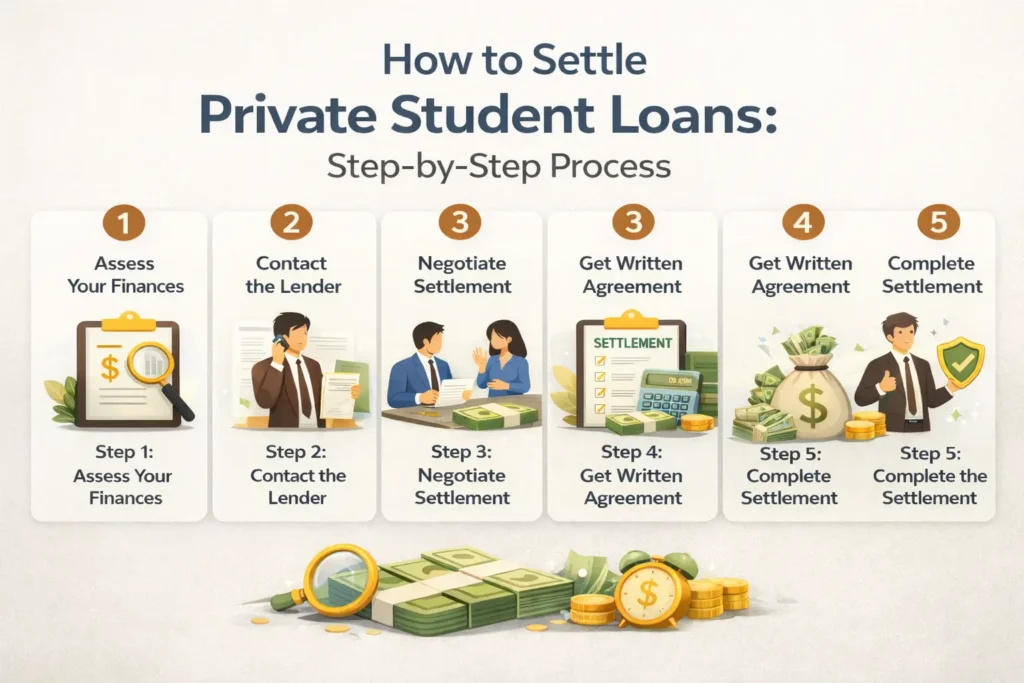

How to Settle Private Student Loans: Step-by-Step Process

Step 1: Assess Your Financial Situation

Before negotiation, gather:

- Total loan balance

- Current delinquency status

- Monthly income and expenses

Step 2: Stop Ignoring the Lender

Avoiding calls can hurt your leverage. Communication matters.

Step 3: Wait for the Right Timing

Settlement leverage increases when:

- The loan enters collections

- The lender fears non-recovery

Step 4: Make a Settlement Offer

Start low. Most lenders expect negotiation.

Step 5: Get the Agreement in Writing

Never send money without a written student loan settlement agreement.

How to Negotiate Private Student Loans Successfully

Negotiation is the most critical part of settlement.

Key Negotiation Tips

- Stay calm and professional

- Emphasize financial hardship

- Avoid emotional arguments

- Ask for a pay-for-delete if possible

What to Say (Example)

“I want to resolve this debt, but I cannot repay the full balance. I can offer a lump-sum settlement today.”

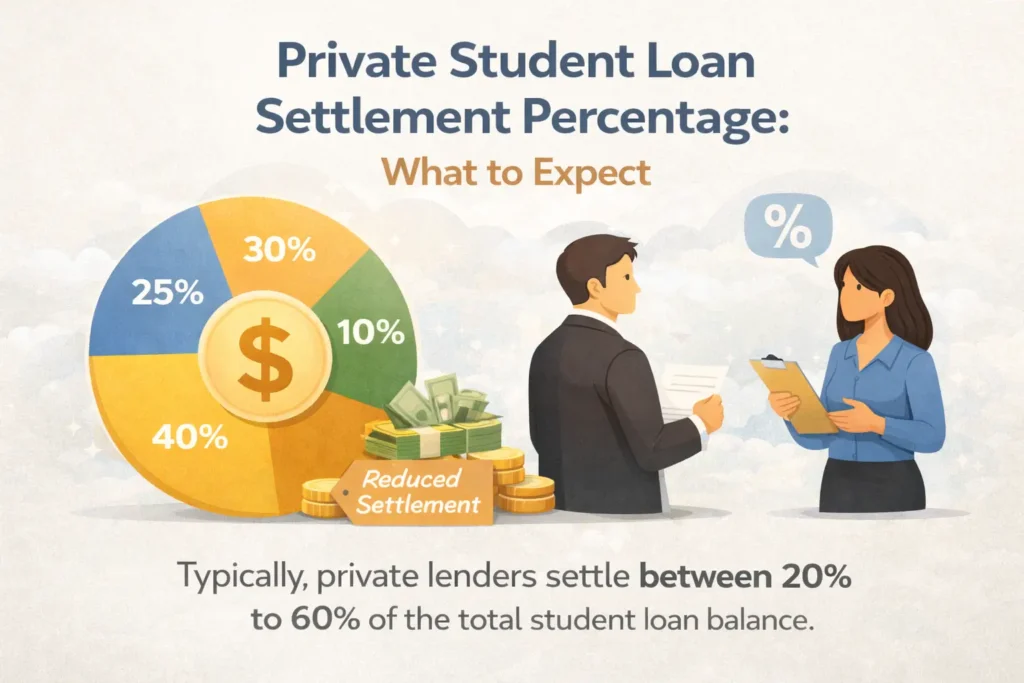

Private Student Loan Settlement Percentage: What to Expect

Settlement amounts vary widely.

Typical Settlement Ranges

- 30%–40%: Rare but possible in severe default

- 40%–60%: Most common range

- 60%–80%: Early settlement or strong borrower profile

Factors affecting settlement percentage:

- Loan age

- Balance size

- Lender policies

- Whether a lawsuit is pending

Lump Sum Settlement of Private Student Loans

A lump-sum settlement offers the highest chance of success.

Why Lenders Prefer Lump Sums

- Immediate recovery

- No ongoing risk

- Reduced administrative costs

Where Borrowers Get Lump-Sum Funds

- Savings

- Family assistance

- Retirement withdrawals (with caution)

Private Student Loan Default & Collections Settlement

Once a loan enters default, collections often begin.

At this stage, it’s critical to understand who owns the debt and whether legal action is possible.

➡️ Private Student Loans in the United States: Legal and Structural Overview

Default can increase settlement chances because lenders want to avoid expensive lawsuits.

What Happens After Default

- Aggressive collection calls

- Credit damage

- Possible legal action

Why Default Can Increase Settlement Chances

Default shifts power toward the borrower because:

- Lenders want to avoid lawsuits

- Recovery becomes uncertain

Private Student Loan Collections Settlement

Once a loan is in collections:

- A third-party agency may handle negotiations

- Settlement authority may be limited

- Documentation becomes critical

Collection Settlement Tips

- Confirm who owns the debt

- Ask if the debt was sold or assigned

- Negotiate with decision-makers only

Private Student Loan Settlement Agreement: What to Look For

Never settle verbally.

A Valid Settlement Agreement Must Include:

- Settled amount

- Payment deadline

- Balance forgiveness language

- Credit reporting terms

Avoid Agreements That:

- Lack of written confirmation

- Allow balance reactivation

- Include vague language

Credit & Tax Impact of Private Student Loan Settlement

Credit Impact

- Short-term score drop

- “Settled for less than full balance” notation

- Long-term recovery possible

Tax Impact

Forgiven debt may be taxable income.

If settlement isn’t enough, some borrowers explore legal discharge options through bankruptcy.

➡️ Student Loan Bankruptcy: Discharge Relief and Legal Options Explained

In some cases, borrowers must file a lawsuit within bankruptcy court.

➡️ How to File an Adversary Proceeding in Bankruptcy

Short-Term Impact

- Credit score drop

- “Settled for less than full balance” remark

Long-Term Impact

- Debt balance becomes zero

- Credit can recover over time

- Better than ongoing default

Tax Consequences of Private Student Loan Settlement

Forgiven debt may be considered taxable income.

Key Points

- You may receive Form 1099-C

- Insolvency exceptions may apply

- Consult a tax professional

Pros and Cons of Private Student Loan Settlement

Advantages

- Reduced debt burden

- Faster resolution

- Stress relief

Disadvantages

- Credit damage

- Tax liability

- No guarantee of acceptance

Alternatives to Private Student Loan Settlement

Settlement isn’t always the best option.

Other Options

- Temporary forbearance

- Refinancing (if credit allows)

- Co-signer release negotiation

- Legal consultation

Frequently Asked Questions

Can private student loans be settled?

Yes, but typically after delinquency or default.

How much can private student loans be settled for?

Most settlements fall between 40% and 60% of the balance.

Is a private student loan settlement worth it?

It depends on your financial situation and long-term goals.

How long does the settlement take?

Anywhere from weeks to several months.

Final Thoughts: Choosing the Right Private Student Loan Settlement Option

Private student loan settlement options can offer real relief—but only when approached strategically. Understanding lender behavior, negotiation tactics, and legal consequences is essential.

If you’re facing private student loan debt:

- Learn your rights

- Document everything

- Avoid rushed decisions

A well-planned settlement can be the turning point toward financial recovery.

Comments (18)

Student Loan Bankruptcy: Discharge, Relief & Legal Options

[…] Private Student Loan Settlement OptionsFederal vs Private Student Loans […]

How Student Loans Are Collected | Federal vs Private Loans

[…] Take legal action (especially for private loans) […]

Federal vs Private Student Loans: Which One Is Better?

[…] Private Student Loans […]

How to File an Adversary Proceeding in Bankruptcy Court

[…] 👉 Many private loan cases resolve through negotiation. Learn more about private student loan settlement options […]

Chapter 7 vs Chapter 13 Bankruptcy for Student Loans

[…] Similarly, borrowers struggling with private lenders may benefit from exploring proven private student loan settlement options. […]

Federal Student Loan Forgiveness Public Service Application

[…] Borrowers with private debt should understand private student loan settlement options […]

Student Loan Consolidation Guide 2026

[…] If you have private loans, a settlement might help:👉 Private student loan settlement […]

How to Get a Student Loan in 2026 | Complete Step-by-Step Guide

[…] Private loan borrowers often explore settlement options later. Learn more:Private Student Loan Settlement […]

Student Loan Social Security Garnishment: How It Works

[…] To explore private debt relief, visit:👉 Private Student Loan Settlement […]

Student Loan Forgiveness for Teachers

[…] 👉 private student loan settlement […]

Student Loan Forgiveness House Vote: Latest Updates

[…] you hold private loans, waiting for Congress may not help at all. In that case, understanding proven private student loan settlement options can be far more effective than relying on forgiveness […]

Student Loan Bankruptcy Process Step by Step

[…] ➡️ Private Student Loan Settlement Options: How Borrowers Reduce Debt […]

Student Loan Help Guide: Lower Payments, Relief & Forgiveness

[…] This guide explains how to negotiate a private student loan settlement:https://federalstudentloandebt.com/private-student-loan-settlement/ […]

Student Loan Payment Plan: Complete Guide to Repayment Options, Forgiveness, Interest, and Strategies - Las Vegas Student Loan Lawyer | Federal Student Loan Debt Relief

[…] Borrowers struggling with private loans may also need to explore programs such as:👉 Private student loan settlement options […]

Student Loan Forgiveness Programs: Eligibility, Types & Relief Guide

[…] Learn more here:👉 Private Student Loan Settlement Options […]

Student Loan Debt Help: Relief, Forgiveness & Repayment Options Las Vegas Student Loan Lawyer | Federal Student Loan Debt Relief

[…] Full explanation:👉 Private student loan settlement options […]

What Is a Student Loan? Full Guide to Types, Rates & Repayment

[…] full guide to private student loan settlement is […]

Is Student Loan Bankruptcy Worth It? Pros & Cons Explained

[…] Private loans also have strong settlement options:✔ private student loan settlement […]