How do federal student loans work?

Federal student loans work by allowing students to borrow money from the U.S. government to pay for college. After graduation, borrowers repay the loan with fixed interest through flexible plans such as income-driven repayment, deferment, or forgiveness programs.

Quick Summary

- Federal student loans come from the U.S. government

- You apply through FAFSA to determine eligibility

- Interest rules depend on subsidized vs unsubsidized loans

- Repayment starts after a grace period

- Flexible plans and forgiveness programs help manage long-term debt

Why Federal Student Loans Matter?

Paying for college in the United States has become increasingly expensive. As tuition rises, more students rely on federal student loans to afford higher education. Fortunately, these loans provide structured repayment options, fixed interest rates, and borrower protections that private lenders rarely offer.

Because federal loans follow government regulations, borrowers receive clear terms and predictable payment structures. As a result, students can focus on completing their education before worrying about repayment.

To understand overall student loan strategies, explore this

👉 Complete student loan help resource hub

In simple terms, federal student loans provide a controlled and flexible way to finance college education.

What Are Federal Student Loans?

Federal student loans are government-issued education loans that help students pay for tuition, housing, books, and other academic expenses.

Federal student loans come directly from the U.S. Department of Education. Unlike private loans, they follow standardized policies that protect borrowers. Therefore, students receive fixed interest rates, flexible repayment plans, and access to loan forgiveness programs.

Moreover, most federal loans do not require a credit check, which makes them accessible to a broader range of students. Because of these benefits, federal loans remain the most common funding option for higher education.

According to the

<a href=”https://en.wikipedia.org/wiki/Student_loan”>overview of student loans on Wikipedia</a>, federal loans differ from private loans mainly due to government backing and borrower protections.

Types of Federal Student Loans

| Loan Type | Eligibility | Interest Benefit | Best For |

| Direct Subsidized | Need-based undergraduates | Govt pays interest in the school | Lower-income students |

| Direct Unsubsidized | Most students | Interest accrues immediately | General borrowers |

| Direct PLUS | Parents & graduates | No subsidy | Higher borrowing needs |

| Direct Consolidation | Existing borrowers | Simplifies repayment | Managing multiple loans |

Federal student loans are government-backed and offer safer repayment terms. Therefore, they remain a preferred option compared to most private student loans.

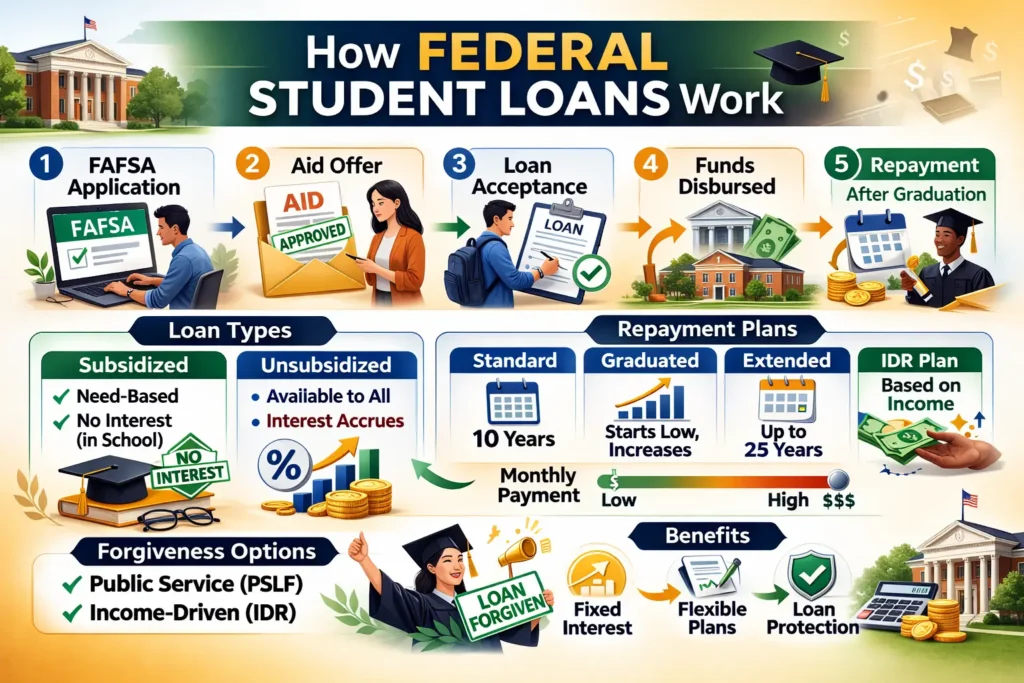

How Do Federal Student Loans Work Step by Step?

Federal student loans work through the FAFSA application, loan acceptance, fund disbursement, grace period, and structured repayment plans after graduation.

Step 1: Submit the FAFSA Application

First, students complete the Free Application for Federal Student Aid (FAFSA). This application determines eligibility for grants, work-study, and federal loans. Therefore, FAFSA acts as the starting point of the federal loan process.

Step 2: Review Financial Aid Offer

Next, schools send a financial aid package. This package shows how much loan funding, grants, and scholarships the student qualifies for. As a result, students can compare available funding options before accepting loans.

Step 3: Accept the Loan and Complete Counseling

After reviewing the offer, students accept the loan amount they need. Then, they complete entrance counseling and sign a Master Promissory Note agreeing to repayment terms.

Step 4: Funds Are Disbursed to the School

Once approved, the government sends funds directly to the school to cover tuition and fees. If any balance remains, the school refunds it to the student for books, housing, or transportation.

Step 5: Repayment Begins After Grace Period

Finally, repayment starts after graduation, typically following a six-month grace period. During this time, borrowers prepare financially before monthly payments begin.

To see how balances grow over time, read

👉 Why student loans grow quickly in the United States

Students apply through FAFSA, receive funds for education, and repay the loan after graduation using structured repayment options.

Subsidized vs Unsubsidized Federal Loans: What’s the Difference?

Subsidized loans do not accrue interest during school, whereas unsubsidized loans start accumulating interest immediately after disbursement.

Subsidized loans benefit students with financial need. In this case, the government pays the interest while the borrower remains enrolled at least half-time. Consequently, the total loan cost stays lower over time.

However, unsubsidized loans behave differently. Interest begins accruing as soon as the loan funds are disbursed. Therefore, the loan balance may increase even before graduation.

For a detailed comparison, see

👉 federal vs private student loan differences

Subsidized loans reduce interest burden during school, while unsubsidized loans increase long-term repayment costs due to immediate interest accrual.

When Does Interest Start Accruing on Federal Loans?

Interest starts immediately on unsubsidized loans, but subsidized loans delay interest accumulation while the student stays enrolled in school.

Interest accrues daily based on the outstanding loan principal and the fixed federal interest rate. Therefore, unpaid interest gradually increases the total balance. If borrowers delay payments too long, capitalization can raise the overall repayment amount significantly.

To understand interest calculations, visit

👉 How student loan interest works explained

Interest rules depend on the loan type. Therefore, understanding accrual timing helps borrowers control long-term debt growth.

What Repayment Plans Are Available for Federal Student Loans?

Federal student loans offer standard, graduated, extended, and income-driven repayment plans that adjust payments based on income and loan size.

Standard Repayment Plan

This plan uses fixed monthly payments over ten years. As a result, borrowers pay the least total interest.

Graduated Repayment Plan

Payments start lower and increase every two years. Therefore, it suits borrowers expecting income growth.

Extended Repayment Plan

This plan stretches repayment up to twenty-five years. Consequently, monthly payments become smaller, but total interest increases.

Income-Driven Repayment (IDR)

IDR plans calculate payments based on income and family size. Therefore, borrowers with lower incomes can maintain affordable monthly payments.

For full details, read

👉income-driven repayment plans explained

Flexible repayment plans help borrowers match monthly payments with income level and financial capacity.

Can Federal Student Loans Be Forgiven?

Yes, federal student loans may qualify for forgiveness through programs like PSLF and income-driven repayment forgiveness after long-term qualifying payments.

Borrowers working in public service may qualify for Public Service Loan Forgiveness (PSLF). Similarly, income-driven repayment plans forgive remaining balances after 20–25 years of qualifying payments. Therefore, forgiveness options provide long-term relief for eligible borrowers.

Loan forgiveness depends on employment type, repayment plan, and consistent qualifying payments over several years.

What Happens If You Cannot Repay Federal Student Loans?

Borrowers can request deferment, forbearance, or income-driven repayment to temporarily reduce or pause payments during financial hardship.

If borrowers face financial difficulties, they can apply for deferment or forbearance. During deferment, payments pause, and subsidized loans may stop accruing interest. Meanwhile, forbearance pauses payment,s but interest continues to grow.

Therefore, borrowers should use these options carefully to avoid increasing total debt.

Need personalized help? Contact

👉student loan support team

Relief options exist for hardship situations. However, interest growth may continue depending on the chosen relief method.

Federal vs Private Student Loans: Which Is Better?

Federal loans are generally safer than private loans because they offer flexible repayment plans, fixed interest rates, and forgiveness eligibility.

| Feature | Federal Loans | Private Loans |

| Interest Rate | Fixed | Variable or fixed |

| Credit Requirement | Usually not required | Required |

| Repayment Flexibility | High | Limited |

| Forgiveness Options | Available | Rare |

Federal loans provide stronger protections and flexible repayment options. Therefore, they remain the better choice for most students.

How Long Do You Have to Repay Federal Student Loans?

Most borrowers repay federal student loans within 10–25 years, depending on repayment plan, income level, and loan balance.

Repayment duration varies based on loan size and chosen plan. Standard plans usually last ten years, while income-driven plans can extend up to twenty-five years. Therefore, repayment timelines differ for each borrower’s financial situation.

Repayment timelines depend on plan type and income. However, most borrowers complete repayment within 10–25 years.

Final Takeaway

In short, federal student loans provide a structured and flexible way to finance college education in the United States. Because these loans offer fixed interest rates, income-based repayment plans, and forgiveness options, they remain safer than private student loans.

Therefore, students should understand loan types, interest rules, and repayment strategies before borrowing. By doing so, they can manage long-term debt effectively and avoid financial stress after graduation.

For deeper insights, explore

👉complete federal student loan knowledge hub